Answered step by step

Verified Expert Solution

Question

1 Approved Answer

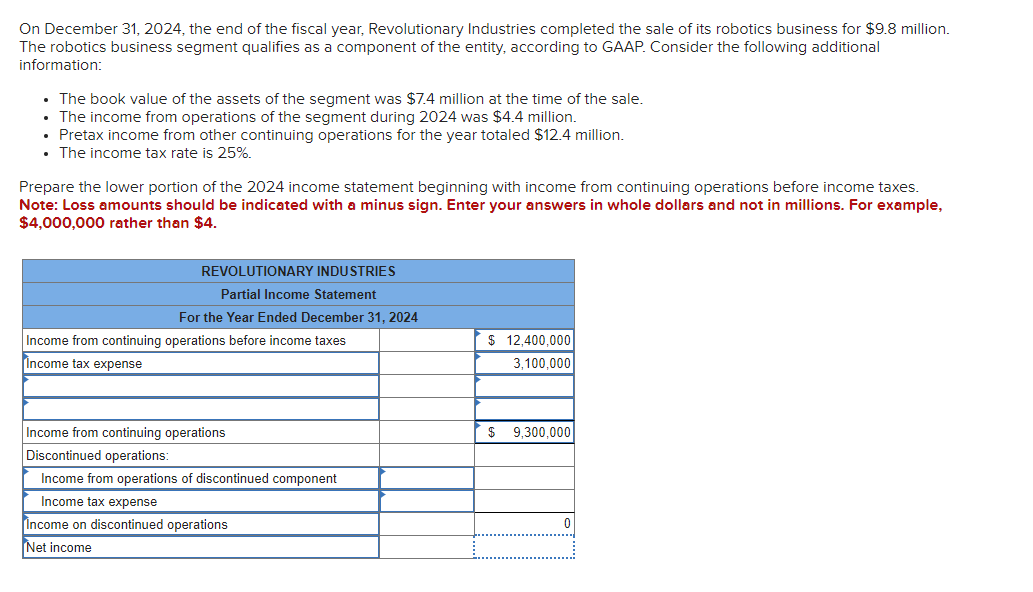

On December 3 1 , 2 0 2 4 , the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business

On December the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $ million. The robotics business segment qualifies as a component of the entity, according to GAAP. Consider the following additional information: On December the end of the fiscal year, Revolutionary Industries completed the sale of its robotics business for $ million.

The robotics business segment qualifies as a component of the entity, according to GAAP. Consider the following additional

information:

The book value of the assets of the segment was $ million at the time of the sale.

The income from operations of the segment during was $ million.

Pretax income from other continuing operations for the year totaled $ million.

The income tax rate is

Prepare the lower portion of the income statement beginning with income from continuing operations before income taxes.

Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example,

$ rather than $

The book value of the assets of the segment was $ million at the time of the sale.

The income from operations of the segment during was $ million.

Pretax income from other continuing operations for the year totaled $ million.

The income tax rate is

Prepare the lower portion of the income statement beginning with income from continuing operations before income taxes.

Note: Loss amounts should be indicated with a minus sign. Enter your answers in whole dollars and not in millions. For example, $ rather than $

THE BLANK VALUES ARE WHERE I NEED HELP PLEASE EXPLAIN

please show work for last three values how you got it rest was right

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started