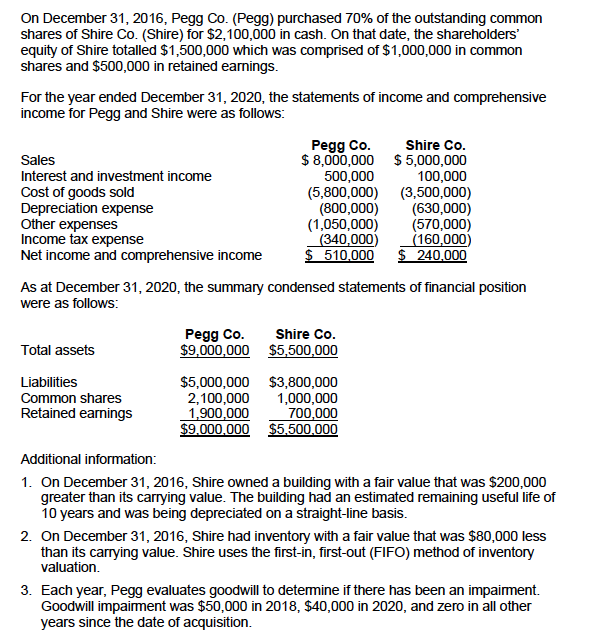

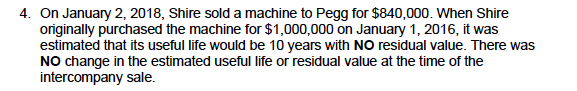

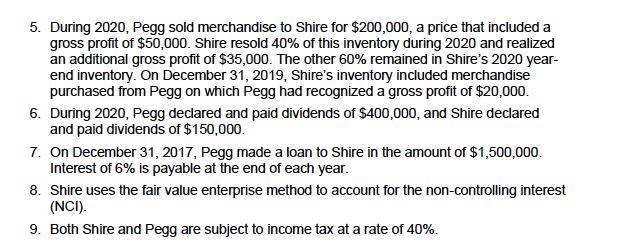

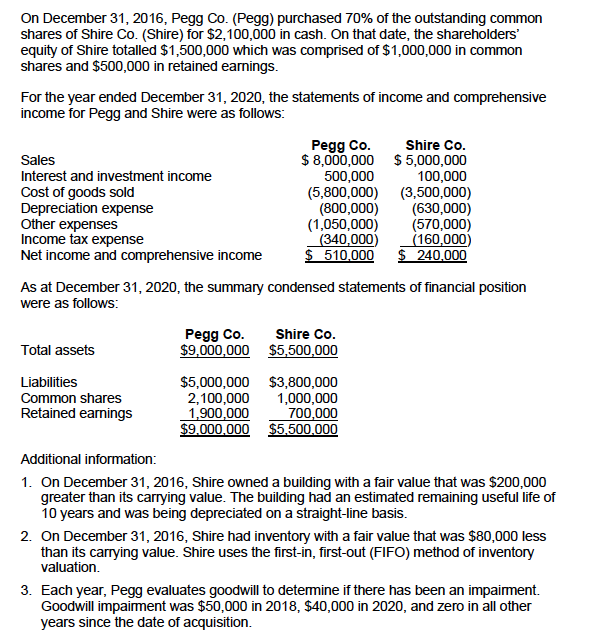

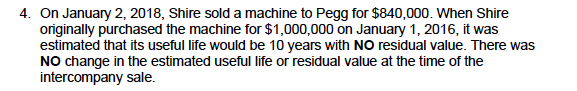

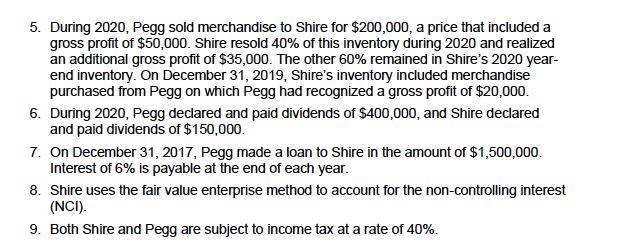

On December 31, 2016, Pegg Co. (Pegg) purchased 70% of the outstanding common shares of Shire Co. (Shire) for $2,100,000 in cash. On that date, the shareholders' equity of Shire totalled $1,500,000 which was comprised of $1,000,000 in common shares and $500,000 in retained earnings. For the year ended December 31, 2020, the statements of income and comprehensive income for Pegg and Shire were as follows: Sales Interest and investment income Cost of goods sold Depreciation expense Other expenses Income tax expense Net income and comprehensive income Pegg Co. Shire Co. $ 8,000,000 $5,000,000 500,000 100,000 (5,800,000) (3,500,000) (800,000) (630,000) (1,050,000) (570,000) (340,000) (160,000) $ 510,000 $ 240,000 As at December 31, 2020, the summary condensed statements of financial position were as follows: Shire Co. Pegg Co. $9,000,000 $5,500,000 Total assets Liabilities Common shares Retained earnings $5,000,000 $3,800,000 2,100,000 1,000,000 1,900,000 700,000 $9,000,000 $5,500,000 Additional information: 1. On December 31, 2016, Shire owned a building with a fair value that was $200,000 greater than its carrying value. The building had an estimated remaining useful life of 10 years and was being depreciated on a straight-line basis. 2. On December 31, 2016, Shire had inventory with a fair value that was $80,000 less than its carrying value. Shire uses the first-in, first-out (FIFO) method of inventory valuation. 3. Each year, Pegg evaluates goodwill to determine if there has been an impairment. Goodwill impairment was $50,000 in 2018, $40,000 in 2020, and zero in all other years since the date of acquisition. 4. On January 2, 2018, Shire sold a machine to Pegg for $840,000. When Shire originally purchased the machine for $1,000,000 on January 1, 2016, it was estimated that its useful life would be 10 years with NO residual value. There was NO change in the estimated useful life or residual value at the time of the intercompany sale. 5. During 2020, Pegg sold merchandise to Shire for $200,000, a price that included a gross profit of $50,000. Shire resold 40% of this inventory during 2020 and realized an additional gross profit of $35,000. The other 60% remained in Shire's 2020 year- end inventory. On December 31, 2019, Shire's inventory included merchandise purchased from Pegg on which Pegg had recognized a gross profit of $20,000. 6. During 2020, Pegg declared and paid dividends of $400,000, and Shire declared and paid dividends of $150,000. 7. On December 31, 2017, Pegg made a loan to Shire in the amount of $1,500,000 Interest of 6% is payable at the end of each year. 8. Shire uses the fair value enterprise method to account for the non-controlling interest (NCI). 9. Both Shire and Pegg are subject to income tax at a rate of 40%. d) Prepare the consolidated statement of comprehensive income for the year ended December 31, 2020. (11 marks) On December 31, 2016, Pegg Co. (Pegg) purchased 70% of the outstanding common shares of Shire Co. (Shire) for $2,100,000 in cash. On that date, the shareholders' equity of Shire totalled $1,500,000 which was comprised of $1,000,000 in common shares and $500,000 in retained earnings. For the year ended December 31, 2020, the statements of income and comprehensive income for Pegg and Shire were as follows: Sales Interest and investment income Cost of goods sold Depreciation expense Other expenses Income tax expense Net income and comprehensive income Pegg Co. Shire Co. $ 8,000,000 $5,000,000 500,000 100,000 (5,800,000) (3,500,000) (800,000) (630,000) (1,050,000) (570,000) (340,000) (160,000) $ 510,000 $ 240,000 As at December 31, 2020, the summary condensed statements of financial position were as follows: Shire Co. Pegg Co. $9,000,000 $5,500,000 Total assets Liabilities Common shares Retained earnings $5,000,000 $3,800,000 2,100,000 1,000,000 1,900,000 700,000 $9,000,000 $5,500,000 Additional information: 1. On December 31, 2016, Shire owned a building with a fair value that was $200,000 greater than its carrying value. The building had an estimated remaining useful life of 10 years and was being depreciated on a straight-line basis. 2. On December 31, 2016, Shire had inventory with a fair value that was $80,000 less than its carrying value. Shire uses the first-in, first-out (FIFO) method of inventory valuation. 3. Each year, Pegg evaluates goodwill to determine if there has been an impairment. Goodwill impairment was $50,000 in 2018, $40,000 in 2020, and zero in all other years since the date of acquisition. 4. On January 2, 2018, Shire sold a machine to Pegg for $840,000. When Shire originally purchased the machine for $1,000,000 on January 1, 2016, it was estimated that its useful life would be 10 years with NO residual value. There was NO change in the estimated useful life or residual value at the time of the intercompany sale. 5. During 2020, Pegg sold merchandise to Shire for $200,000, a price that included a gross profit of $50,000. Shire resold 40% of this inventory during 2020 and realized an additional gross profit of $35,000. The other 60% remained in Shire's 2020 year- end inventory. On December 31, 2019, Shire's inventory included merchandise purchased from Pegg on which Pegg had recognized a gross profit of $20,000. 6. During 2020, Pegg declared and paid dividends of $400,000, and Shire declared and paid dividends of $150,000. 7. On December 31, 2017, Pegg made a loan to Shire in the amount of $1,500,000 Interest of 6% is payable at the end of each year. 8. Shire uses the fair value enterprise method to account for the non-controlling interest (NCI). 9. Both Shire and Pegg are subject to income tax at a rate of 40%. d) Prepare the consolidated statement of comprehensive income for the year ended December 31, 2020. (11 marks)