On December 31, 2023, the Bryan Bank enters into a debt restructuring agreement with Kyle Company, which is now experiencing financial trouble. The bank

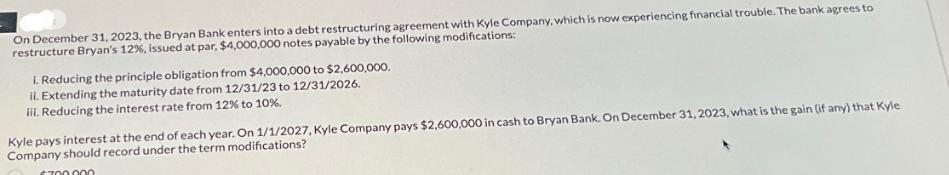

On December 31, 2023, the Bryan Bank enters into a debt restructuring agreement with Kyle Company, which is now experiencing financial trouble. The bank agrees to restructure Bryan's 12%, issued at par, $4,000,000 notes payable by the following modifications: i. Reducing the principle obligation from $4,000,000 to $2,600,000. ii. Extending the maturity date from 12/31/23 to 12/31/2026. iii. Reducing the interest rate from 12% to 10%. Kyle pays interest at the end of each year. On 1/1/2027, Kyle Company pays $2,600,000 in cash to Bryan Bank. On December 31, 2023, what is the gain (if any) that Kyle Company should record under the term modifications? $700.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets think through this stepbystep Originally Kyle Co had 4000000 notes pay...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started