Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2022, Ditka Incorporated had Retained Earnings of $269,800 before its closing entries were prepared and posted. During 2022, the company had

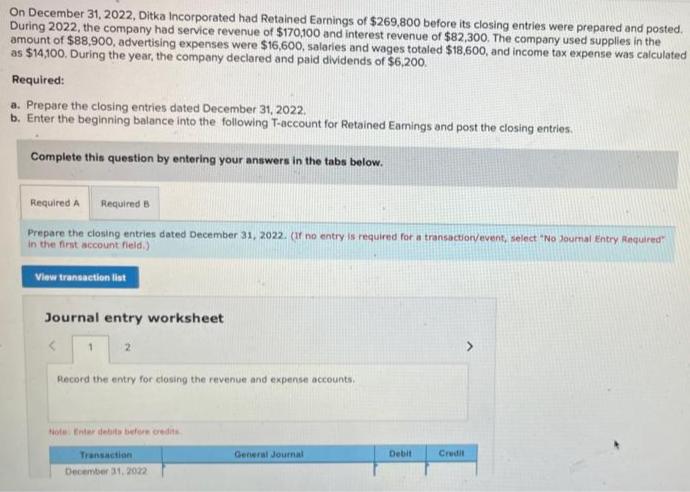

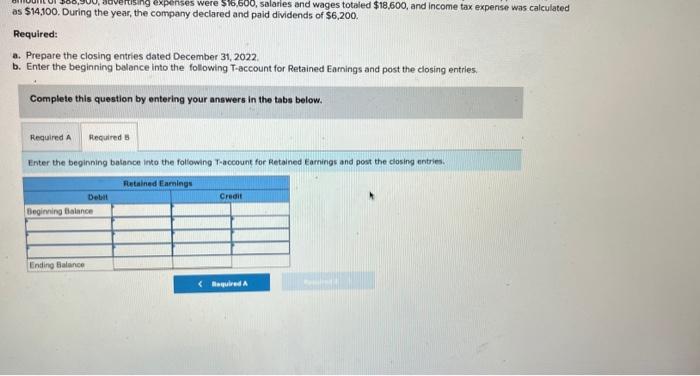

On December 31, 2022, Ditka Incorporated had Retained Earnings of $269,800 before its closing entries were prepared and posted. During 2022, the company had service revenue of $170,100 and interest revenue of $82,300. The company used supplies in the amount of $88,900, advertising expenses were $16,600, salaries and wages totaled $18,600, and income tax expense was calculated as $14,100. During the year, the company declared and paid dividends of $6,200. Required: a. Prepare the closing entries dated December 31, 2022. b. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the closing entries dated December 31, 2022. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the entry for closing the revenue and expense accounts. Note Enter debits before credits Transaction General Journal Credit December 31, 2022 Debit tising expenses were $16,600, salaries and wages totaled $18,600, and income tax expense was calculated as $14,100. During the year, the company declared and paid dividends of $6,200. Required: a. Prepare the closing entries dated December 31, 2022. b. Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Complete this question by entering your answers in the tabs below. Required A Required Enter the beginning balance into the following T-account for Retained Earnings and post the closing entries. Retained Earnings Debil Credit Beginning Balance Ending Balance < Required A

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 Recording of Closing entries Transaction Dec31 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started