Question

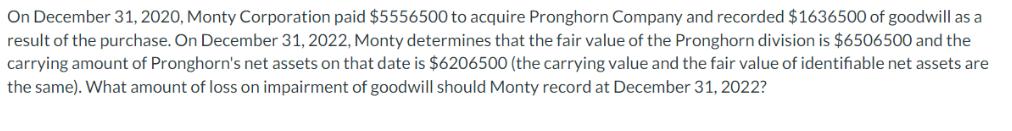

On December 31, 2020, Monty Corporation paid $5556500 to acquire Pronghorn Company and recorded $1636500 of goodwill as a result of the purchase. On

On December 31, 2020, Monty Corporation paid $5556500 to acquire Pronghorn Company and recorded $1636500 of goodwill as a result of the purchase. On December 31, 2022, Monty determines that the fair value of the Pronghorn division is $6506500 and the carrying amount of Pronghorn's net assets on that date is $6206500 (the carrying value and the fair value of identifiable net assets are the same). What amount of loss on impairment of goodwill should Monty record at December 31, 2022?

Step by Step Solution

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of loss on impairment of goodwill we need to compare the carrying amount of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

3rd Edition

978-0078110955, 0078110955

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App