The pivotal role of accountants today is to undertake much accounting work using computers (small accounting software or ERP system). This practice question in

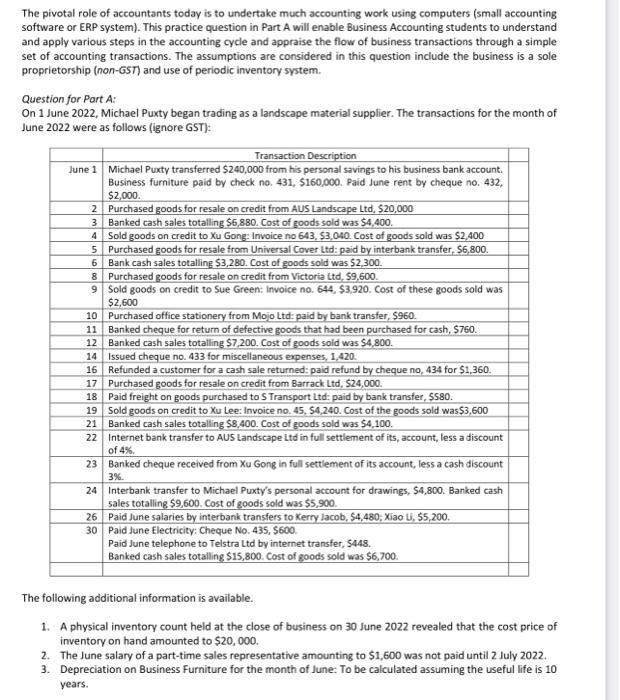

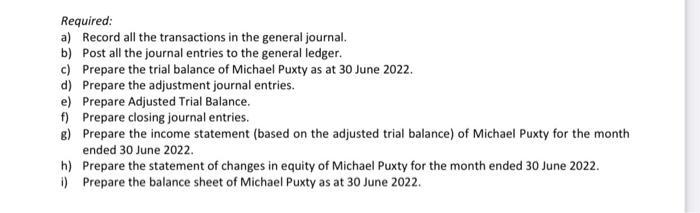

The pivotal role of accountants today is to undertake much accounting work using computers (small accounting software or ERP system). This practice question in Part A will enable Business Accounting students to understand and apply various steps in the accounting cycle and appraise the flow of business transactions through a simple set of accounting transactions. The assumptions are considered in this question include the business is a sole proprietorship (non-GST) and use of periodic inventory system. Question for Part A: On 1 June 2022, Michael Puxty began trading as a landscape material supplier. The transactions for the month of June 2022 were as follows (ignore GST): Transaction Description June 1 Michael Puxty transferred $240,000 from his personal savings to his business bank account. Business furniture paid by check no. 431, $160,000. Paid June rent by cheque no. 432, $2,000. 2 Purchased goods for resale on credit from AUS Landscape Ltd, $20,000 3 Banked cash sales totalling $6,880. Cost of goods sold was $4,400. 4 Sold goods on credit to Xu Gong: Invoice no 643, $3,040. Cost of goods sold was $2,400 5 Purchased goods for resale from Universal Cover Ltd: paid by interbank transfer, $6,800. 6 Bank cash sales totalling $3,280. Cost of goods sold was $2,300. 8 Purchased goods for resale on credit from Victoria Ltd, $9,600. 9 Sold goods on credit to Sue Green: Invoice no. 644, $3,920. Cost of these goods sold was $2,600 10 Purchased office stationery from Mojo Ltd: paid by bank transfer, $960. 11 Banked cheque for return of defective goods that had been purchased for cash, $760. 12 Banked cash sales totalling $7,200. Cost of goods sold was $4,800. 14 Issued cheque no. 433 for miscellaneous expenses, 1,420. 16 Refunded a customer for a cash sale returned: paid refund by cheque no, 434 for $1,360. 17 Purchased goods for resale on credit from Barrack Ltd, $24,000. 18 Paid freight on goods purchased to S Transport Ltd: paid by bank transfer, $580. 19 Sold goods on credit to Xu Lee: Invoice no. 45, $4,240. Cost of the goods sold was $3,600 Banked cash sales totalling $8,400. Cost of goods sold was $4,100. 21 22 Internet bank transfer to AUS Landscape Ltd in full settlement of its, account, less a discount of 4%. 23 Banked cheque received from Xu Gong in full settlement of its account, less a cash discount 3%. 24 Interbank transfer to Michael Puxty's personal account for drawings, $4,800. Banked cash sales totalling $9,600. Cost of goods sold was $5,900. 26 Paid June salaries by interbank transfers to Kerry Jacob, $4,480, Xiao Li, $5,200. 30 Paid June Electricity: Cheque No. 435, $600. Paid June telephone to Telstra Ltd by internet transfer, $448. Banked cash sales totalling $15,800. Cost of goods sold was $6,700. The following additional information is available. 1. A physical inventory count held at the close of business on 30 June 2022 revealed that the cost price of inventory on hand amounted to $20,000. 2. The June salary of a part-time sales representative amounting to $1,600 was not paid until 2 July 2022. 3. Depreciation on Business Furniture for the month of June: To be calculated assuming the useful life is 10 years. Required: a) Record all the transactions in the general journal. b) Post all the journal entries to the general ledger. c) Prepare the trial balance of Michael Puxty as at 30 June 2022. d) Prepare the adjustment journal entries. e) Prepare Adjusted Trial Balance. f) Prepare closing journal entries. g) Prepare the income statement (based on the adjusted trial balance) of Michael Puxty for the month ended 30 June 2022. h) Prepare the statement of changes in equity of Michael Puxty for the month ended 30 June 2022. i) Prepare the balance sheet of Michael Puxty as at 30 June 2022.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Part A General Journal DateTransaction DescriptionDebitCredit 162022Michael Puxty transferred 240000 from his personal savings to his business bank account 240000 162022Business furniture paid by chec...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started