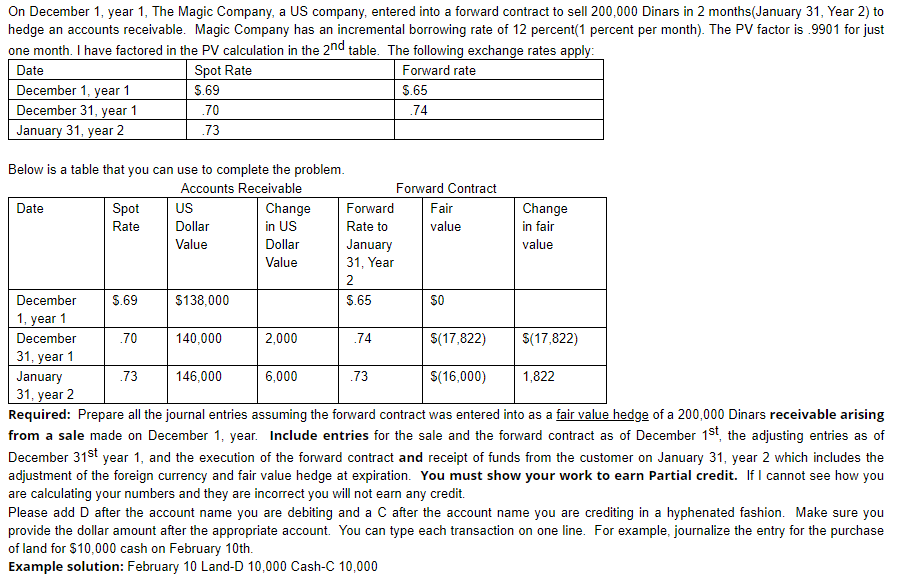

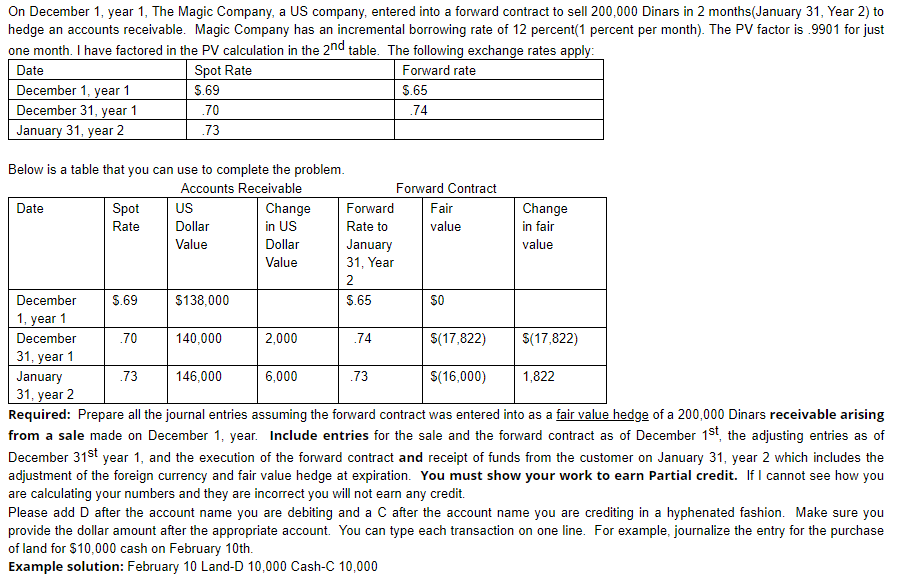

On December 1, year 1, The Magic Company, a US company, entered into a forward contract to sell 200,000 Dinars in 2 months(January 31, Year 2) to hedge an accounts receivable. Magic Company has an incremental borrowing rate of 12 percent(1 percent per month). The PV factor is 9901 for just one month. I have factored in the PV calculation in the 2nd table. The following exchange rates apply: Date Spot Rate Forward rate December 1, year 1 5.69 9.65 December 31, year 1 .70 .74 January 31, year 2 .73 .74 Below is a table that you can use to complete the problem. Accounts Receivable Forward Contract Date Spot US Change Forward Fair Change Rate Dollar in US Rate to value in fair Value Dollar January value Value 31, Year 2 December 5.69 $138,000 5.65 SO 1, year 1 December .70 140,000 2,000 S(17,822) S(17,822) 31, year 1 January .73 146,000 6,000 .73 S(16,000) 1,822 31, year 2 Required: Prepare all the journal entries assuming the forward contract was entered into as a fair value hedge of a 200,000 Dinars receivable arising from a sale made on December 1, year. Include entries for the sale and the forward contract as of December 1st the adjusting entries as of December 31st year 1, and the execution of the forward contract and receipt of funds from the customer on January 31, year 2 which includes the adjustment of the foreign currency and fair value hedge at expiration. You must show your work to earn Partial credit. If I cannot see how you are calculating your numbers and they are incorrect you will not earn any credit. Please add D after the account name you are debiting and a C after the account name you are crediting in a hyphenated fashion. Make sure you provide the dollar amount after the appropriate account. You can type each transaction on one line. For example, journalize the entry for the purchase of land for $10,000 cash on February 10th. Example solution: February 10 Land-D 10,000 Cash-C 10,000 On December 1, year 1, The Magic Company, a US company, entered into a forward contract to sell 200,000 Dinars in 2 months(January 31, Year 2) to hedge an accounts receivable. Magic Company has an incremental borrowing rate of 12 percent(1 percent per month). The PV factor is 9901 for just one month. I have factored in the PV calculation in the 2nd table. The following exchange rates apply: Date Spot Rate Forward rate December 1, year 1 5.69 9.65 December 31, year 1 .70 .74 January 31, year 2 .73 .74 Below is a table that you can use to complete the problem. Accounts Receivable Forward Contract Date Spot US Change Forward Fair Change Rate Dollar in US Rate to value in fair Value Dollar January value Value 31, Year 2 December 5.69 $138,000 5.65 SO 1, year 1 December .70 140,000 2,000 S(17,822) S(17,822) 31, year 1 January .73 146,000 6,000 .73 S(16,000) 1,822 31, year 2 Required: Prepare all the journal entries assuming the forward contract was entered into as a fair value hedge of a 200,000 Dinars receivable arising from a sale made on December 1, year. Include entries for the sale and the forward contract as of December 1st the adjusting entries as of December 31st year 1, and the execution of the forward contract and receipt of funds from the customer on January 31, year 2 which includes the adjustment of the foreign currency and fair value hedge at expiration. You must show your work to earn Partial credit. If I cannot see how you are calculating your numbers and they are incorrect you will not earn any credit. Please add D after the account name you are debiting and a C after the account name you are crediting in a hyphenated fashion. Make sure you provide the dollar amount after the appropriate account. You can type each transaction on one line. For example, journalize the entry for the purchase of land for $10,000 cash on February 10th. Example solution: February 10 Land-D 10,000 Cash-C 10,000