Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 27, Cloud Corp. accepted delivery of merchandise that it purchased on account. As at December 31, Cloud had recorded the transaction, but

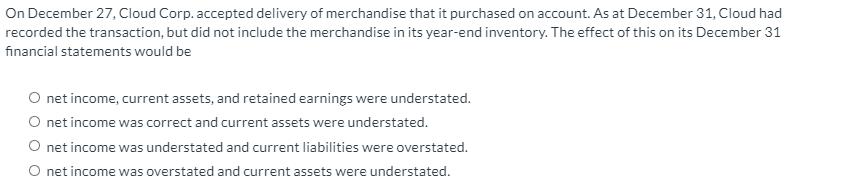

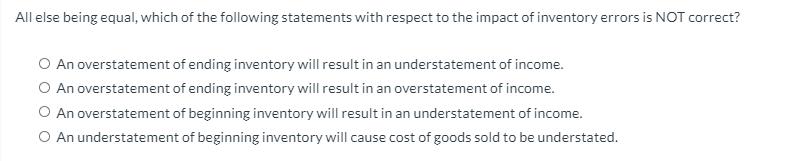

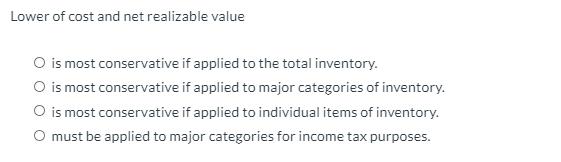

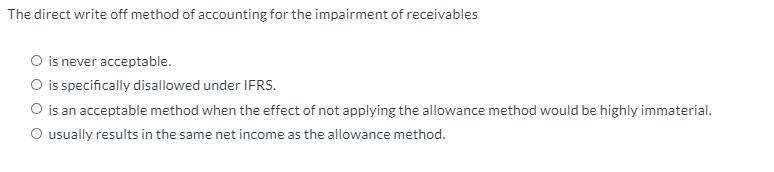

On December 27, Cloud Corp. accepted delivery of merchandise that it purchased on account. As at December 31, Cloud had recorded the transaction, but did not include the merchandise in its year-end inventory. The effect of this on its December 31 financial statements would be O net income, current assets, and retained earnings were understated. O net income was correct and current assets were understated. O net income was understated and current liabilities were overstated. O net income was overstated and current assets were understated. All else being equal, which of the following statements with respect to the impact of inventory errors is NOT correct? O An overstatement of ending inventory will result in an understatement of income. O An overstatement of ending inventory will result in an overstatement of income. O An overstatement of beginning inventory will result in an understatement of income. O An understatement of beginning inventory will cause cost of goods sold to be understated. Lower of cost and net realizable value O is most conservative if applied to the total inventory. O is most conservative if applied to major categories of inventory. O is most conservative if applied to individual items of inventory. O must be applied to major categories for income tax purposes. The direct write off method of accounting for the impairment of receivables O is never acceptable. O is specifically disallowed under IFRS. O is an acceptable method when the effect of not applying the allowance method would be highly immaterial. O usually results in the same net income as the allowance method.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 since the transaction is recorded but the ending inventory is not hence closing inventory is under...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started