Answered step by step

Verified Expert Solution

Question

1 Approved Answer

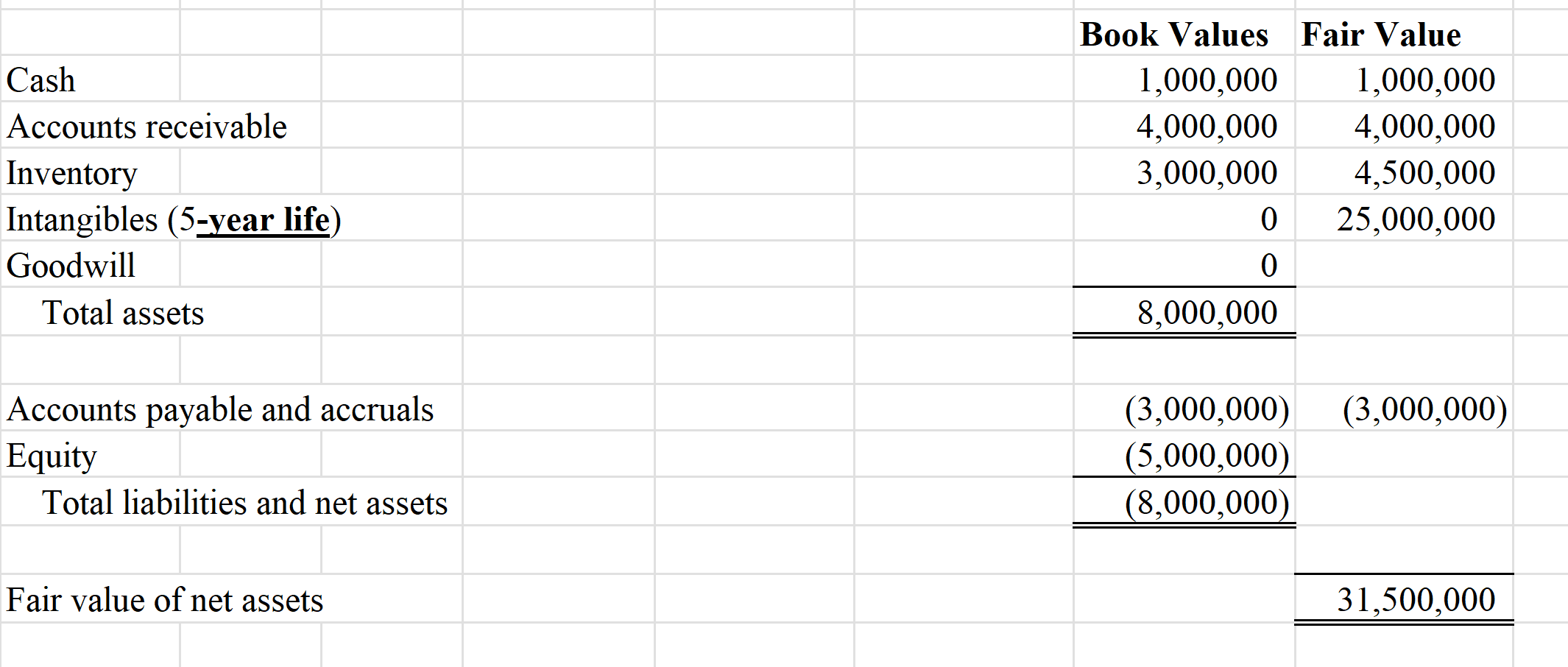

On December 31, 2023, Parent Inc. acquired 100% of SubCo, Inc. for $50 million. The following are historical and fair values of the assets and

| On December 31, 2023, Parent Inc. acquired 100% of SubCo, Inc. for $50 million. The following are historical and fair values of the assets and liabilities |

| of SubCo on the date of acquisition: |

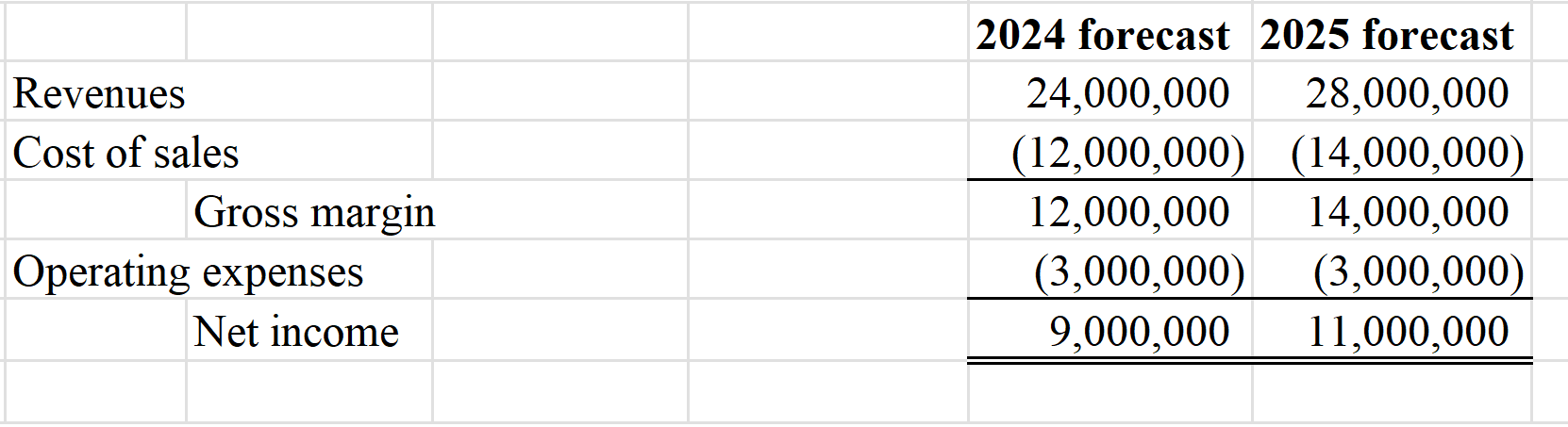

| Prior to the acquisition, SubCo prepared an income statement forecast for 2024 and 2025 (again, assume tax rate of zero %). This forecast does not include |

| any impacts of the effect of the acquisition of SubCo by Parent |

| After adjusting for the impacts of acquisition accounting, 2024 forecast net income of SubCo included in Parents consolidation should be: |

| After adjusting for the impacts of acquisition accounting, 2025 forecast net income of SubCo included in Parents consolidation should be: |

\begin{tabular}{|c|c|c|} \hline & Book Values & Fair Value \\ \hline Cash & 1,000,000 & 1,000,000 \\ \hline Accounts receivable & 4,000,000 & 4,000,000 \\ \hline Inventory & 3,000,000 & 4,500,000 \\ \hline Intangibles (5-year life) & 0 & 25,000,000 \\ \hline Goodwill & 0 & \\ \hline Total assets & 8,000,000 & \\ \hline Accounts payable and accruals & (3,000,000) & (3,000,000) \\ \hline Equity & (5,000,000) & \\ \hline Total liabilities and net assets & (8,000,000) & \\ \hline \multirow{2}{*}{ Fair value of net assets } & & 21500000 \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline & 2024 forecast & 2025 forecast \\ \hline Revenues & 24,000,000 & 28,000,000 \\ \hline Cost of sales & (12,000,000) & (14,000,000) \\ \hline Gross margin & 12,000,000 & 14,000,000 \\ \hline Operating expenses & (3,000,000) & (3,000,000) \\ \hline Net income & 9,000,000 & 11,000,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started