Question

On December 31, 2020, Blossom Corp. had a $9-million, 9% fixed-rate note outstanding that was payable in two years. It decided to enter into a

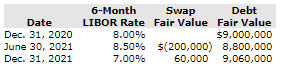

On December 31, 2020, Blossom Corp. had a $9-million, 9% fixed-rate note outstanding that was payable in two years. It decided to enter into a two-year swap with First Bank to convert the fixed-rate debt to floating-rate debt. The terms of the swap specified that Master will receive interest at a fixed rate of 9% and will pay a variable rate equal to the six-month LIBOR rate, based on the $9-million amount. The LIBOR rate on December 31, 2020, was 8.00%. The LIBOR rate will be reset every six months and will be used to determine the variable rate to be paid for the following six-month period. Blossom Corp. designated the swap as a fair value hedge. Assume that the hedging relationship meets all the conditions necessary for hedge accounting and that IFRS is a constraint. The six-month LIBOR rate and the swap and debt fair values were as follows:

Present the journal entries to record the following transactions.

| 1. | The entry, if any, to record the swap on December 31, 2020 | |

| 2. | The entry to record the semi-annual debt interest payment on June 30, 2021 | |

| 3. | The entry to record the settlement of the semi-annual swap amount receivable at 9%, less the amount payable at LIBOR, 8.00% | |

| 4. | The entry, if any, to record the change in the swaps fair value at June 30, 2021 | |

| 5. | The entry, if any, to record the change in the debts fair value at June 30, 2021 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started