Answered step by step

Verified Expert Solution

Question

1 Approved Answer

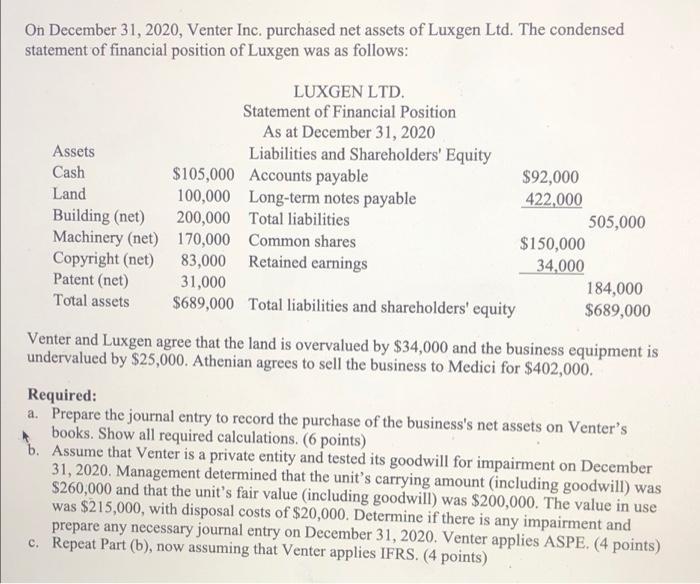

On December 31, 2020, Venter Inc. purchased net assets of Luxgen Ltd. The condensed statement of financial position of Luxgen was as follows: Assets

On December 31, 2020, Venter Inc. purchased net assets of Luxgen Ltd. The condensed statement of financial position of Luxgen was as follows: Assets Cash Land Building (net) Machinery (net) Copyright (net) Patent (net) Total assets $105,000 100,000 LUXGEN LTD. Statement of Financial Position As at December 31, 2020 Liabilities and Shareholders' Equity Accounts payable Long-term notes payable Total liabilities Common shares Retained earnings 200,000 170,000 83,000 31,000 $689,000 Total liabilities and shareholders' equity $92,000 422,000 $150,000 34,000 505,000 184,000 $689,000 Venter and Luxgen agree that the land is overvalued by $34,000 and the business equipment is undervalued by $25,000. Athenian agrees to sell the business to Medici for $402,000. Required: a. Prepare the journal entry to record the purchase of the business's net assets on Venter's books. Show all required calculations. (6 points) b. Assume that Venter is a private entity and tested its goodwill for impairment on December 31, 2020. Management determined that the unit's carrying amount (including goodwill) was $260,000 and that the unit's fair value (including goodwill) was $200,000. The value in use was $215,000, with disposal costs of $20,000. Determine if there is any impairment and prepare any necessary journal entry on December 31, 2020. Venter applies ASPE. (4 points) c. Repeat Part (b), now assuming that Venter applies IFRS. (4 points)

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a To record the purchase of Luxgen Ltds net assets on Venters books we need to calculate the fair value of the identifiable net assets acquired and de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started