Question

Sheridan Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1997. Prior to 2020, cumulative net pension expense recognized equaled cumulative

Sheridan Inc. has sponsored a noncontributory, defined benefit pension plan for its employees since 1997. Prior to 2020, cumulative net pension expense recognized equaled cumulative contributions to the plan. Other relevant information about the pension plan on January 1, 2020, is as follows.

| 1. | The company has 200 employees. All these employees are expected to receive benefits under the plan. The average remaining service life per employee is 12 years. | |

| 2. | The projected benefit obligation amounted to $4,903,000 and the fair value of pension plan assets was $2,946,000. The market-related asset value was also $2,946,000. Unrecognized prior service cost was $1,957,000. |

On December 31, 2020, the projected benefit obligation and the accumulated benefit obligation were $4,936,000 and $4,081,000, respectively. The fair value of the pension plan assets amounted to $4,048,000 at the end of the year. A 10% settlement rate and a 10% expected asset return rate were used in the actuarial present value computations in the pension plan. The present value of benefits attributed by the pension benefit formula to employee service in 2020 amounted to $201,000. The employer’s contribution to the plan assets amounted to $761,000 in 2020. This problem assumes no payment of pension benefits.

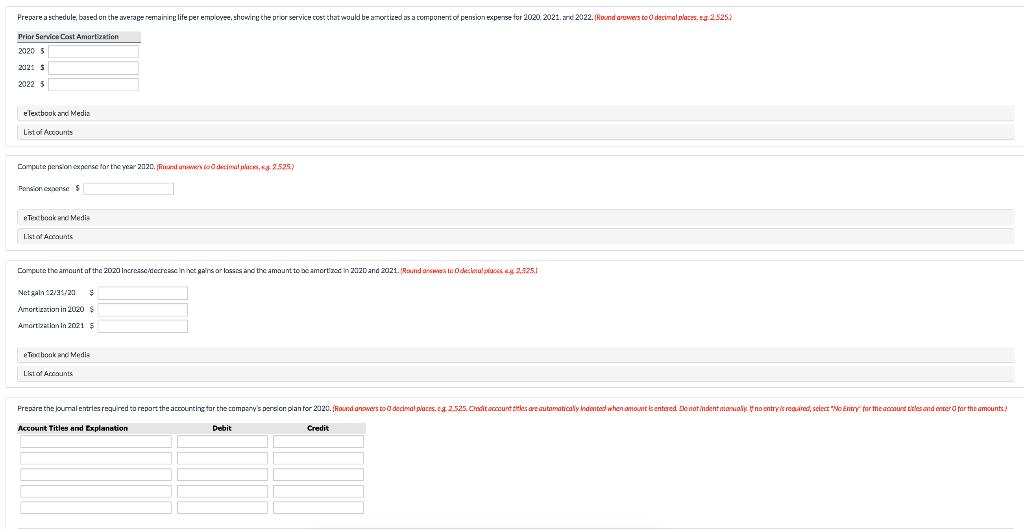

Prepare a schedule, bosed on the average remaining life per empioyee, showing the pricr service coet that would be amortized as a componernt of pension experse for 2020, 2021. ard 2022. Round arewers to O decimal placs, eg.2525) Prior Service Cost Amortization 2020 5 2021 $ 2022 $ e Textbook anci Media Listof Aucounts Compute pansion experse far the ycar 2120. (Rurd urwers tod decimil plases, sa. 2.525) Penwion exocnse S eTexbook and Medis Listof Accounts Compute the amcunt af the 2020 1Increasetecrease innct gairs ar lasEs and the amount to be amort'zod n 202D and 2021. Round answas to Odecinal places eg 2,5251 Net gain 12/31/23 Amortization in 2020 $ Amortization in 2021 $ eTehook and Medis Listof Accounts Prepare the Jourmal entries required to report the acCOunting tor the company's persion plan for 2020. (Round anowers to Odecimal places. eg. 2.525. Craditacccunt ttles are autamaticaly Indented when amount senteared Do not indent manualy tno entry is reauinad, seiect "Mo Entry far the account celesand enter a far the amounts.) Account Titles and Explanntion Debit Credit

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 The prior service cost amortization table is given below Prior Service Cost Amortization 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started