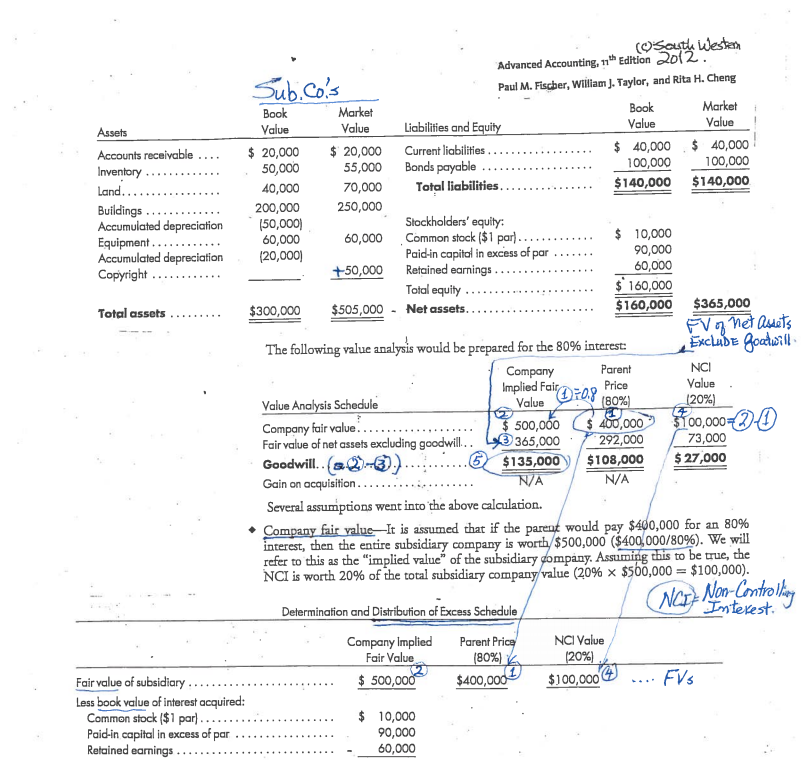

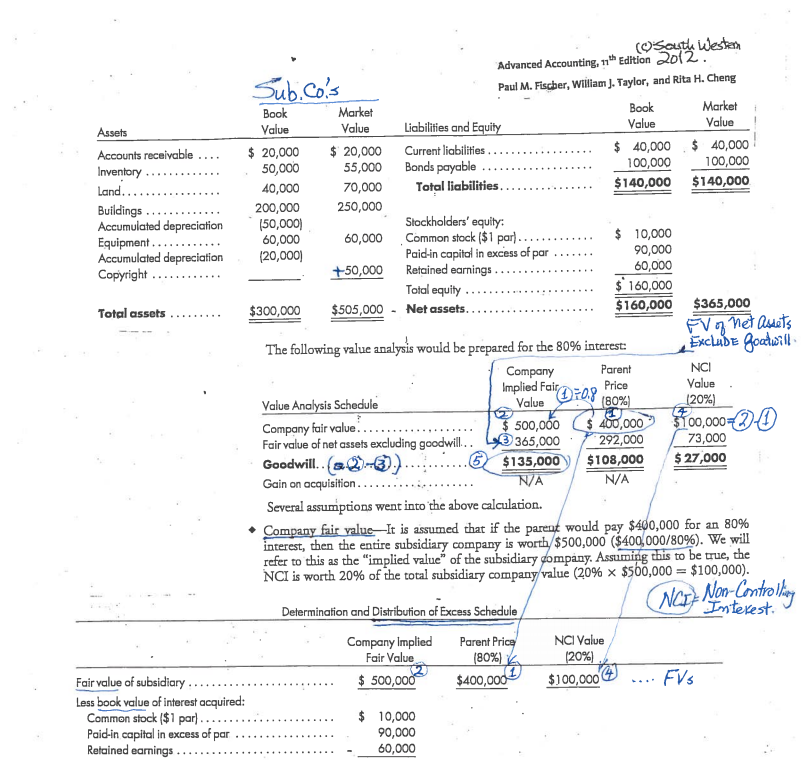

On December 31, 2011, Parental, Inc. is preparing its consolidated balance sheet to include Sample Co. acquisition. As of the date of acquisition, the Sample

On December 31, 2011, Parental, Inc. is preparing its consolidated balance sheet to include Sample Co. acquisition. As of the date of acquisition, the Sample Co.s fair value of identifiable net assets of $365,000, while the net book value of $160,000, according to an independent valuation report [for the details, see attached Goodwill Calc p. 2 file]. Required:

1. What was the total Implied fair value of the acquired firm? $___________. Show your calculation method. [Consult the attached Goodwill Calc p. 2 file]

2. What amount of GOODWILL will Parental Inc. include in its consolidated balance sheet? $___________. Show your calculation method. [Consult the attached Goodwill Calc p. 2]

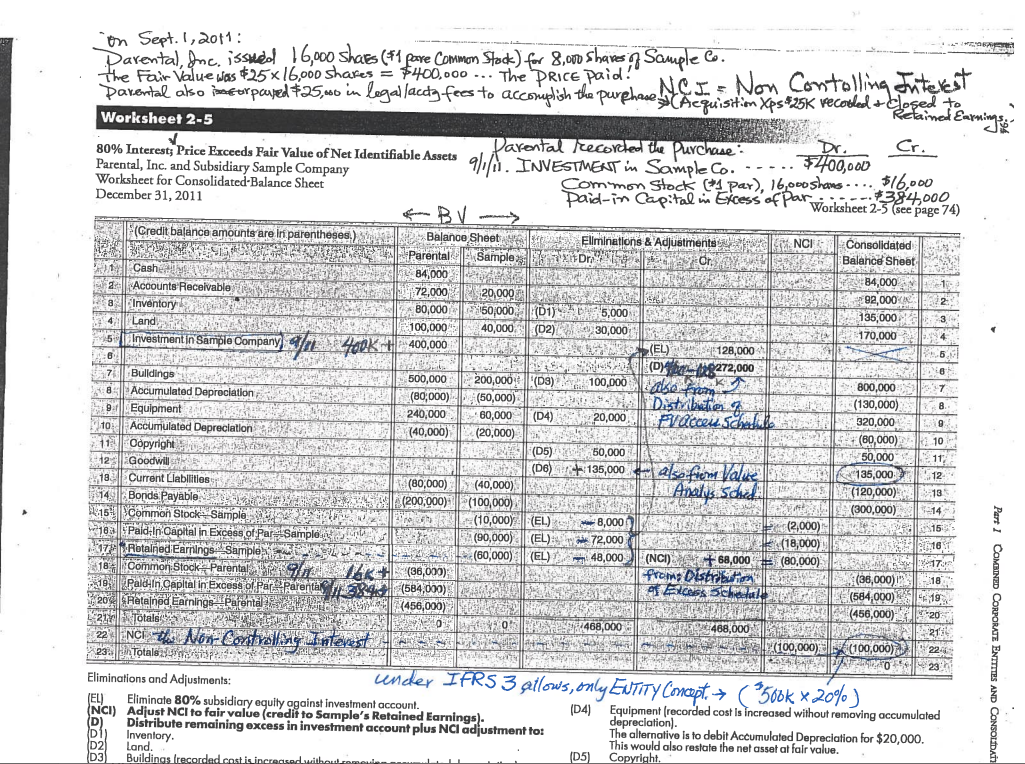

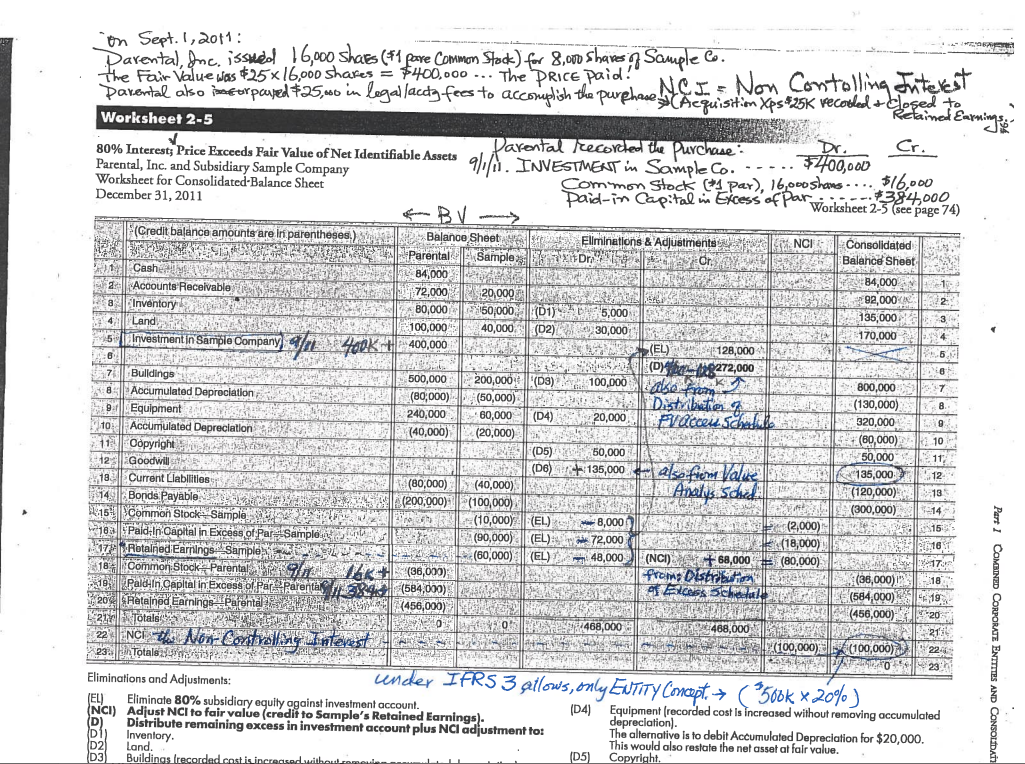

3. Write your Consolidation journal entries. [Consult the attached Consolidation Worksheet in the Consol Worksheet file. ]

Subico's NCI South Westen Advanced Accounting, 11th Edition 2012 Paul M. Fischer, William J. Taylor, and Rita H. Cheng Book Market Book Market Assets Value Value Liabilities and Equity Value Value Accounts receivable .... $ 20,000 $ 20,000 Current liabilities..... $ 40,000 $ 40,000 Inventory ....... 50,000 55,000 Bonds payable .................. 100,000 100,000 Land................ 40,000 70,000 Total liabilities. $140,000 $140,000 Buildings. ............ 200,000 250,000 Accumulated depreciation (50,000 Stockholders' equity: Equipment. 60,000 60,000 Common stock ($1 par) ............. $ 10,000 Accumulated depreciation (20,000) Paid-in capital in excess of par....... 90,000 Copyright .......... +50,000 Retained earnings .......... 60,000 Total equity ............ $ 160,000 Total assets ......... $300,000 $505,000 - Net assets........... $ 160,000 $365,000 FV of net assets The following value analysis would be prepared for the 80% interest: Exclude Goalueill Company Parent Implied Fair209 Price Value . Value Analysis Schedule Value UEU (80% (20%) 7 Company fair value ...... $500,000 $400,000 $700,000 Fair value of net assets excluding goodwill... 3365,000 292,000 73,000 Goodwill. 2- ............6 $135,000 $108,000 $ 27,000 Gain on acquisition.......... ........ N/A Several assumptions went into the above calculation. Company fair value-It is assumed that if the parent would pay $400,000 for an 80% interest, then the entire subsidiary company is worth $500,000 ($400,000/80%). We will refer to this as the "implied value of the subsidiary company. Assuming this to be true, the NCI is worth 20% of the total subsidiary company value (20% $500,000 = $100,000). I NGI Non-Controllin Determination and Distribution of Excess Schedule f Interest Company Implied Parent Price NCI Value Fair Value (80%) (20%) Fair value of subsidiary ......... $ 500,000 $400,000 $100,000 ... FVS Less book value of interest acquired: Common stock ($1 par......... $ 10,000 Paid-in capital in excess of par ............ 90,000 Retained earnings ............ 60,000 NA Non compte de contre le content on Sept. 1, 2011 : parental, Inc. issued 16,000 shares (#1 pare Common Stock) for 8,000 shares of Sample Co. the Fair Value was $25 x 16,000 Shares = $400,000 ... The PRICE paid! Sarental ako imeur poured +25,0 in legal lacey fees to accomplish the purphase Acquisition Xps $25K Vecotlede Worksheet 2-5 Darental Trecorched the purchase 80% Interest Price Exceeds Pair Value of Net Identifiable Assets Parental, Inc. and Subsidiary Sample Company W. INVESTMEAT in Sample Co. La..... 3400,000 Worksheet for Consolidated-Balance Sheet Common stock (1 par), 16,000 shans .... $16,000 Capital w Ecess of par Worksheet 23 (see page 74) ... 384000 December 31, 2011 BV (Credit balance amounts are in parentheses.), Balance Sheetal Eliminations & Adjustments NCIS Consolidated EGO Parental : Sample Balance Sheet Cashes 84,000 84,000 Accounts Receivable $$72,000 20,000 92,000 3. Inventory 80,000 50000 (DISH 5,000 135,000 Land 100,000 40,000 (02) 30,000 170,000 5 Investment in Sample Company Shi 40K 400,000 (EL) - 128,000 (D) 18272,00 iso fra KL (40,000) 73 Bulldings 500,000 200,000 (DE) 100,000 800,000 Accumulated Depreciation (80,000) (50,000) Distries (130,000) Equipment 240,000 60,000 (D4) 20,000 Il FV acouschall 320,000 Accumulated Depreciation (20,000) +(80,000) Copyright (05) 50,000 50,000 Goodwill (DE) + 135,000 as Am Valve l l 135,000 12 Current Llabilities (80,000) (40,000) Analys Sched (120,000) 14 Bonds Payable S E (200,000)? (100,000) (300,000) 15 Common Stock-Sample ne (10,000) (EL) 8,000 (2,000) 10 Paid In Capital in Excess of Par Samples (90,000) (EL) 72.000 (18,000) 17 Rotalmed Earrings Samples (60,000) || (EL) 48,000 2 (NC) 68,000 (80,000) 18 is common Stock Parental (36,000); Howe (36,000) 18 Seri Paldin, Gapital im:Excuse of par Parertas 38 (584,000 AUDIREMAS S Chwali SMPM (584,000) 100 ** 20. Ratajned Earnings Parental ! (456,000) (456,000) 13:20 273 Totals ROKAST, 468,000 468,000 K UFACTIE 2142 22. ENCHO -Control untenst (100,000) (100,000) 220 23. Totals 23 Eliminations and Adjustments: under IFRS 3 allows, only EUTITY Concept + (500k * 20%) (EL) Eliminate 80% subsidiary equity against investment account. (D4) Equipment (recorded cost is increased without removing accumulated (NCI) Adjust NCI to fair value (credit to Sample's Retained Earnings). depreciation). Distribute remaining excess in investment account plus NCI adjustment to: The alternative is to debit Accumulated Depreciation for $20,000. D) Inventory This would also restate the net asset at falr value. D2) Land. _D5) Copyright Part 1 COMBINED CORPORATE ENTITIES AND CONSOLIDATI (D)