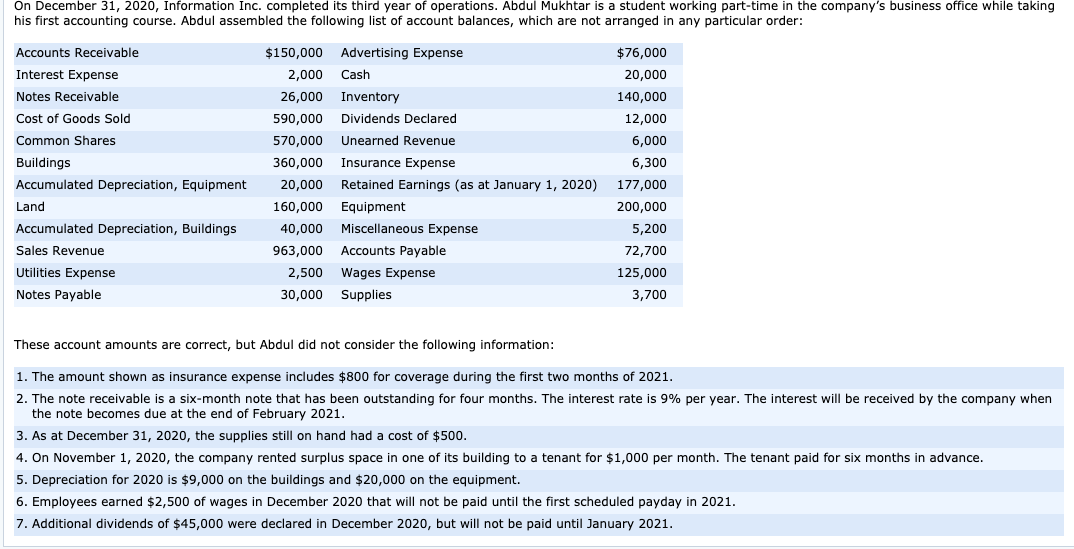

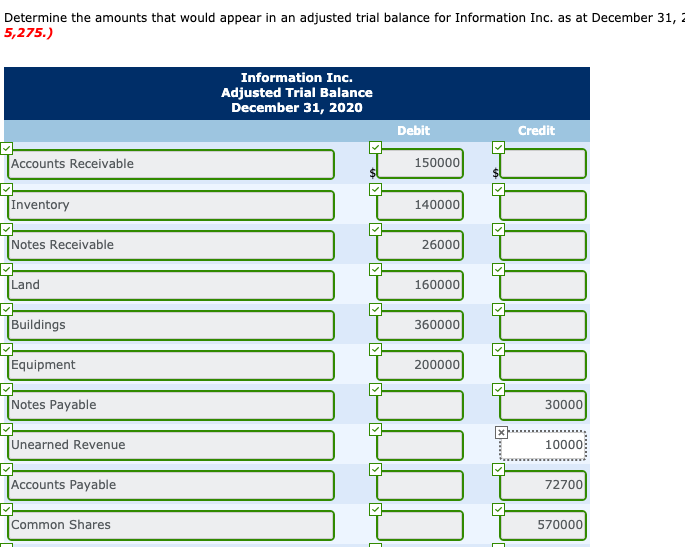

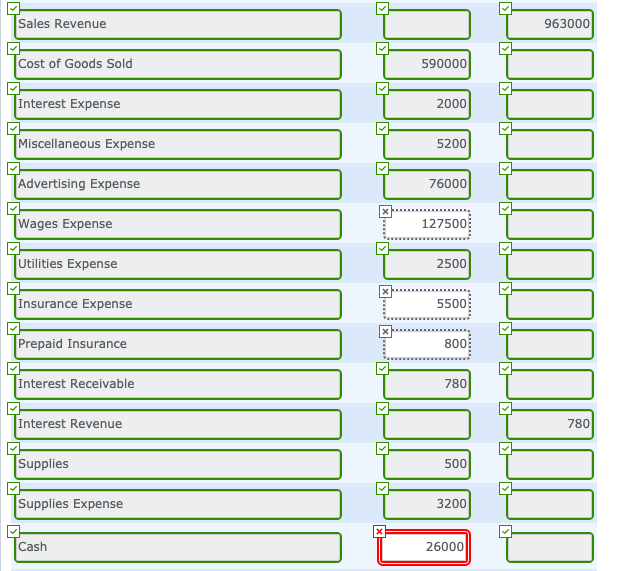

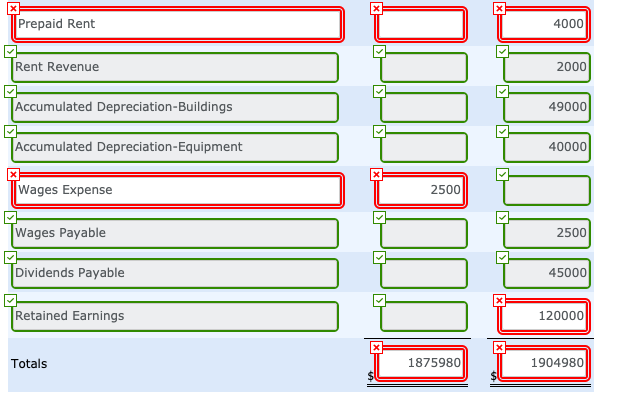

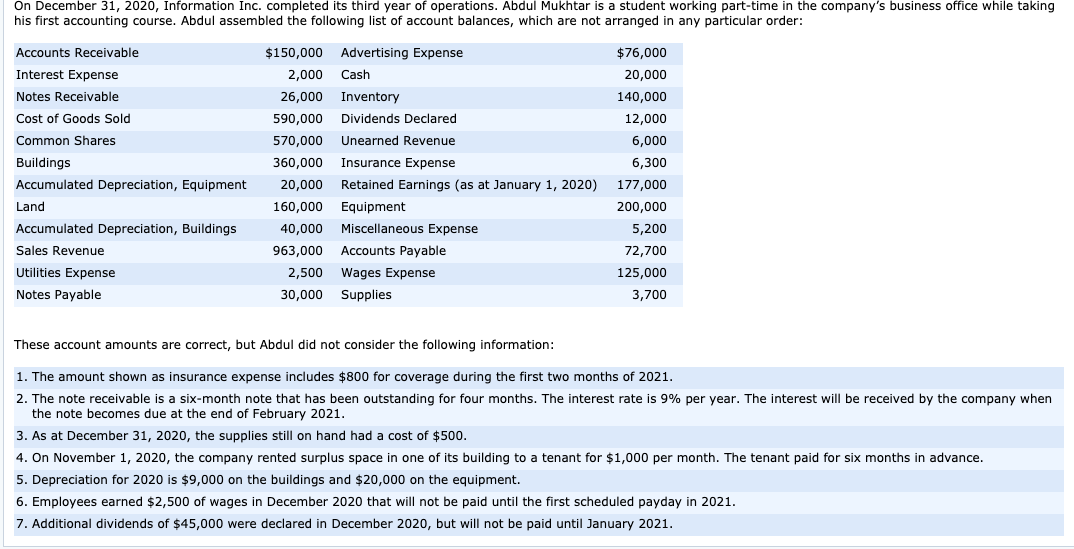

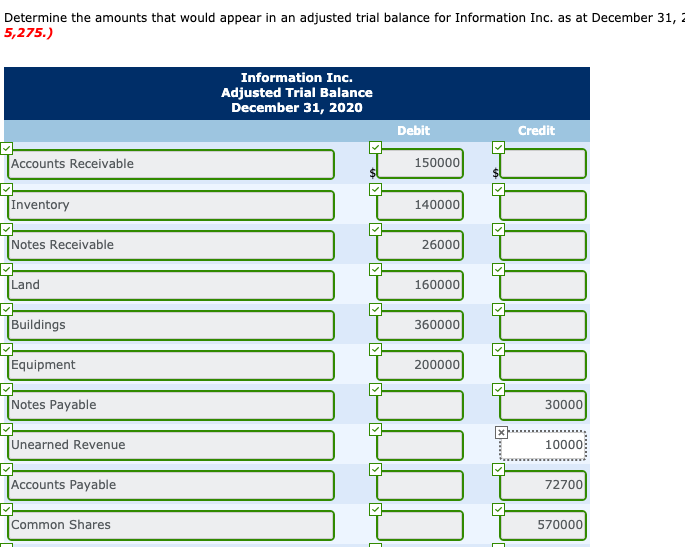

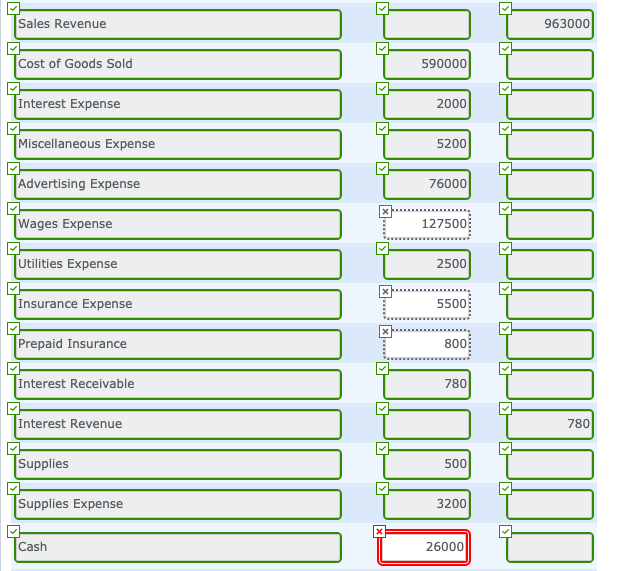

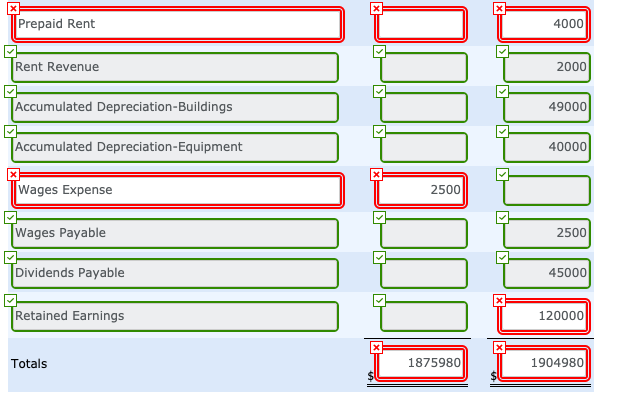

On December 31, 2020, Information Inc. completed its third year of operations. Abdul Mukhtar is a student working part-time in the company's business office while taking his first accounting course. Abdul assembled the following list of account balances, which are not arranged in any particular order: Accounts Receivable Interest Expense Notes Receivable Cost of Goods Sold Common Shares Buildings Accumulated Depreciation, Equipment Land Accumulated Depreciation, Buildings Sales Revenue Utilities Expense Notes Payable $150,000 Advertising Expense 2,000 Cash 26,000 Inventory 590,000 Dividends Declared 570,000 Unearned Revenue 360,000 Insurance Expense 20,000 Retained Earnings (as at January 1, 2020) 160,000 Equipment 40,000 Miscellaneous Expense 963,000 Accounts Payable 2,500 Wages Expense 30,000 Supplies $76,000 20,000 140,000 12,000 6,000 6,300 177,000 200,000 5,200 72,700 125,000 3,700 These account amounts are correct, but Abdul did not consider the following information: 1. The amount shown as insurance expense includes $800 for coverage during the first two months of 2021. 2. The note receivable is a six-month note that has been outstanding for four months. The interest rate is 9% per year. The interest will be received by the company when the note becomes due at the end of February 2021. 3. As at December 31, 2020, the supplies still on hand had a cost of $500. 4. On November 1, 2020, the company rented surplus space in one of its building to a tenant for $1,000 per month. The tenant paid for six months in advance. 5. Depreciation for 2020 is $9,000 on the buildings and $20,000 on the equipment. 6. Employees earned $2,500 of wages in December 2020 that will not be paid until the first scheduled payday in 2021. 7. Additional dividends of $45,000 were declared in December 2020, but will not be paid until January 2021. Determine the amounts that would appear in an adjusted trial balance for Information Inc. as at December 31, 2 5,275.) Information Inc. Adjusted Trial Balance December 31, 2020 Debit Credit Accounts Receivable 150000 Inventory 140000 Notes Receivable 26000 Land 160000 Buildings 360000 Equipment 200000 Notes Payable 30000 x 40000 Unearned Revenue Accounts Payable 72700 Common Shares 570000 Sales Revenue 963000 2 Tcost of Goods Sold T 590000 Interest Expense I 2000 Miscellaneous Expense T 5200 2 Advertising Expense 76000 Wages Expense 127500 Tutilities Expense T 2500 Insurance Expense 5500 X Prepaid Insurance Interest Receivable 780 Interest Revenue 1 780 Supplies 1 500 Supplies Expense 3200 Cash 26000 Prepaid Rent 4000 TRent Revenue 2000 Accumulated Depreciation-Buildings 1 49000 Accumulated Depreciation-Equipment T 40000 Wages Expense 2500 Wages Payable 2500 Dividends Payable 45000 Retained Earnings 120000 Totals 1875980 1904980