Answered step by step

Verified Expert Solution

Question

1 Approved Answer

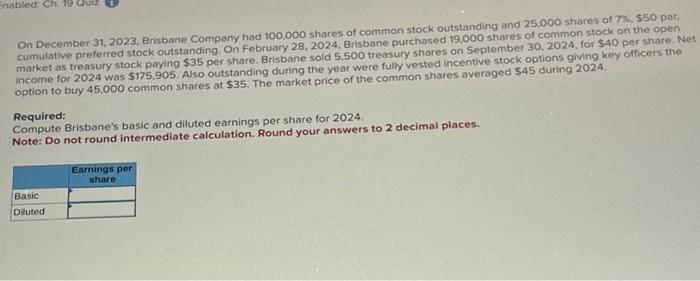

On December 31, 2023, Brisbane Company had 100,000 shares of common stock outstanding and 25,000 shares of 7%, $50 par, cumulative preferred stock outstanding. On

On December 31, 2023, Brisbane Company had 100,000 shares of common stock outstanding and 25,000 shares of 7%, $50 par, cumulative preferred stock outstanding. On February 28, 2024, Brisbane purchased 19,000 shares of common stock on the open market as treasury stock paying $35 per share. Brisbane sold 5,500 treasury shares on September 30, 2024, for $40 per share. Net income for 2024 was $175,905. Also outstanding during the year were fully vested incentive stock options giving key officers the option to buy 45,000 common shares at $35. The market price of the common shares averaged $45 during 2024. Required: Compute Brisbane's basic and diluted earnings per share for 2024. Note: Do not round intermediate calculation. Round your answers to 2 decimal places. Basic Diluted Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started