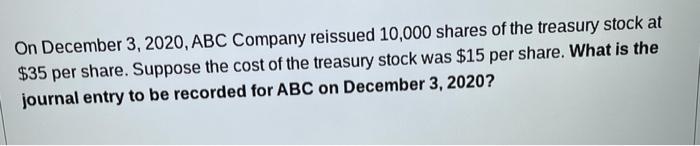

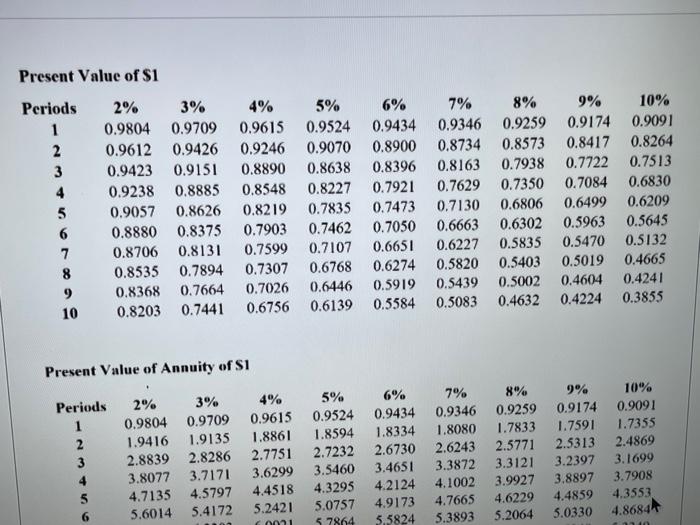

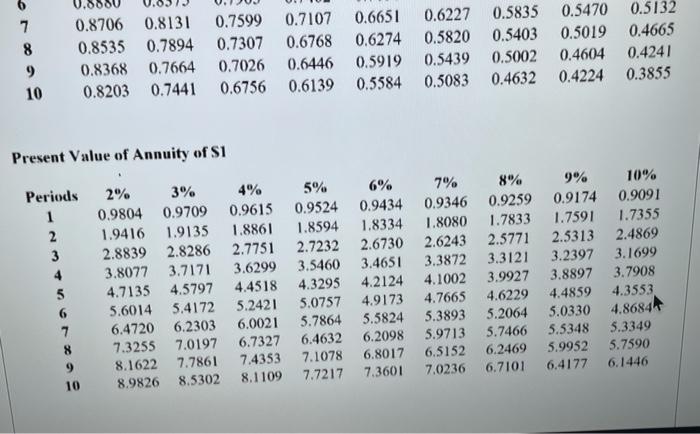

On December 3, 2020, ABC Company reissued 10,000 shares of the treasury stock at $35 per share. Suppose the cost of the treasury stock was $15 per share. What is the journal entry to be recorded for ABC on December 3, 2020? Present Value of $1 Periods 2% 3% 4% 5% 6% 7% 8% 9% 1 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 2 0.9612 0.9426 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 3 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 4 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 5 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 6 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 7 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 8 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 9 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 10 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 10% 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 Present Value of Annuity of S1 Periods 2% 3% 0.9804 0.9709 1.9416 1.9135 2.8839 2.8286 3.8077 3.7171 4.7135 4.5797 5.6014 5.4172 4% 0.9615 1.8861 2.7751 3.6299 4.4518 5.2421 (0021 5% 0.9524 1.8594 2.7232 3.5460 4.3295 5.0757 57864 3 4 6% 0.9434 1.8334 2.6730 3.4651 4.2124 4.9173 5.5824 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 7% 0.9346 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 9% 0.9174 1.7591 2.5313 3.2397 3.8897 4.4859 5.0330 10% 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 7 8 9 10 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.8368 0.7664 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.8203 0.7441 0.6756 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 Present Value of Annuity of S1 Periods 1 2 3 4 5 6 7 8 2% 3% 4% 5% 0.9804 0.9709 0.9615 0.9524 1.9416 1.9135 1.8861 1.8594 2.8839 2.8286 2.7751 2.7232 3.8077 3.7171 3.6299 3.5460 4.7135 4.5797 4.4518 4.3295 5.6014 5.4172 5.2421 5.0757 6.4720 6.2303 6.0021 5.7864 7.3255 7.0197 6.7327 6.4632 8.1622 7.7861 7.4353 7.1078 8.9826 8.5302 8.1109 7.7217 6% 7% 0.9434 0.9346 1.8334 1.8080 2.6730 2.6243 3.4651 3.3872 4.2124 4.1002 4.9173 4.7665 5.5824 5.3893 6.2098 5.9713 6.8017 6.5152 7.3601 7.0236 8% 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 9% 10% 0.9174 0.9091 1.7591 1.7355 2.5313 2.4869 3.2397 3.1699 3.8897 3.7908 4.4859 4.3553 5.0330 4.8684 5.5348 5.3349 5.9952 5.7590 6.4177 6.1446 9 10