Question

On December 31, 2020, Berclair Inc. had 280 million shares of common stock and 7 million shares of 9%, $100 par value cumulative preferred

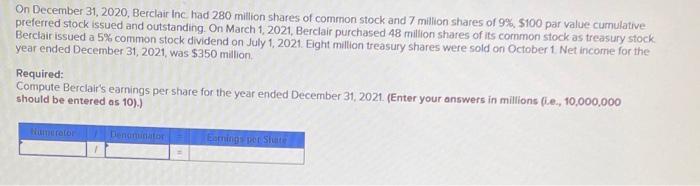

On December 31, 2020, Berclair Inc. had 280 million shares of common stock and 7 million shares of 9%, $100 par value cumulative preferred stock issued and outstanding. On March 1, 2021, Berclair purchased 48 million shares of its common stock as treasury stock Berclair issued a 5% common stock dividend on July 1, 2021. Eight million treasury shares were sold on October 1. Net income for the year ended December 31, 2021, was $350 million. Required: Compute Berclair's earnings per share for the year ended December 31, 2021. (Enter your answers in millions (.e., 10,000,000 should be entered as 10).) Numerator Denominator Earnings per Shate

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Note Time Factor is not applicable on Stock dividend Formulation 1 P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: David Spiceland

11th Edition

1264134525, 9781264134526

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App