Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2019, the Cash in Bank account of Express Transit had a balance of 72, 166. On that date, the bank statement

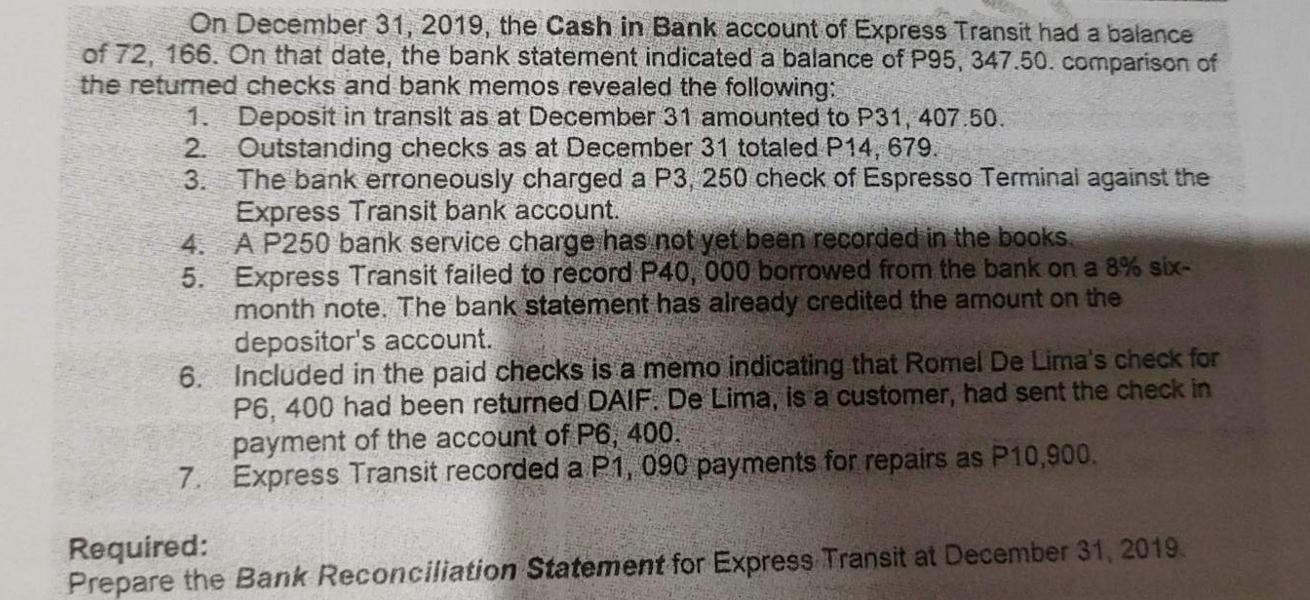

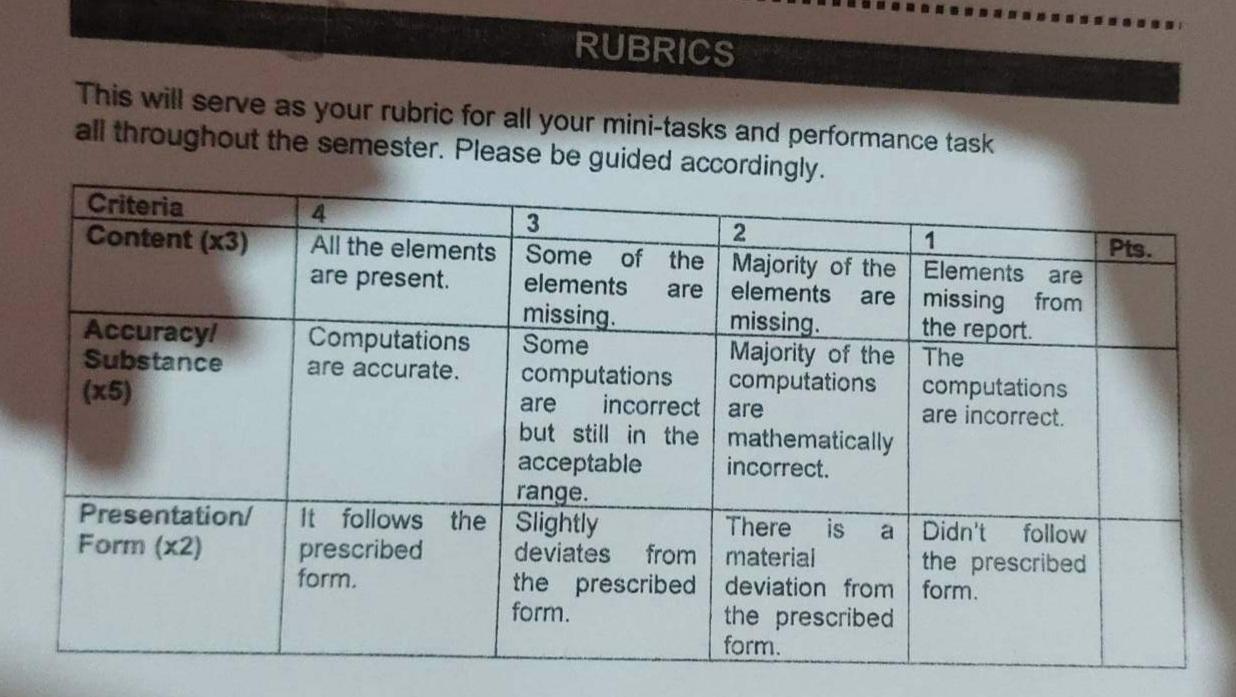

On December 31, 2019, the Cash in Bank account of Express Transit had a balance of 72, 166. On that date, the bank statement indicated a balance of P95, 347.50. comparison of the returned checks and bank memos revealed the following: 1. Deposit in transit as at December 31 amounted to P31, 407.50. Outstanding checks as at December 31 totaled P14, 679. 2. 3. The bank erroneously charged a P3, 250 check of Espresso Terminal against the Express Transit bank account. A P250 bank service charge has not yet been recorded in the books. Express Transit failed to record P40, 000 borrowed from the bank on a 8% six- month note. The bank statement has already credited the amount on the depositor's account. 4. 5. 6. Included in the paid checks is a memo indicating that Romel De Lima's check for P6, 400 had been returned DAIF. De Lima, is a customer, had sent the check in payment of the account of P6, 400. 7. Express Transit recorded a P1, 090 payments for repairs as P10,900. Required: Prepare the Bank Reconciliation Statement for Express Transit at December 31, 2019. RUBRICS This will serve as your rubric for all your mini-tasks and performance task all throughout the semester. Please be guided accordingly. Criteria Content (x3) Accuracy! Substance (x5) Presentation/ Form (x2) 4 All the elements are present. Computations are accurate. 3 2 Some of the Majority of the elements are missing. Some elements are missing. Majority of the computations computations are incorrect but still in the acceptable range. It follows the Slightly prescribed form. deviates from the prescribed form. are mathematically incorrect. There is a material deviation from the prescribed form. 1 from Elements are missing the report. The computations are incorrect. Didn't follow the prescribed form. Pts.

Step by Step Solution

★★★★★

3.30 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The Bank Reconciliation Statement is prepared as follows Sr No Particulars Amount Amount 1 Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started