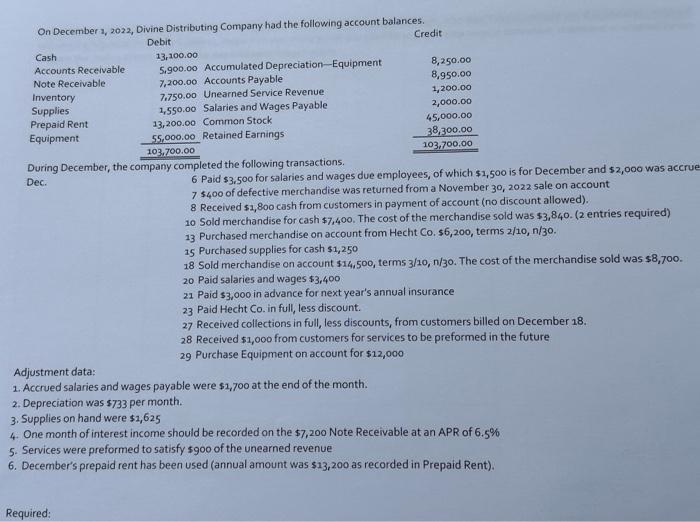

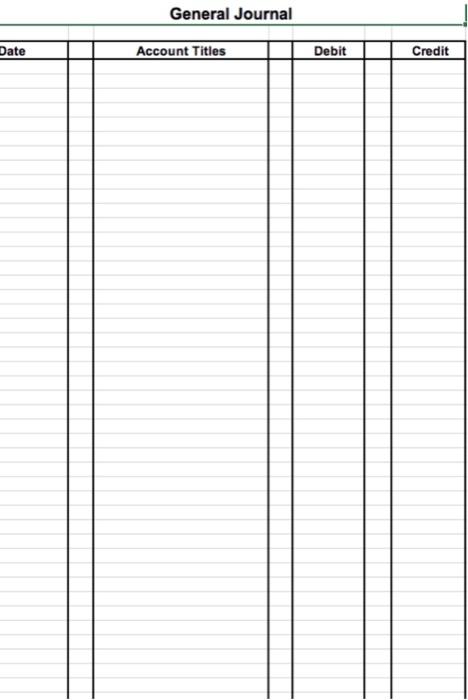

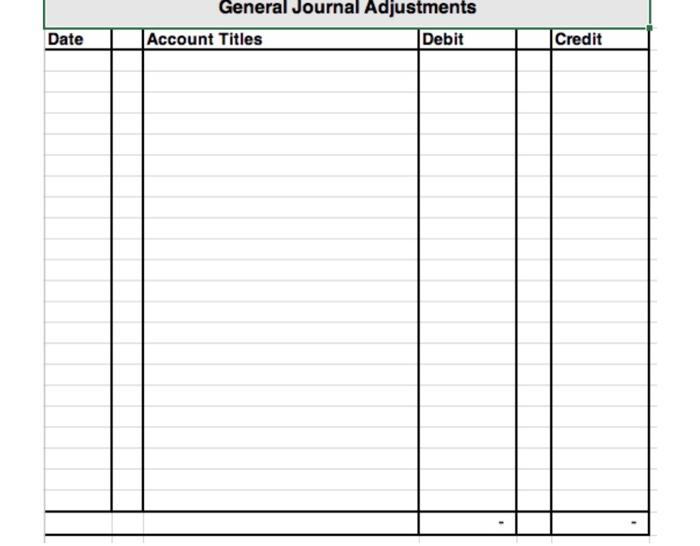

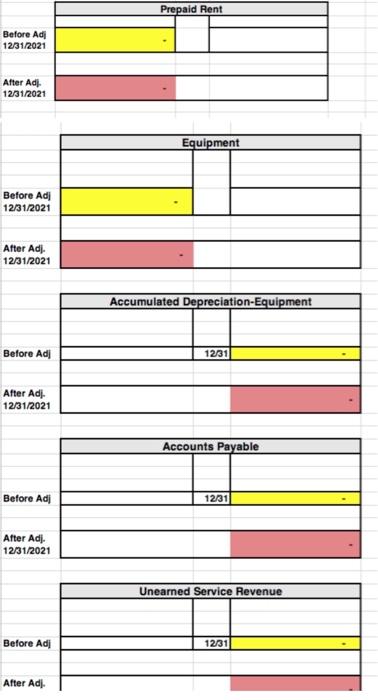

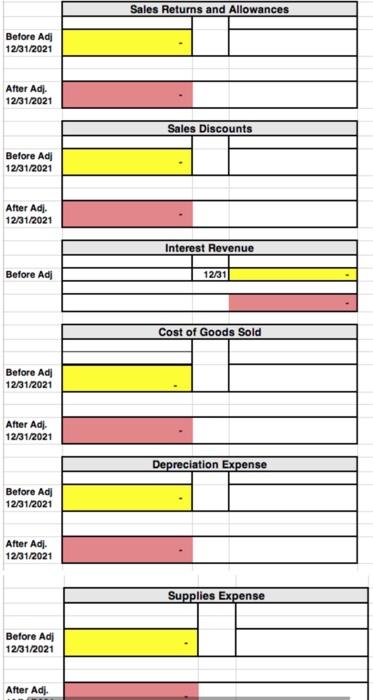

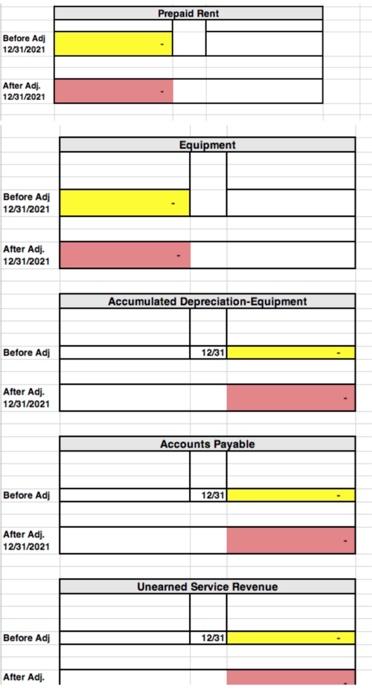

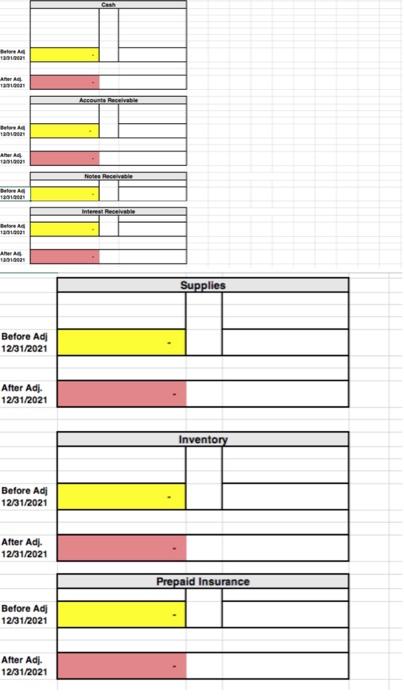

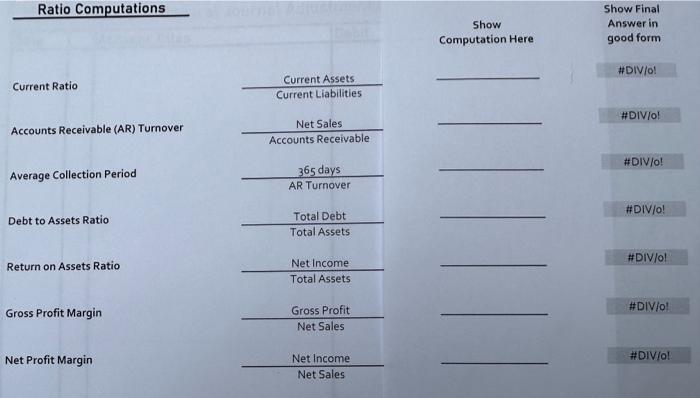

On December 2, 2022, Divine Distributing Company had the following account balances. Credit During December, the company completed the following transactions. Dec. 6 Paid $3.500 for salaries and wages due employees, of which $1,500 is for December and $2,000 was acerue 7$400 of defective merchandise was returned from a November 30,2022 sale on account 8 Received 51,800 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $7,400. The cost of the merchandise sold was $3,840. (2 entries required) 13 Purchased merchandise on account from Hecht Co. 56,200 , terms 2/10, n/30. 15 Purchased supplies for cash $1,250 18 Sold merchandise on account $14,500, terms 3/10,n/30. The cost of the merchandise sold was $8,700. 20 Paid salaries and wages $3,400 21 Paid s3,000 in advance for next year's annual insurance 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18 . 28 Received $1,000 from customers for services to be preformed in the future 29 Purchase Equipment on account for $12,000 Adjustment data: 1. Accrued salaries and wages payable were $1,700 at the end of the month. 2. Depreciation was $733 per month. 3. Supplies on hand were $1,625 4. One month of interest income should be recorded on the $7,200 Note Receivable at an APR of 6.5% 5. Services were preformed to satisfy sgoo of the unearned revenue 6. December's prepaid rent has been used (annual amount was $13,200 as recorded in Prepaid Rent). General Journal Adjustments \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Interest Revenue } \\ \hline \multirow{4}{*}{ Before Adj } & & \\ \hline & 12/31 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \hline \multicolumn{1}{c|}{ Equipment } \\ \cline { 2 - 4 } & & & \\ \hline BeforeAdi12/31/2021 & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \cline { 2 - 4 } & \multicolumn{3}{|c|}{ Accumulated Depreciation-Equipment } \\ \hline \multirow{4}{*}{ Betore Ad] } & & \\ \hline & & 12/31 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \cline { 1 - 3 } \multicolumn{13}{|c|}{ Accounts Payable } \\ \hline \multirow{3}{*}{ Betore Ad] } & & \\ \hline & & 12/31 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \cline { 2 - 4 } \multicolumn{1}{c|}{ Unearned Service Pevenue } \\ \cline { 2 - 4 } & \multicolumn{3}{|c|}{} \\ \hline Before AdI & & \\ \hline & & 12/31 & \\ \hline & & \\ \hline \end{tabular} Re Gr Ne On December 2, 2022, Divine Distributing Company had the following account balances. Credit During December, the company completed the following transactions. Dec. 6 Paid $3.500 for salaries and wages due employees, of which $1,500 is for December and $2,000 was acerue 7$400 of defective merchandise was returned from a November 30,2022 sale on account 8 Received 51,800 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $7,400. The cost of the merchandise sold was $3,840. (2 entries required) 13 Purchased merchandise on account from Hecht Co. 56,200 , terms 2/10, n/30. 15 Purchased supplies for cash $1,250 18 Sold merchandise on account $14,500, terms 3/10,n/30. The cost of the merchandise sold was $8,700. 20 Paid salaries and wages $3,400 21 Paid s3,000 in advance for next year's annual insurance 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18 . 28 Received $1,000 from customers for services to be preformed in the future 29 Purchase Equipment on account for $12,000 Adjustment data: 1. Accrued salaries and wages payable were $1,700 at the end of the month. 2. Depreciation was $733 per month. 3. Supplies on hand were $1,625 4. One month of interest income should be recorded on the $7,200 Note Receivable at an APR of 6.5% 5. Services were preformed to satisfy sgoo of the unearned revenue 6. December's prepaid rent has been used (annual amount was $13,200 as recorded in Prepaid Rent). General Journal Adjustments \begin{tabular}{|l|l|l|l|} \hline \multicolumn{1}{|c|}{ Interest Revenue } \\ \hline \multirow{4}{*}{ Before Adj } & & \\ \hline & 12/31 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \hline \multicolumn{1}{c|}{ Equipment } \\ \cline { 2 - 4 } & & & \\ \hline BeforeAdi12/31/2021 & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \cline { 2 - 4 } & \multicolumn{3}{|c|}{ Accumulated Depreciation-Equipment } \\ \hline \multirow{4}{*}{ Betore Ad] } & & \\ \hline & & 12/31 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \cline { 1 - 3 } \multicolumn{13}{|c|}{ Accounts Payable } \\ \hline \multirow{3}{*}{ Betore Ad] } & & \\ \hline & & 12/31 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{l|l|l|l|} \cline { 2 - 4 } \multicolumn{1}{c|}{ Unearned Service Pevenue } \\ \cline { 2 - 4 } & \multicolumn{3}{|c|}{} \\ \hline Before AdI & & \\ \hline & & 12/31 & \\ \hline & & \\ \hline \end{tabular} Re Gr Ne