Answered step by step

Verified Expert Solution

Question

1 Approved Answer

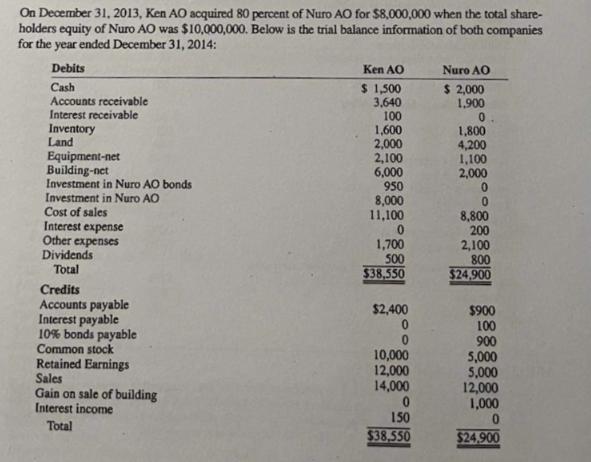

On December 31, 2013, Ken AO acquired 80 percent of Nuro AO for $8,000,000 when the total share- holders equity of Nuro AO was

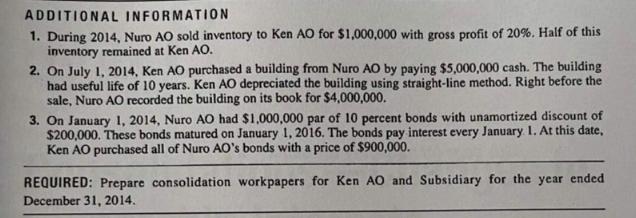

On December 31, 2013, Ken AO acquired 80 percent of Nuro AO for $8,000,000 when the total share- holders equity of Nuro AO was $10,000,000. Below is the trial balance information of both companies for the year ended December 31, 2014: Debits Cash Accounts receivable Interest receivable Inventory Land Equipment-net Building-net Investment in Nuro AO bonds Investment in Nuro AO Cost of sales Interest expense Other expenses Dividends Total Credits Accounts payable Interest payable 10% bonds payable Common stock Retained Earnings Sales Gain on sale of building Interest income Total Ken AO $ 1,500 3,640 100 1,600 2,000 2,100 6,000 950 8,000 11,100 0 1,700 500 $38,550 $2,400 0 0 10,000 12,000 14,000 0 150 $38,550 Nuro AO $ 2,000 1,900 0 1,800 4,200 1,100 2,000 0 0 8,800 200 2,100 800 $24,900 $900 100 900 5,000 5,000 12,000 1,000 0 $24,900 ADDITIONAL INFORMATION 1. During 2014, Nuro AO sold inventory to Ken AO for $1,000,000 with gross profit of 20%. Half of this inventory remained at Ken AO. 2. On July 1, 2014, Ken AO purchased a building from Nuro AO by paying $5,000,000 cash. The building had useful life of 10 years. Ken AO depreciated the building using straight-line method. Right before the sale, Nuro AO recorded the building on its book for $4,000,000. 3. On January 1, 2014, Nuro AO had $1,000,000 par of 10 percent bonds with unamortized discount of $200,000. These bonds matured on January 1, 2016. The bonds pay interest every January 1. At this date, Ken AO purchased all of Nuro AO's bonds with a price of $900,000. REQUIRED: Prepare consolidation workpapers for Ken AO and Subsidiary for the year ended December 31, 2014.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started