Question

On December 31, 2025, Larkspur Corporation sold for $370000 an old machine having an original cost of $490000 and a book value of $350000.

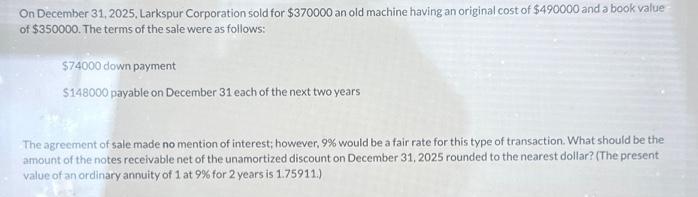

On December 31, 2025, Larkspur Corporation sold for $370000 an old machine having an original cost of $490000 and a book value of $350000. The terms of the sale were as follows: $74000 down payment $148000 payable on December 31 each of the next two years The agreement of sale made no mention of interest; however, 9% would be a fair rate for this type of transaction. What should be the amount of the notes receivable net of the unamortized discount on December 31, 2025 rounded to the nearest dollar? (The present value of an ordinary annuity of 1 at 9% for 2 years is 1.75911.)

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the amount of the notes receivable net of the unamortized discount on December 31 2025 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

18th edition

538479736, 978-1111534783, 1111534780, 978-0538479738

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App