Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. On December 31, 2019, Manama Corporation issued 90,000 shares of its no-par, no-stated-value common stock (current fair value $14 a share) for 36,000 shares

.

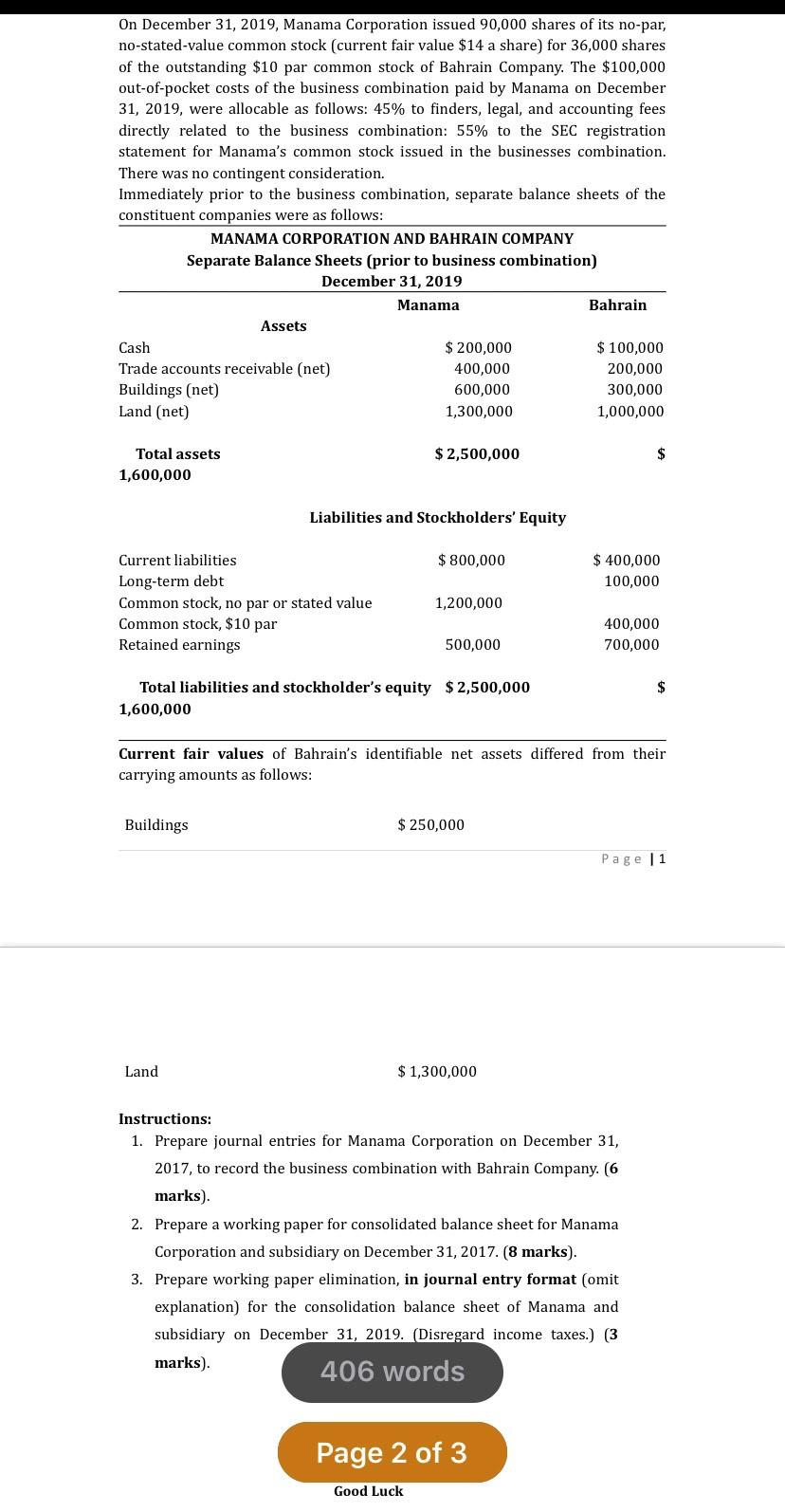

On December 31, 2019, Manama Corporation issued 90,000 shares of its no-par, no-stated-value common stock (current fair value $14 a share) for 36,000 shares of the outstanding $10 par common stock of Bahrain Company. The $100,000 out-of-pocket costs of the business combination paid by Manama on December 31, 2019, were allocable as follows: 45% to finders, legal, and accounting fees directly related to the business combination: 55% to the SEC registration statement for Manama's common stock issued in the businesses combination. There was no contingent consideration. Immediately prior to the business combination, separate balance sheets of the constituent companies were as follows: MANAMA CORPORATION AND BAHRAIN COMPANY Separate Balance Sheets (prior to business combination) December 31, 2019 Manama Bahrain Assets Cash $ 200,000 $ 100,000 Trade accounts receivable (net) Buildings (net) Land (net) 400,000 200,000 600,000 300,000 1,300,000 1,000,000 Total assets $ 2,500,000 2$ 1,600,000 Liabilities and Stockholders' Equity Current liabilities $ 800,000 $ 400,000 Long-term debt Common stock, no par or stated value Common stock, $10 par Retained earnings 100,000 1,200,000 400,000 500,000 700,000 Total liabilities and stockholder's equity $2,500,000 2$ 1,600,000 Current fair values of Bahrain's identifiable net assets differed from their carrying amounts as follows: Buildings $ 250,000 Page |1 Land $ 1,300,000 Instructions: 1. Prepare journal entries for Manama Corporation on December 31, 2017, to record the business combination with Bahrain Company. (6 marks). 2. Prepare a working paper for consolidated balance sheet for Manama Corporation and subsidiary on December 31, 2017. (8 marks). 3. Prepare working paper elimination, in journal entry format (omit explanation) for the consolidation balance sheet of Manama and subsidiary on December 31, 2019. (Disregard income taxes.) (3 marks). 406 words Page 2 of 3 Good Luck

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated Financials of Manama as on 31 December 2019 Assets Liabilities Manama Bahrain Investmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started