Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2017, Pharoah Co. sold equipment to Shamrock, Inc. Pharoah Co. agreed to accept a $380,000 zero-interest- bearing note due December 31,

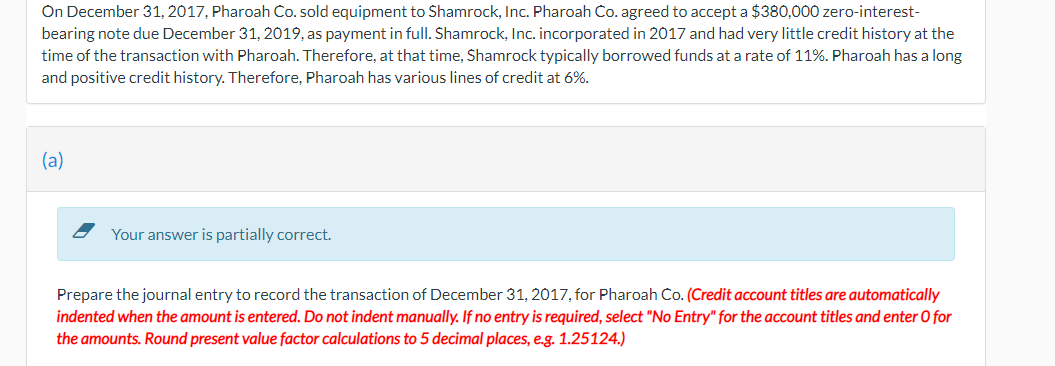

On December 31, 2017, Pharoah Co. sold equipment to Shamrock, Inc. Pharoah Co. agreed to accept a $380,000 zero-interest- bearing note due December 31, 2019, as payment in full. Shamrock, Inc. incorporated in 2017 and had very little credit history at the time of the transaction with Pharoah. Therefore, at that time, Shamrock typically borrowed funds at a rate of 11%. Pharoah has a long and positive credit history. Therefore, Pharoah has various lines of credit at 6%. (a) Your answer is partially correct. Prepare the journal entry to record the transaction of December 31, 2017, for Pharoah Co. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124.) Account Titles and Explanation Debit Credit Notes Receivable 380000 Discount on Notes Receivable Sales Revenue

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The interest rate to be used would be long term rate of 6 Face v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started