Answered step by step

Verified Expert Solution

Question

1 Approved Answer

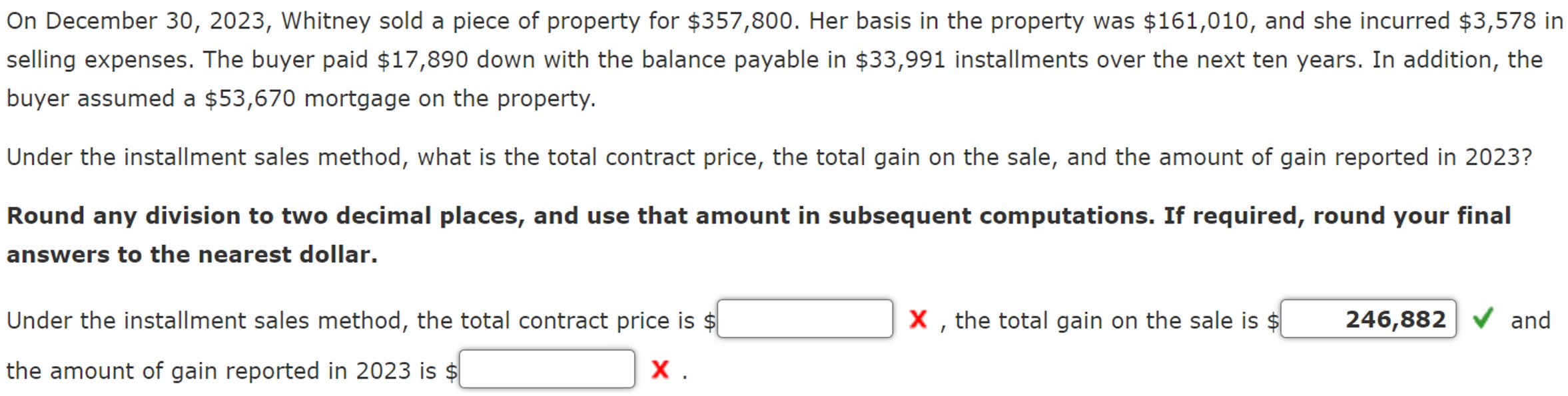

On December 3 0 , 2 0 2 3 , Whitney sold a piece of property for $ 3 5 7 , 8 0 0

On December Whitney sold a piece of property for $ Her basis in the property was $ and she incurred $ in selling expenses. The buyer paid $ down with the balance payable in $ installments over the next ten years. In addition, the buyer assumed a $ mortgage on the property.

Under the installment sales method, what is the total contract price, the total gain on the sale, and the amount of gain reported in

Round any division to two decimal places, and use that amount in subsequent computations. If required, round your final answers to the nearest dollar.

Under the installment sales method, the total contract price is the total gain on the sale is and the amount of gain reported in is Please note I have the correct total gain on sale.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started