Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 30, a fire destroyed most of the accounting records of the Adams Division, a small one-product manufacturing division that uses standard costs and

On December 30, a fire destroyed most of the accounting records of the Adams Division, a small one-product manufacturing division that uses standard costs and flexible budgets. All variances are written off as additions to (or deductions from) income; none are pro-rated to inventories. You have the task of reconstructing the records for the year. The general manager informs you that the accountant has been experimenting with both absorption costing and variable costing.

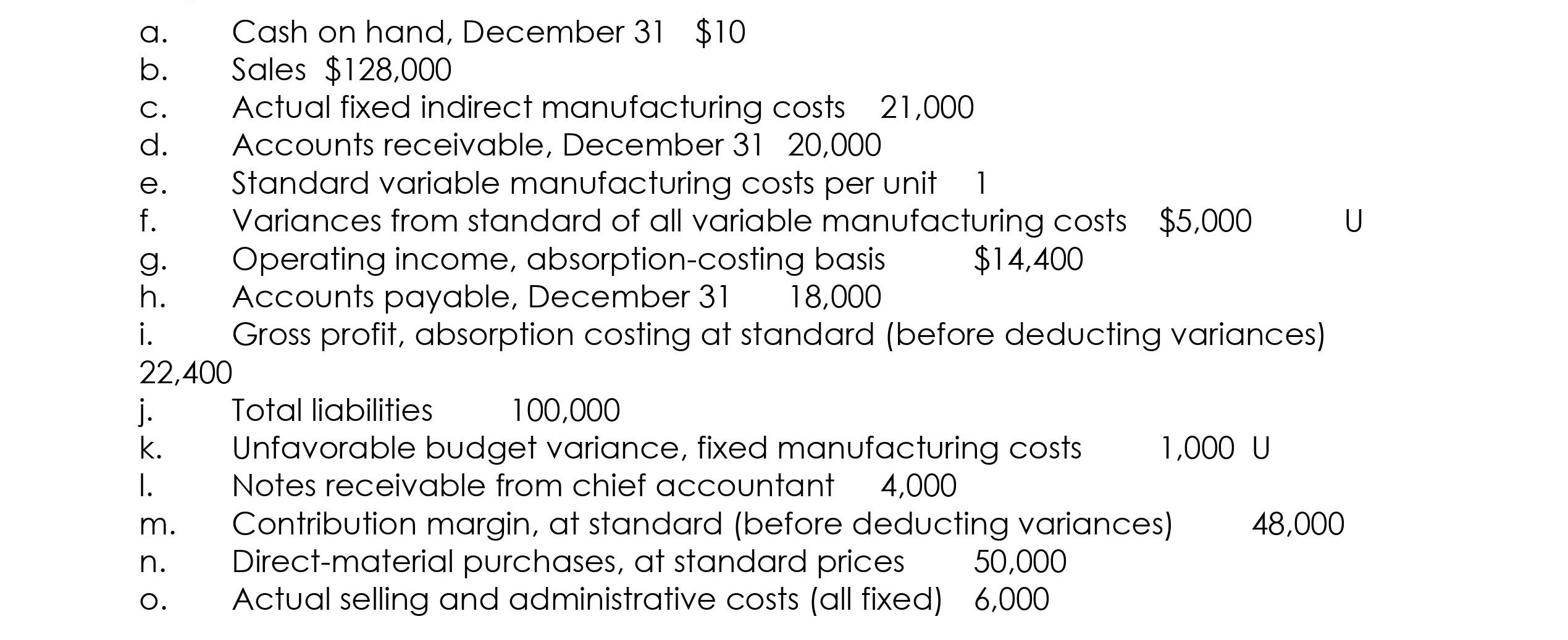

The following information is available for the current year:

a. b. Cash on hand, December 31 $10 Sales $128,000 C. d. Actual fixed indirect manufacturing costs 21,000 Accounts receivable, December 31 20,000 e. Standard variable manufacturing costs per unit 1 f. g. h. Accounts payable, December 31 i. Variances from standard of all variable manufacturing costs $5,000 Operating income, absorption-costing basis Gross profit, absorption costing at standard (before deducting variances) $14,400 18,000 22,400 j. Total liabilities 100,000 k. I. m. Unfavorable budget variance, fixed manufacturing costs. Notes receivable from chief accountant Contribution margin, at standard (before deducting variances) 4,000 1,000 U 48,000 n. O. Direct-material purchases, at standard prices Actual selling and administrative costs (all fixed) 50,000 6,000 U

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets systematically reconstruct the income statement and balance sheet Income Statement Absorption C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started