Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 3 1 , 2 0 1 9 , Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in

On December Akron, Inc., purchased percent of Zip Company's common shares on the open market in exchange for $ On December Akron, Inc., acquires an additional percent of Zip Company's outstanding common stock for $

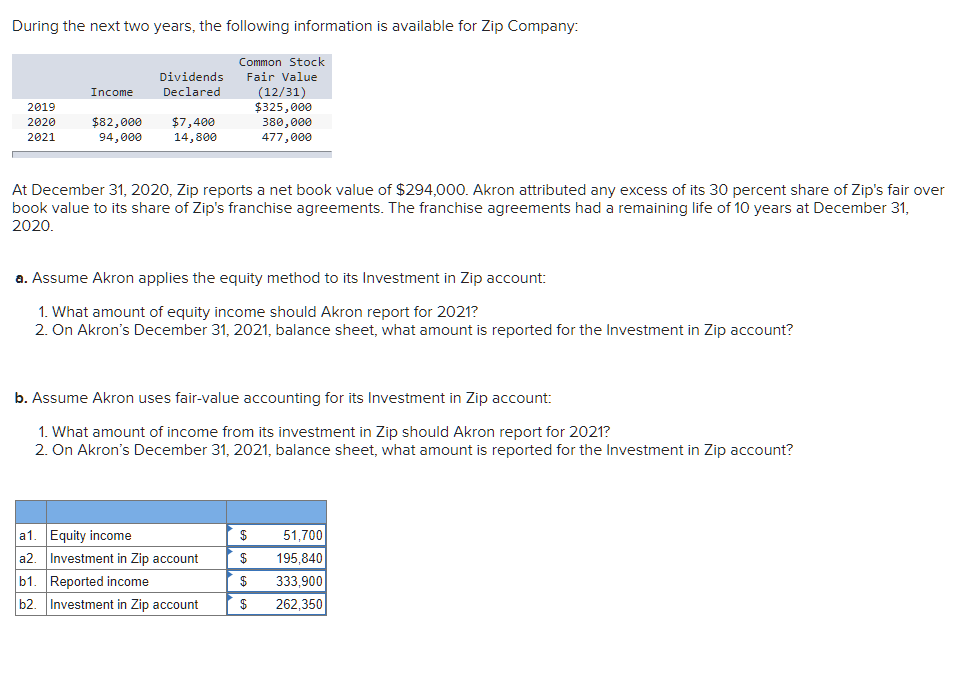

During the next two years, the following information is available for Zip Company:

Income Dividends Declared Common Stock

Fair Value

$

$ $

At December Zip reports a net book value of $ Akron attributed any excess of its percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of years at December

Assume Akron applies the equity method to its Investment in Zip account:

What amount of equity income should Akron report for

On Akrons December balance sheet, what amount is reported for the Investment in Zip account?

Assume Akron uses fairvalue accounting for its Investment in Zip account:

What amount of income from its investment in Zip should Akron report for

On Akrons December balance sheet, what amount is reported for the Investment in Zip account?During the next two years, the following information is available for Zip Company:

At December Zip reports a net book value of $ Akron attributed any excess of its percent share of Zip's fair over

book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of years at December

a Assume Akron applies the equity method to its Investment in Zip account:

What amount of equity income should Akron report for

On Akron's December balance sheet, what amount is reported for the Investment in Zip account?

b Assume Akron uses fairvalue accounting for its Investment in Zip account:

What amount of income from its investment in Zip should Akron report for

On Akron's December balance sheet, what amount is reported for the Investment in Zip account?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started