Question

On December 31, 2017, Pace Co. paid $3,000,000 to Sanders Corp. shareholders to acquire 100% of the net assets of Sanders Corp. Pace Co. also

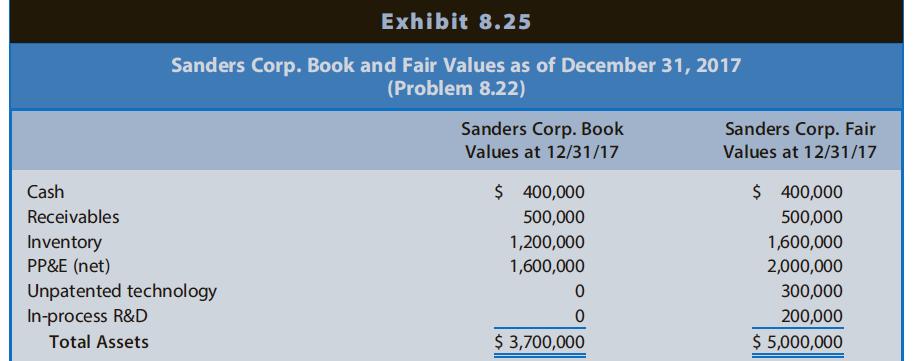

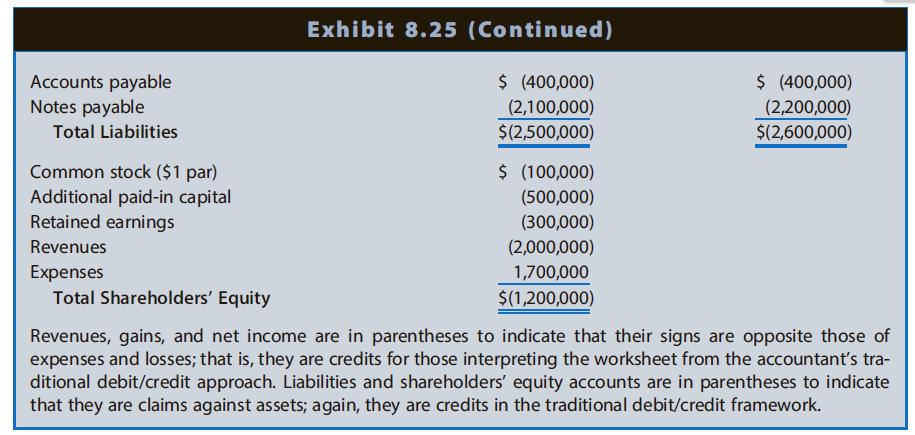

On December 31, 2017, Pace Co. paid $3,000,000 to Sanders Corp. shareholders to acquire 100% of the net assets of Sanders Corp. Pace Co. also agreed to pay former Sanders shareholders$200,000 in cash if certain earnings projections were achieved over the next two years. Based on probabilities of achieving the earnings projections, Pace estimated the fair value of this promise to be $150,000. Pace paid $10,000 in legal fees and incurred $10,000 in internal cash costs related to management's time to complete the transaction. Exhibit 8.25 provides the book and fair values of Sanders Corp. at the date of acquisition.

REQUIREDa. Record the merger using the financial statement effects template or journal entries.

b. How would the financial effects change if the cash paid was $2,000,000?

Cash Exhibit 8.25 Sanders Corp. Book and Fair Values as of December 31, 2017 (Problem 8.22) Sanders Corp. Book Values at 12/31/17 $ 400,000 500,000 1,200,000 1,600,000 0 0 $ 3,700,000 Sanders Corp. Fair Values at 12/31/17 $ 400,000 500,000 1,600,000 2,000,000 300,000 200,000 $ 5,000,000 Receivables Inventory PP&E (net) Unpatented technology In-process R&D Total Assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Recording the Merger a Using the Financial Statement Effects Template Account Debit Credit Cash 3000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e787ebf636_955507.pdf

180 KBs PDF File

663e787ebf636_955507.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started