Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2014, Paolo Corporation acquired 90 percent of the ordinary shares of Sandy Inc. for P1,243,200, P336,000 in excess of the book

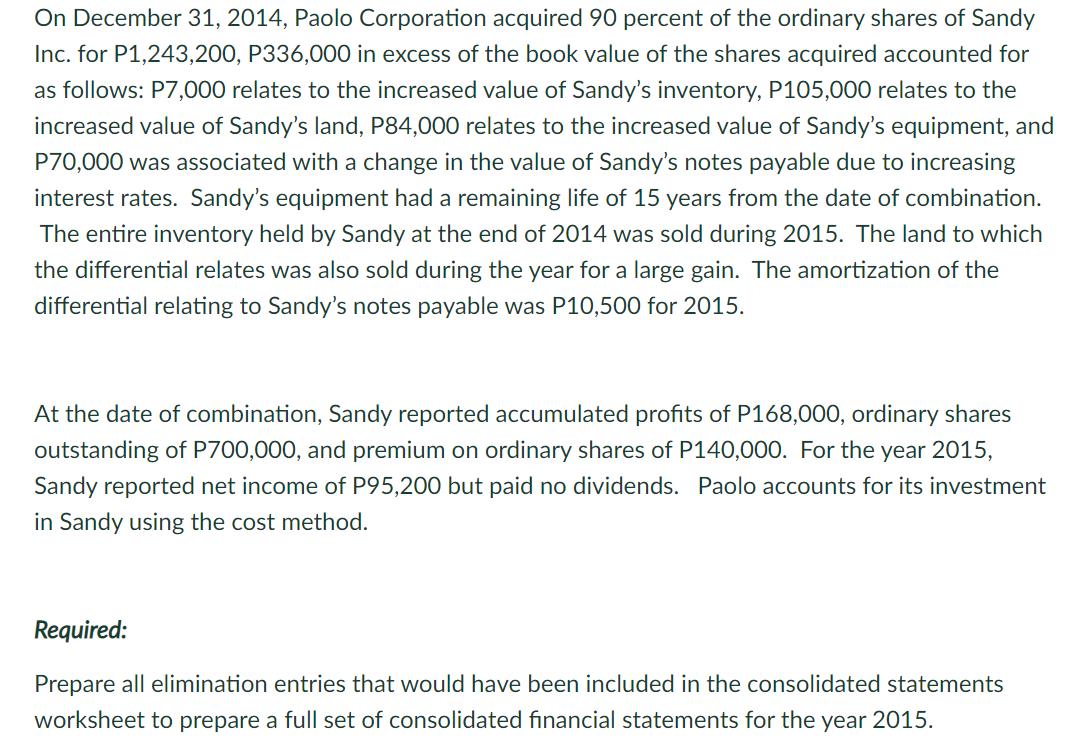

On December 31, 2014, Paolo Corporation acquired 90 percent of the ordinary shares of Sandy Inc. for P1,243,200, P336,000 in excess of the book value of the shares acquired accounted for as follows: P7,000 relates to the increased value of Sandy's inventory, P105,000 relates to the increased value of Sandy's land, P84,000 relates to the increased value of Sandy's equipment, and P70,000 was associated with a change in the value of Sandy's notes payable due to increasing interest rates. Sandy's equipment had a remaining life of 15 years from the date of combination. The entire inventory held by Sandy at the end of 2014 was sold during 2015. The land to which the differential relates was also sold during the year for a large gain. The amortization of the differential relating to Sandy's notes payable was P10,500 for 2015. At the date of combination, Sandy reported accumulated profits of P168,000, ordinary shares outstanding of P700,000, and premium on ordinary shares of P140,000. For the year 2015, Sandy reported net income of P95,200 but paid no dividends. Paolo accounts for its investment in Sandy using the cost method. Required: Prepare all elimination entries that would have been included in the consolidated statements worksheet to prepare a full set of consolidated financial statements for the year 2015.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Ordinary Share Sandy700000 Share Premium Sandy 140000 Retained Earnings Sandy...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started