Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2016, you purchased a house, financing $350,000 with a standard 30-year fixed rate mortgage with a contract interest rate of 5.2%

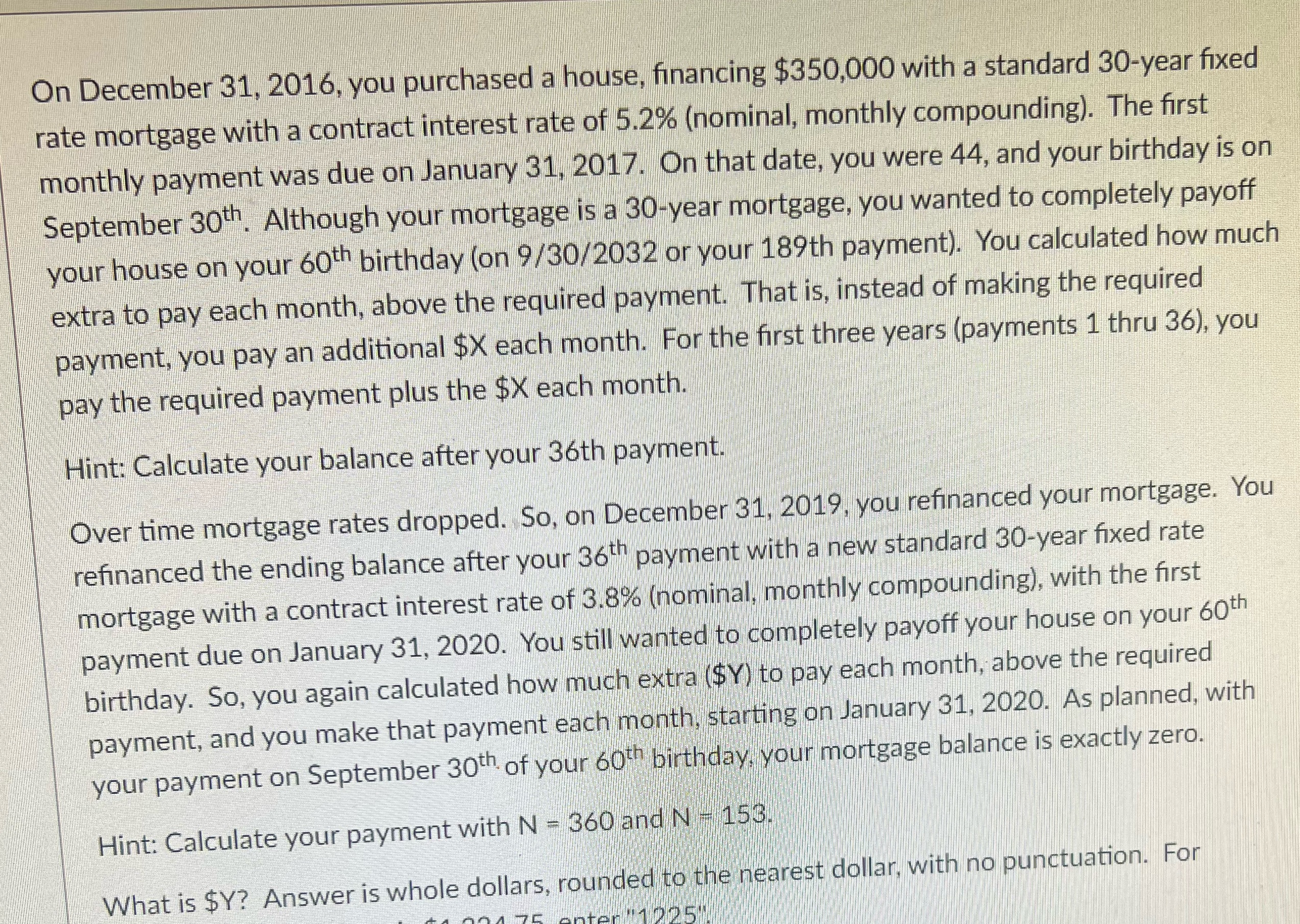

On December 31, 2016, you purchased a house, financing $350,000 with a standard 30-year fixed rate mortgage with a contract interest rate of 5.2% (nominal, monthly compounding). The first monthly payment was due on January 31, 2017. On that date, you were 44, and your birthday is on September 30th. Although your mortgage is a 30-year mortgage, you wanted to completely payoff your house on your 60th birthday (on 9/30/2032 or your 189th payment). You calculated how much extra to pay each month, above the required payment. That is, instead of making the required payment, you pay an additional $X each month. For the first three years (payments 1 thru 36), you pay the required payment plus the $X each month. Hint: Calculate your balance after your 36th payment. Over time mortgage rates dropped. So, on December 31, 2019, you refinanced your mortgage. You refinanced the ending balance after your 36th payment with a new standard 30-year fixed rate mortgage with a contract interest rate of 3.8% (nominal, monthly compounding), with the first payment due on January 31, 2020. You still wanted to completely payoff your house on your birthday. So, you again calculated how much extra ($Y) to pay each month, above the required payment, and you make that payment each month, starting on January 31, 2020. As planned, with your payment on September 30th of your 60th birthday, your mortgage balance is exactly zero. 60th Hint: Calculate your payment with N = 360 and N = 153. What is $Y? Answer is whole dollars, rounded to the nearest dollar, with no punctuation. For 004.75. enter "1225"

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of Y the extra amount paid each month after refinancing we need to go through the following steps Step 1 Calculate the remainin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started