Question

On December 31, 20x0, an entity issues convertible bonds for total proceeds of $55,250,000 with the following characteristics: Face Value Coupon rate Yield to

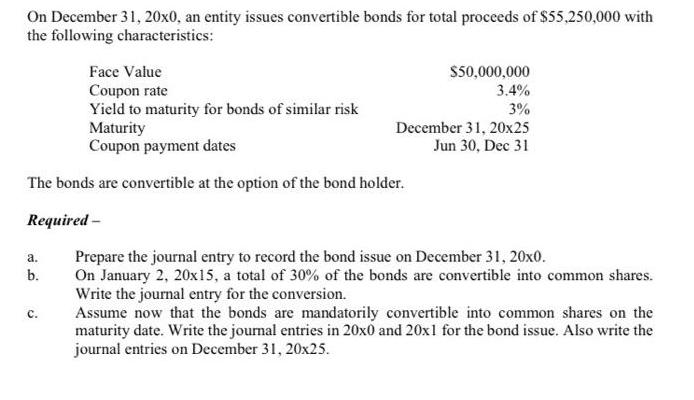

On December 31, 20x0, an entity issues convertible bonds for total proceeds of $55,250,000 with the following characteristics: Face Value Coupon rate Yield to maturity for bonds of similar risk Maturity Coupon payment dates The bonds are convertible at the option of the bond holder. Required- a. b. C. $50,000,000 3.4% 3% December 31, 20x25 Jun 30, Dec 31 Prepare the journal entry to record the bond issue on December 31, 20x0. On January 2, 20x15, a total of 30% of the bonds are convertible into common shares. Write the journal entry for the conversion. Assume now that the bonds are mandatorily convertible into common shares on the maturity date. Write the journal entries in 20x0 and 20x1 for the bond issue. Also write the journal entries on December 31, 20x25.

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Kin Lo, George Fisher

Volume 1, 1st Edition

132612119, 978-0132612111

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App