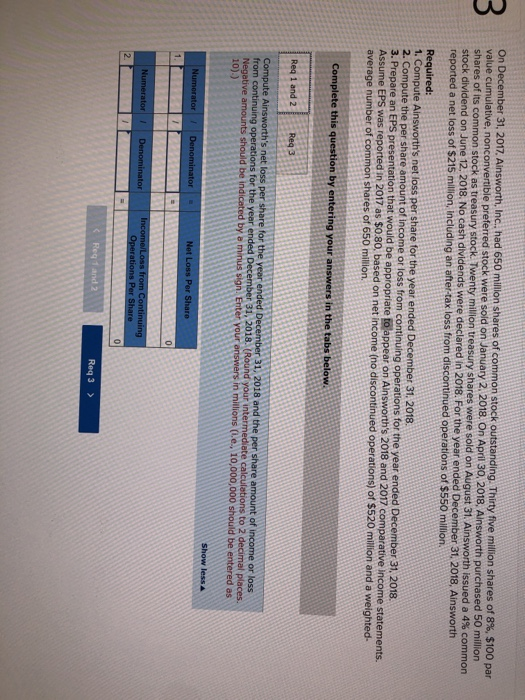

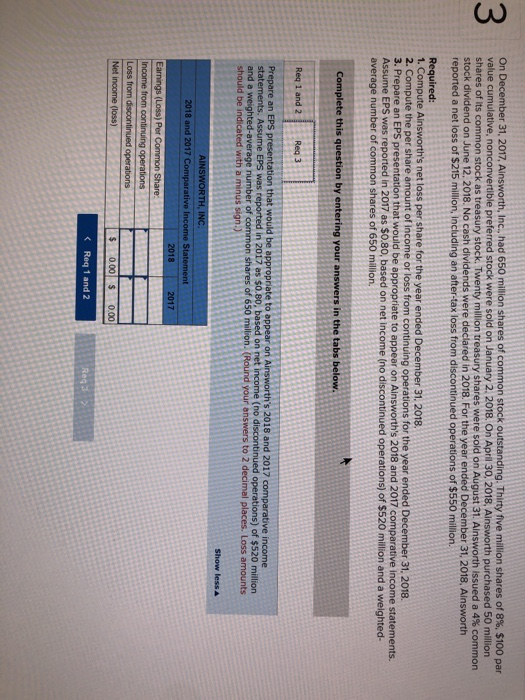

on December 31, 2017, Ainsworth, Inc. had 650 million shares of common stock outstanding. Thirty five million shares of 8%. $100 par value cumulative, nonconvertible preferred stock were sold on January 2 shares of its common stock as treasury stock. Twenty milion treasury shares wer Ainsworth purchased 50 million sold on August 31, Ainsworth issued a 4% common dividend on June 12, 2018 No cash dividends were declared in 2018. For the year ended December 31, 2018, Ainsworth lion, including an after-tax loss from discontinued operations of $550 million. reported a net loss of $215 million, including an after-tax loss from discontinued Required 1, Compute Ainsworth's net loss per share for the year ended December 31. 2018 Compute the per share amount of income or loss from continuing operations for the year ended December 31. 2018 3. Prepare an EPS presentation that would be appropriate to appear on Ainsworth's 2018 and 2017 comparative income statements. Assume EPS was reported in 2017 as $080 based on net income (no discontinued operations) of $520 milion and a weighted- average number of common shares of 650 million. Req 1 and 2Reg3 Compute Ainsworth's net loss per share for the yeer or loss to 2 decimal places. 10).) Show less Numerator inator Req 3 > On December 31, 2017, Ainsworth, Inc., had 650 million shares of common stock outstanding. Thirty five million shares of 8%, $100 par value cumulative, nonconvertible preferred stock were sold on January 2. 2018. On April 30, 2018, Ainsworth purchased 50 million shares of its common stock as treasury stock. Twenty million treasury shares were sold on August 31 Ainsworth issued a 4% common stock dividend on June 12. 2018. No cash dividends were declared in 2018. For the year ended December 31, 2018. Ainsworth reported a net loss of $215 million, including an after-tax loss from discontinued operations of $550 million. Required: 1. Compute Ainsworth's net loss per share for the year ended December 31. 2018. 2. Compute the per share amount of income or loss from continuing operations for the year ended December 31. 2018. 3. Prepare an EPS presentation that would be appropriate to appear on Ainsworth's 2018 and 2017 comparative income statements. Assume EPS was reported in 2017 as $0.80, based on net income (no discontinued operations) of $520 million and a weighted- average number of common shares of 650 million, Req 1 and 2Req 3 Prepare an EPS p and a weighted-average number of common shares of 650 million. (Round your answers to 2 decimal places. Loss amounts should be i with a minus sign.) 2018 and 2017 Comparative Income Statement Loss) Per from Loss from 0.00 S 0.00 Req 1 and 2