Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2015, the following data are available on one of the cash- generating units of Paradise Company: Cash Inventory Accounts receivable Plant

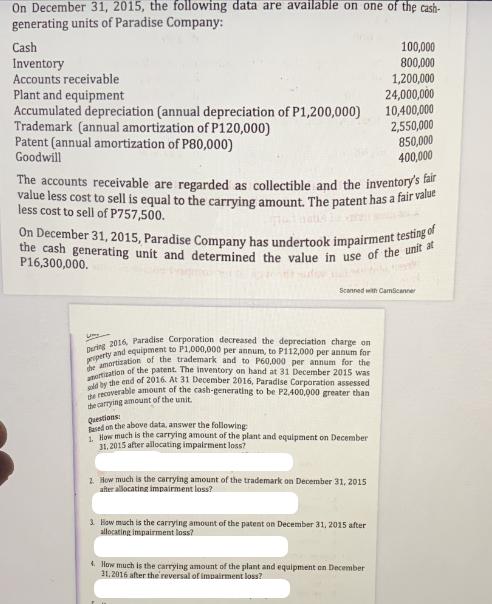

On December 31, 2015, the following data are available on one of the cash- generating units of Paradise Company: Cash Inventory Accounts receivable Plant and equipment Accumulated depreciation (annual depreciation of P1,200,000) Trademark (annual amortization of P120,000) Patent (annual amortization of P80,000) Goodwill The accounts receivable are regarded as collectible and the inventory's fair value less cost to sell is equal to the carrying amount. The patent has a fair value less cost to sell of P757,500. On December 31, 2015, Paradise Company has undertook impairment testing of the cash generating unit and determined the value in use of the unit at P16,300,000. Un During 2016, Paradise Corporation decreased the depreciation charge on property and equipment to P1,000,000 per annum, to P112,000 per annum for the amortization of the trademark and to P60,000 per annum for the amortization of the patent. The inventory on hand at 31 December 2015 was dhe recoverable amount of the cash-generating to be P2,400,000 greater than gold by the end of 2016. At 31 December 2016, Paradise Corporation assessed the carrying amount of the unit. Scanned with CamScanner Questions: Based on the above data, answer the following 1. How much is the carrying amount of the plant and equipment on December 31, 2015 after allocating impairment loss? 100,000 800,000 1,200,000 24,000,000 10,400,000 2. How much is the carrying amount of the trademark on December 31, 2015 after allocating impairment loss? 2,550,000 850,000 400,000 3. How much is the carrying amount of the patent on December 31, 2015 after allocating impairment loss? 4. How much is the carrying amount of the plant and equipment on December 31,2016 after the reversal of impairment loss?

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Carrying amount of the plant and equipment on December 31 2015 after allocating the impairment loss ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started