Answered step by step

Verified Expert Solution

Question

1 Approved Answer

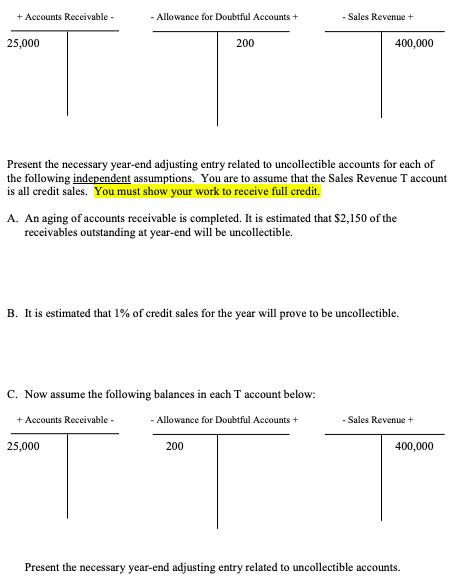

On December 31, 2017, Carter Corporation had the following account balances related to credit sales and receivables prior to recording adjusting entries: + Accounts Receivable

On December 31, 2017, Carter Corporation had the following account balances related to credit sales and receivables prior to recording adjusting entries:

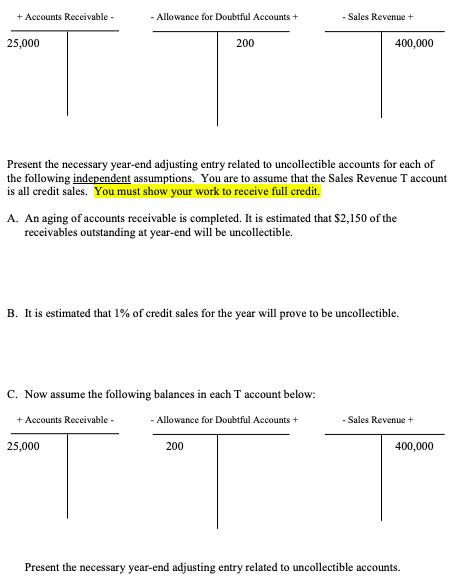

+ Accounts Receivable - Allowance for Doubtful Accounts + Sales Revenue + 25,000 200 400,000 Present the necessary year-end adjusting entry related to uncollectible accounts for each of the following independent assumptions. You are to assume that the Sales Revenue T account is all credit sales. You must show your work to receive full credit. A. An aging of accounts receivable is completed. It is estimated that $2,150 of the receivables outstanding at year-end will be uncollectible. B. It is estimated that 1% of credit sales for the year will prove to be uncollectible. C. Now assume the following balances in each T account below: + Accounts Receivable - - Allowance for Doubtful Accounts + - Sales Revenue + 25,000 200 400,000 Present the necessary year-end adjusting entry related to uncollectible accounts.

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Date Basedontne auestrom we cen nower asfallans formetim arailoble inte RequoementA ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started