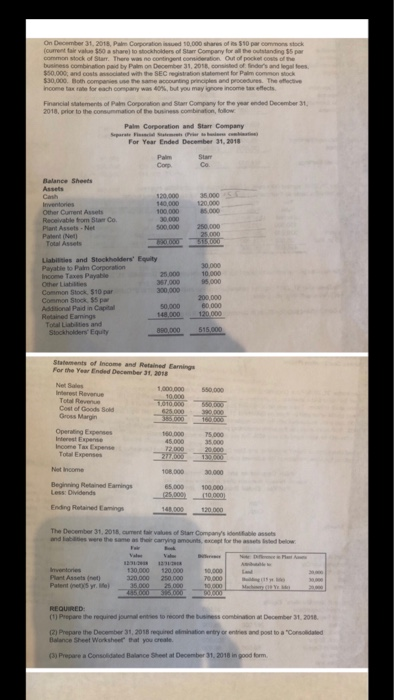

On December 31, 2018, Palm Corporation issued 10,000 shares of its $10 par commons stock (ourrent tair value $50 a share) to stockholders of Starr Company for all the outstanding $5 par common stock of Starr. There was no contingent consideration Out of pocket costs of the business combination paid by Palm on December 31, 2018, consisted of findor's and legal fees $50,000, and costs ansociated with the SEC registration statement for Palm common stock $30,000. Both companies use the same accounting principles and procedures. The effective income tax rate for each company was 40 % , but you may ignore income tax effects Financial statements of Palm Corporation and Star Company for the year ended December 31, 2018, prior to the consummation of the business combination, follow Palm Corporation and Starr Company Separate Fiesid Sa b For Year Ended December 31, 2018 Palm Corp Star Co. Balance Sheets Assets Cash Inventories 35.000 120.000 a5.000 120,000 140,000 100,000 30.000 500,000 Other Curent Assets Receivable from Star Co. Plant Assets-Net 250,000 25,000 515.000 Patent (Net) Total Assets Liabilities and Stockholders' Equity Payatle to Palm Corporation Income Taxes Payable Other Liabilties Common Stock $10 par Common Stock $5 par Additional Paid in Capital Retained Eamings Total Liabilities and Stockholders Equity 30.000 10.000 s5.000 25,000 367,000 300,000 200.000 60.000 120,000 50,000 148.000 515.000 850,000 Statements of Income and Retained Eamings For the Year Ended December 31, 2018 Net Sales Interest Revernue Total Revenue Cost of Goods Sold Gross Margin 1,000,000 550.000 10,000 1010 000 625000 365000 550,000 390,000 160T000 Operating Expenses Interest Expense Income Tax Expense Total Expenses 160.000 45.000 75.000 35.000 20000 130000 72.000 277,000 Net Income 108.000 30,000 Beginning Relained Eamings Less: Dividends 65,000 (25.000 100,000 (10.000) Ending Retained Eamings 120 000 148,000 The December 31, 2018, cument fair values of Starr Company's identifable assets and labites were the same as their carying amounts, except for the assets sled below Fair Vale Ne eP e Vale 1231 120.000 12312 Inventories Plant Assets (net) Patent (net5 yr. Me 130.000 320,000 35.000 485 000 s0,000 70,000 20000 250.000 25,000 316.000 ng15 y Machiry Ye M00 10,000 9O000 20000 REQUIRED: (1) Prepare the required joumal entries to record the business combination at December 31, 2018 (2) Prepare the December 31, 2018 required efimination entry or entries and post to a "Consolidated Balance Sheet Worksheer that you oreate (3) Prepare a Consolidated Balance Sheet at December 31, 2018 in good form On December 31, 2018, Palm Corporation issued 10,000 shares of its $10 par commons stock (ourrent tair value $50 a share) to stockholders of Starr Company for all the outstanding $5 par common stock of Starr. There was no contingent consideration Out of pocket costs of the business combination paid by Palm on December 31, 2018, consisted of findor's and legal fees $50,000, and costs ansociated with the SEC registration statement for Palm common stock $30,000. Both companies use the same accounting principles and procedures. The effective income tax rate for each company was 40 % , but you may ignore income tax effects Financial statements of Palm Corporation and Star Company for the year ended December 31, 2018, prior to the consummation of the business combination, follow Palm Corporation and Starr Company Separate Fiesid Sa b For Year Ended December 31, 2018 Palm Corp Star Co. Balance Sheets Assets Cash Inventories 35.000 120.000 a5.000 120,000 140,000 100,000 30.000 500,000 Other Curent Assets Receivable from Star Co. Plant Assets-Net 250,000 25,000 515.000 Patent (Net) Total Assets Liabilities and Stockholders' Equity Payatle to Palm Corporation Income Taxes Payable Other Liabilties Common Stock $10 par Common Stock $5 par Additional Paid in Capital Retained Eamings Total Liabilities and Stockholders Equity 30.000 10.000 s5.000 25,000 367,000 300,000 200.000 60.000 120,000 50,000 148.000 515.000 850,000 Statements of Income and Retained Eamings For the Year Ended December 31, 2018 Net Sales Interest Revernue Total Revenue Cost of Goods Sold Gross Margin 1,000,000 550.000 10,000 1010 000 625000 365000 550,000 390,000 160T000 Operating Expenses Interest Expense Income Tax Expense Total Expenses 160.000 45.000 75.000 35.000 20000 130000 72.000 277,000 Net Income 108.000 30,000 Beginning Relained Eamings Less: Dividends 65,000 (25.000 100,000 (10.000) Ending Retained Eamings 120 000 148,000 The December 31, 2018, cument fair values of Starr Company's identifable assets and labites were the same as their carying amounts, except for the assets sled below Fair Vale Ne eP e Vale 1231 120.000 12312 Inventories Plant Assets (net) Patent (net5 yr. Me 130.000 320,000 35.000 485 000 s0,000 70,000 20000 250.000 25,000 316.000 ng15 y Machiry Ye M00 10,000 9O000 20000 REQUIRED: (1) Prepare the required joumal entries to record the business combination at December 31, 2018 (2) Prepare the December 31, 2018 required efimination entry or entries and post to a "Consolidated Balance Sheet Worksheer that you oreate (3) Prepare a Consolidated Balance Sheet at December 31, 2018 in good form