Answered step by step

Verified Expert Solution

Question

1 Approved Answer

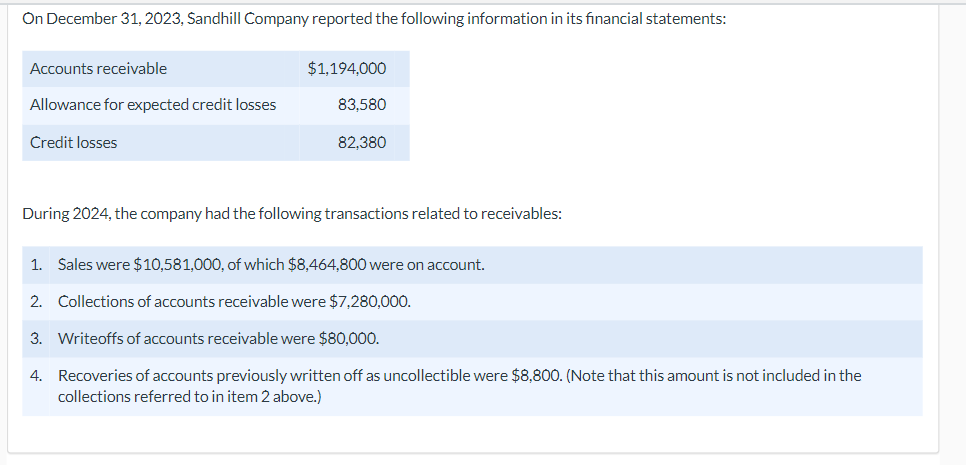

On December 31, 2023, Sandhill Company reported the following information in its financial statements: Accounts receivable Allowance for expected credit losses Credit losses $1,194,000

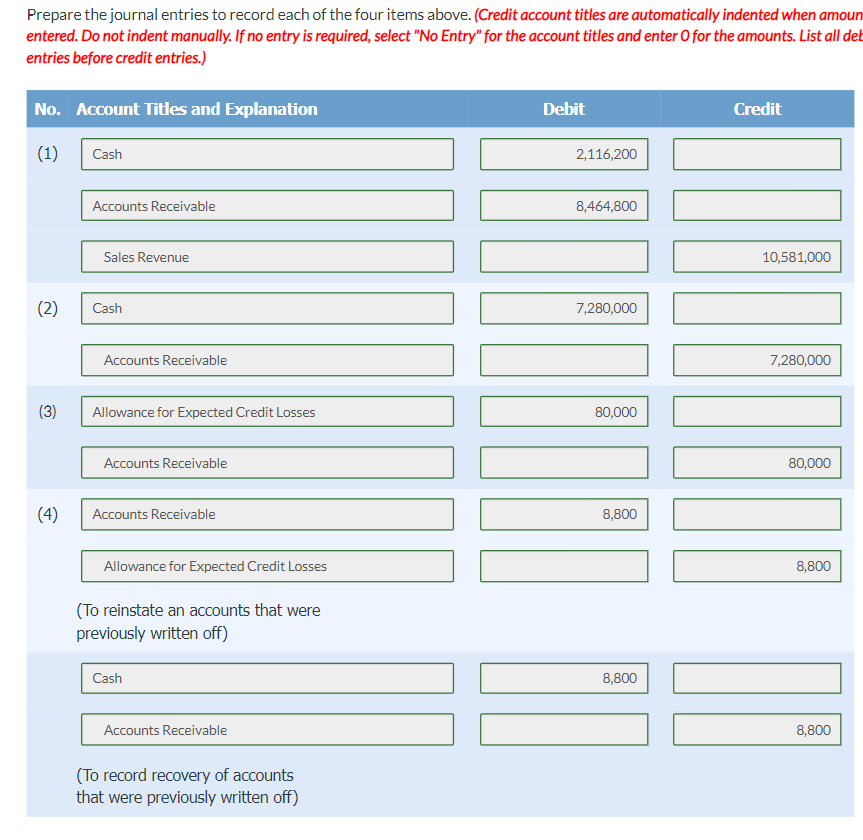

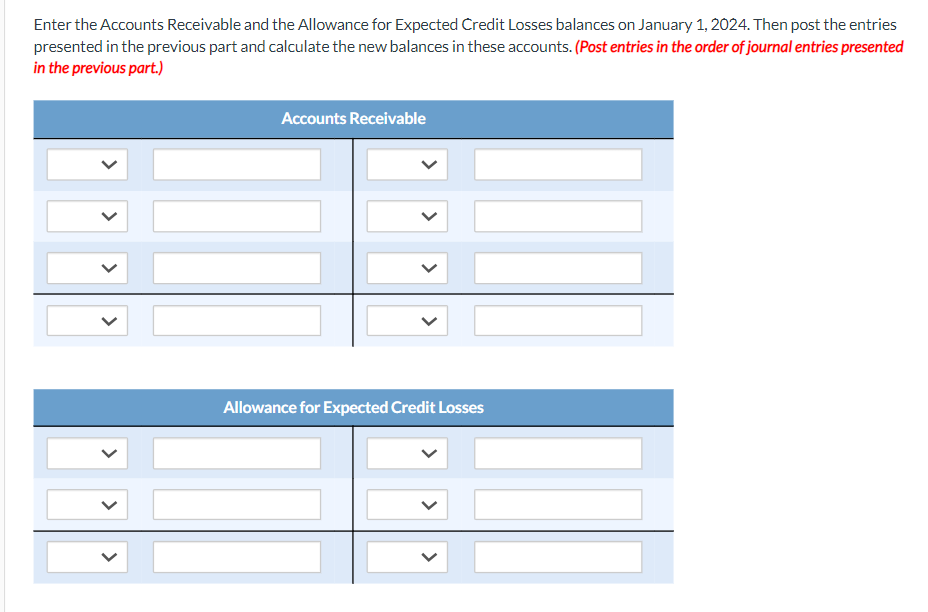

On December 31, 2023, Sandhill Company reported the following information in its financial statements: Accounts receivable Allowance for expected credit losses Credit losses $1,194,000 83,580 82,380 During 2024, the company had the following transactions related to receivables: 1. Sales were $10,581,000, of which $8,464,800 were on account. 2. Collections of accounts receivable were $7,280,000. 3. Writeoffs of accounts receivable were $80,000. 4. Recoveries of accounts previously written off as uncollectible were $8,800. (Note that this amount is not included in the collections referred to in item 2 above.) Prepare the journal entries to record each of the four items above. (Credit account titles are automatically indented when amoun entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all deb entries before credit entries.) No. Account Titles and Explanation (1) Cash Accounts Receivable Sales Revenue (2) Cash Accounts Receivable Debit 2,116,200 8,464,800 7,280,000 (3) Allowance for Expected Credit Losses 80,000 Accounts Receivable (4) Accounts Receivable Allowance for Expected Credit Losses (To reinstate an accounts that were previously written off) Cash Accounts Receivable (To record recovery of accounts that were previously written off) 8,800 8,800 Credit 10,581,000 7,280,000 80,000 8,800 8,800 Enter the Accounts Receivable and the Allowance for Expected Credit Losses balances on January 1, 2024. Then post the entries presented in the previous part and calculate the new balances in these accounts. (Post entries in the order of journal entries presented in the previous part.) > Accounts Receivable > Allowance for Expected Credit Losses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started