Question

On December 31, 2020, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are

On December 31, 2020, Reagan Inc. signed a lease with Silver Leasing Co. for some equipment having a seven-year useful life. The lease payments are made by Reagan annually, beginning at signing date. Title does not transfer to the lessee, so the equipment will be returned to the lessor on December 31, 2026. There is no purchase option, and Reagan guarantees a residual value to the lessor on termination of the lease.

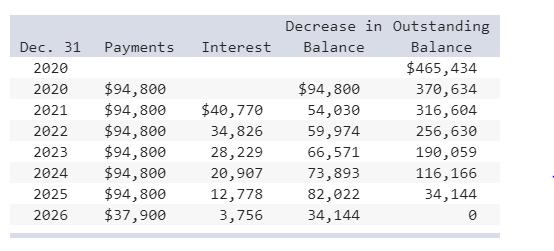

Reagan's lease amortization schedule appears below:

What is the amount of residual value guaranteed by Reagan to the lessor?

Decrease in Outstanding Dec. 31 Payments Interest Balance Balance 2020 $465,434 $94,800 $94,800 $94,800 $94,800 $94,800 $94,800 $37,900 2020 $94,800 370,634 2021 $40,770 54,030 316,604 2022 34,826 59,974 256,630 2023 28,229 66,571 190,059 2024 20,907 73,893 116,166 2025 12,778 82,022 34,144 2026 3,756 34,144

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The amount of residual value guaranteed by Reagan to the lessor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started