Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 1, 20X1, P. Young launched a company called Business Star, which provides consulting services, computer system installations, custom program development and sells

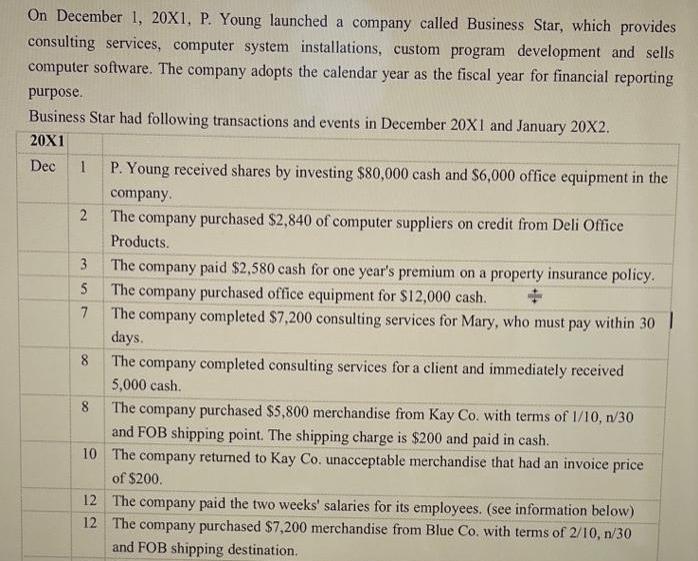

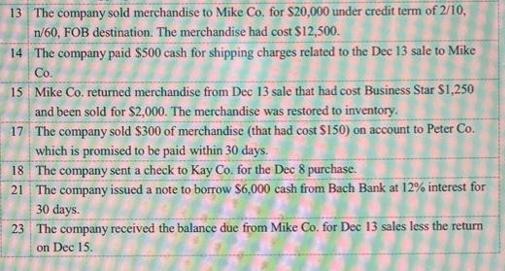

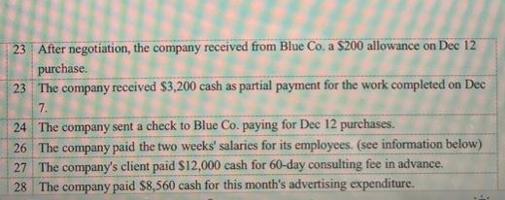

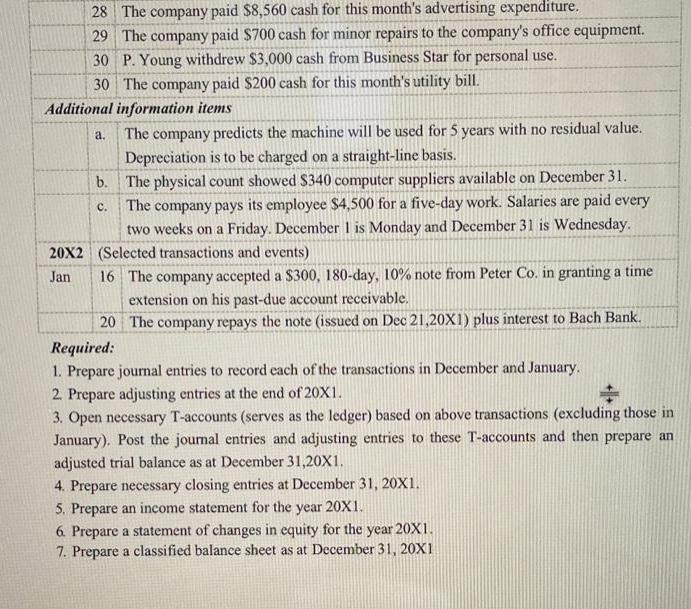

On December 1, 20X1, P. Young launched a company called Business Star, which provides consulting services, computer system installations, custom program development and sells computer software. The company adopts the calendar year as the fiscal year for financial reporting purpose. Business Star had following transactions and events in December 20X1 and January 20X2. 20X1 Dec 1 P. Young received shares by investing $80,000 cash and $6,000 office equipment in the company. The company purchased $2,840 of computer suppliers on credit from Deli Office Products. 2 3 5 7 8 The company paid $2,580 cash for one year's premium on a property insurance policy. The company purchased office equipment for $12,000 cash. 8 The company completed $7,200 consulting services for Mary, who must pay within 30 days. The company completed consulting services for a client and immediately received 5,000 cash. The company purchased $5,800 merchandise from Kay Co. with terms of 1/10, n/30 and FOB shipping point. The shipping charge is $200 and paid in cash. 10 The company returned to Kay Co. unacceptable merchandise that had an invoice price of $200. 12 The company paid the two weeks' salaries for its employees. (see information below) 12 The company purchased $7,200 merchandise from Blue Co. with terms of 2/10, n/30 and FOB shipping destination. 13 The company sold merchandise to Mike Co. for $20,000 under credit term of 2/10, n/60, FOB destination. The merchandise had cost $12,500. 14 The company paid $500 cash for shipping charges related to the Dec 13 sale to Mike Co. 15 Mike Co. returned merchandise from Dec 13 sale that had cost Business Star $1,250 and been sold for $2,000. The merchandise was restored to inventory. 17 The company sold $300 of merchandise (that had cost $150) on account to Peter Co. which is promised to be paid within 30 days. 18 The company sent a check to Kay Co. for the Dec 8 purchase. 21 The company issued a note to borrow $6,000 cash from Bach Bank at 12% interest for 30 days. 23 The company received the balance due from Mike Co. for Dec 13 sales less the return on Dec 15. 23 After negotiation, the company received from Blue Co. a $200 allowance on Dec 12 purchase. 23 The company received $3,200 cash as partial payment for the work completed on Dec 7. 24 The company sent a check to Blue Co. paying for Dec 12 purchases. 26 The company paid the two weeks' salaries for its employees. (see information below) 27 The company's client paid $12,000 cash for 60-day consulting fee in advance. 28 The company paid $8,560 cash for this month's advertising expenditure. 28 The company paid $8,560 cash for this month's advertising expenditure. 29 The company paid $700 cash for minor repairs to the company's office equipment. P. Young withdrew $3,000 cash from Business Star for personal use. 30 30 The company paid $200 cash for this month's utility bill. Additional information items a. The company predicts the machine will be used for 5 years with no residual value. Depreciation is to be charged on a straight-line basis. C. b. The physical count showed $340 computer suppliers available on December 31. The company pays its employee $4,500 for a five-day work. Salaries are paid every two weeks on a Friday. December 1 is Monday and December 31 is Wednesday. 20X2 (Selected transactions and events) Jan 16 The company accepted a $300, 180-day, 10% note from Peter Co. in granting a time extension on his past-due account receivable. 20 The company repays the note (issued on Dec 21,20X1) plus interest to Bach Bank. Required: 1. Prepare journal entries to record each of the transactions in December and January. 2. Prepare adjusting entries at the end of 20X1. # 3. Open necessary T-accounts (serves as the ledger) based on above transactions (excluding those in January). Post the journal entries and adjusting entries to these T-accounts and then prepare an adjusted trial balance as at December 31,20X1. 4. Prepare necessary closing entries at December 31, 20X1. 5. Prepare an income statement for the year 20X1. 6. Prepare a statement of changes in equity for the year 20X1. 7. Prepare a classified balance sheet as at December 31, 20X1 On December 1, 20X1, P. Young launched a company called Business Star, which provides consulting services, computer system installations, custom program development and sells computer software. The company adopts the calendar year as the fiscal year for financial reporting purpose. Business Star had following transactions and events in December 20X1 and January 20X2. 20X1 Dec 1 P. Young received shares by investing $80,000 cash and $6,000 office equipment in the company. The company purchased $2,840 of computer suppliers on credit from Deli Office Products. 2 3 5 7 8 The company paid $2,580 cash for one year's premium on a property insurance policy. The company purchased office equipment for $12,000 cash. 8 The company completed $7,200 consulting services for Mary, who must pay within 30 days. The company completed consulting services for a client and immediately received 5,000 cash. The company purchased $5,800 merchandise from Kay Co. with terms of 1/10, n/30 and FOB shipping point. The shipping charge is $200 and paid in cash. 10 The company returned to Kay Co. unacceptable merchandise that had an invoice price of $200. 12 The company paid the two weeks' salaries for its employees. (see information below) 12 The company purchased $7,200 merchandise from Blue Co. with terms of 2/10, n/30 and FOB shipping destination. 13 The company sold merchandise to Mike Co. for $20,000 under credit term of 2/10, n/60, FOB destination. The merchandise had cost $12,500. 14 The company paid $500 cash for shipping charges related to the Dec 13 sale to Mike Co. 15 Mike Co. returned merchandise from Dec 13 sale that had cost Business Star $1,250 and been sold for $2,000. The merchandise was restored to inventory. 17 The company sold $300 of merchandise (that had cost $150) on account to Peter Co. which is promised to be paid within 30 days. 18 The company sent a check to Kay Co. for the Dec 8 purchase. 21 The company issued a note to borrow $6,000 cash from Bach Bank at 12% interest for 30 days. 23 The company received the balance due from Mike Co. for Dec 13 sales less the return on Dec 15. 23 After negotiation, the company received from Blue Co. a $200 allowance on Dec 12 purchase. 23 The company received $3,200 cash as partial payment for the work completed on Dec 7. 24 The company sent a check to Blue Co. paying for Dec 12 purchases. 26 The company paid the two weeks' salaries for its employees. (see information below) 27 The company's client paid $12,000 cash for 60-day consulting fee in advance. 28 The company paid $8,560 cash for this month's advertising expenditure. 28 The company paid $8,560 cash for this month's advertising expenditure. 29 The company paid $700 cash for minor repairs to the company's office equipment. P. Young withdrew $3,000 cash from Business Star for personal use. 30 30 The company paid $200 cash for this month's utility bill. Additional information items a. The company predicts the machine will be used for 5 years with no residual value. Depreciation is to be charged on a straight-line basis. C. b. The physical count showed $340 computer suppliers available on December 31. The company pays its employee $4,500 for a five-day work. Salaries are paid every two weeks on a Friday. December 1 is Monday and December 31 is Wednesday. 20X2 (Selected transactions and events) Jan 16 The company accepted a $300, 180-day, 10% note from Peter Co. in granting a time extension on his past-due account receivable. 20 The company repays the note (issued on Dec 21,20X1) plus interest to Bach Bank. Required: 1. Prepare journal entries to record each of the transactions in December and January. 2. Prepare adjusting entries at the end of 20X1. # 3. Open necessary T-accounts (serves as the ledger) based on above transactions (excluding those in January). Post the journal entries and adjusting entries to these T-accounts and then prepare an adjusted trial balance as at December 31,20X1. 4. Prepare necessary closing entries at December 31, 20X1. 5. Prepare an income statement for the year 20X1. 6. Prepare a statement of changes in equity for the year 20X1. 7. Prepare a classified balance sheet as at December 31, 20X1 On December 1, 20X1, P. Young launched a company called Business Star, which provides consulting services, computer system installations, custom program development and sells computer software. The company adopts the calendar year as the fiscal year for financial reporting purpose. Business Star had following transactions and events in December 20X1 and January 20X2. 20X1 Dec 1 P. Young received shares by investing $80,000 cash and $6,000 office equipment in the company. The company purchased $2,840 of computer suppliers on credit from Deli Office Products. 2 3 5 7 8 The company paid $2,580 cash for one year's premium on a property insurance policy. The company purchased office equipment for $12,000 cash. 8 The company completed $7,200 consulting services for Mary, who must pay within 30 days. The company completed consulting services for a client and immediately received 5,000 cash. The company purchased $5,800 merchandise from Kay Co. with terms of 1/10, n/30 and FOB shipping point. The shipping charge is $200 and paid in cash. 10 The company returned to Kay Co. unacceptable merchandise that had an invoice price of $200. 12 The company paid the two weeks' salaries for its employees. (see information below) 12 The company purchased $7,200 merchandise from Blue Co. with terms of 2/10, n/30 and FOB shipping destination. 13 The company sold merchandise to Mike Co. for $20,000 under credit term of 2/10, n/60, FOB destination. The merchandise had cost $12,500. 14 The company paid $500 cash for shipping charges related to the Dec 13 sale to Mike Co. 15 Mike Co. returned merchandise from Dec 13 sale that had cost Business Star $1,250 and been sold for $2,000. The merchandise was restored to inventory. 17 The company sold $300 of merchandise (that had cost $150) on account to Peter Co. which is promised to be paid within 30 days. 18 The company sent a check to Kay Co. for the Dec 8 purchase. 21 The company issued a note to borrow $6,000 cash from Bach Bank at 12% interest for 30 days. 23 The company received the balance due from Mike Co. for Dec 13 sales less the return on Dec 15. 23 After negotiation, the company received from Blue Co. a $200 allowance on Dec 12 purchase. 23 The company received $3,200 cash as partial payment for the work completed on Dec 7. 24 The company sent a check to Blue Co. paying for Dec 12 purchases. 26 The company paid the two weeks' salaries for its employees. (see information below) 27 The company's client paid $12,000 cash for 60-day consulting fee in advance. 28 The company paid $8,560 cash for this month's advertising expenditure. 28 The company paid $8,560 cash for this month's advertising expenditure. 29 The company paid $700 cash for minor repairs to the company's office equipment. P. Young withdrew $3,000 cash from Business Star for personal use. 30 30 The company paid $200 cash for this month's utility bill. Additional information items a. The company predicts the machine will be used for 5 years with no residual value. Depreciation is to be charged on a straight-line basis. C. b. The physical count showed $340 computer suppliers available on December 31. The company pays its employee $4,500 for a five-day work. Salaries are paid every two weeks on a Friday. December 1 is Monday and December 31 is Wednesday. 20X2 (Selected transactions and events) Jan 16 The company accepted a $300, 180-day, 10% note from Peter Co. in granting a time extension on his past-due account receivable. 20 The company repays the note (issued on Dec 21,20X1) plus interest to Bach Bank. Required: 1. Prepare journal entries to record each of the transactions in December and January. 2. Prepare adjusting entries at the end of 20X1. # 3. Open necessary T-accounts (serves as the ledger) based on above transactions (excluding those in January). Post the journal entries and adjusting entries to these T-accounts and then prepare an adjusted trial balance as at December 31,20X1. 4. Prepare necessary closing entries at December 31, 20X1. 5. Prepare an income statement for the year 20X1. 6. Prepare a statement of changes in equity for the year 20X1. 7. Prepare a classified balance sheet as at December 31, 20X1

Step by Step Solution

★★★★★

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Journal Entries December 1 20X1 Cash 80000 Office Equipment 6000 Capital Stock 86000 To record issuance of shares December 2 20X1 Computer Supplies 2840 Accounts Payable 2840 To record purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started