Answered step by step

Verified Expert Solution

Question

1 Approved Answer

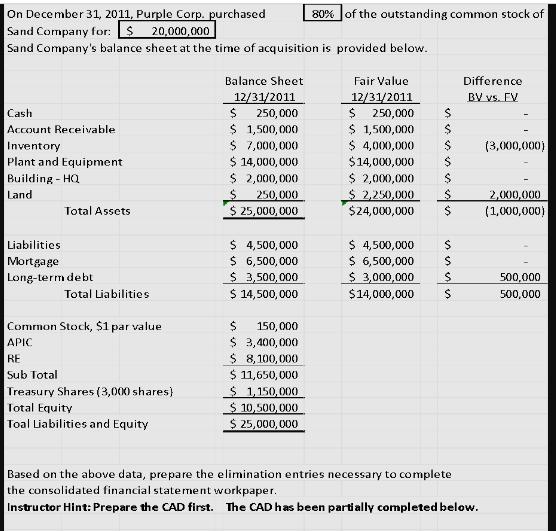

On December 31, 2011, Purple Corp. purchased Sand Company for: $ 20,000,000 Sand Company's balance sheet at the time of acquisition is provided below.

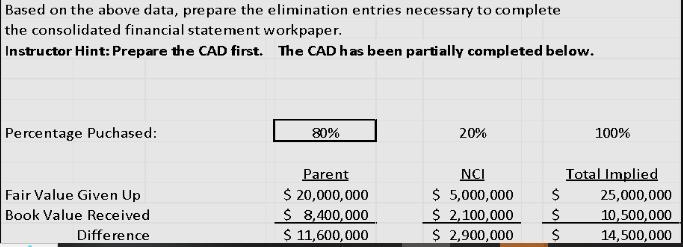

On December 31, 2011, Purple Corp. purchased Sand Company for: $ 20,000,000 Sand Company's balance sheet at the time of acquisition is provided below. Cash Account Receivable Inventory Plant and Equipment Building - HQ Land Total Assets Liabilities Mortgage Long-term debt Total Liabilities Common Stock, $1 par value APIC RE Sub Total Treasury Shares (3,000 shares) Total Equity Toal Liabilities and Equity Balance Sheet 12/31/2011 $ 250,000 $ 1,500,000 $ 7,000,000 $ 14,000,000 $ 2,000,000 $ 250,000 $ 25,000,000 $ 4,500,000 $ 6,500,000 $ 3,500,000 $ 14,500,000 80% of the outstanding common stock of 150,000 $ 3,400,000 $ 8,100,000 $ 11,650,000 $ 1,150,000 $ 10,500,000 $ 25,000,000 Fair Value 12/31/2011 250,000 $1,500,000 $ 4,000,000 $14,000,000 $ 2,000,000 $ 2,250,000 $24,000,000 $ 4,500,000 $ 6,500,000 $ 3,000,000 $14,000,000 sssss $ $ ssss $ $ $ Difference BV vs. FV Based on the above data, prepare the elimination entries necessary to complete the consolidated financial statement workpaper. Instructor Hint: Prepare the CAD first. The CAD has been partially completed below. (3,000,000) 2,000,000 (1,000,000) 500,000 500,000 Based on the above data, prepare the elimination entries necessary to complete the consolidated financial statement work paper. Instructor Hint: Prepare the CAD first. The CAD has been partially completed below. Percentage Puchased: Fair Value Given Up Book Value Received Difference 80% Parent $ 20,000,000 $ 8,400,000 $ 11,600,000 20% NCI $ 5,000,000 2,100,000 $ 2,900,000 $ $ $ 100% Total Implied 25,000,000 10,500,000 14,500,000

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

part II part III Computation and Allocation Schedule for the difference between book v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started