Question

On December 31, 20X1, Art Levinsen Corporation issued 1,000, 6% bonds with a 20-year maturity. The bonds pay interest semiannually (on June 30 and December

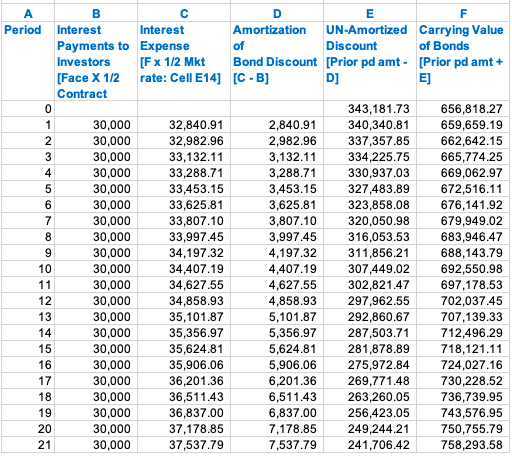

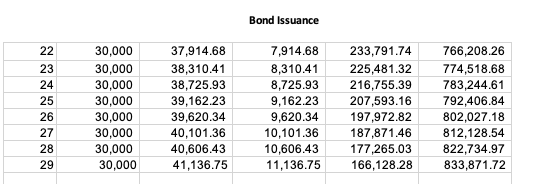

On December 31, 20X1, Art Levinsen Corporation issued 1,000, 6% bonds with a 20-year maturity. The bonds pay interest semiannually (on June 30 and December 31), and the market/effective interest rate is 10%. HINT: the face of all bonds is $1,000 unless otherwise stated. (Total = 8 points)

| a) Compute the price of the bonds. (4 points) |

b) Prepare the bond issuance journal entry Art Levinsen Corp. will record on December 31, 20X1. (2 points)

c) Use the bond amortization schedule that begins in cell D49 . Calculate total interest expense Art Levinsen Corporation will record on the books from January 2, 20X2, through December 31, 20X9 (assume zero interest expense during 20X1). (2 points)

A Period B Interest D Interest Amortization Payments to Expense of E UN-Amortized Discount F Carrying Value of Bonds Investors [F x 1/2 Mkt Bond Discount [Prior pd amt [Prior pd amt + [Face X 1/2 rate: Cell E14] [C-B] D] E] Contract 0 343,181.73 656,818.27 1 30,000 32,840.91 2,840.91 340,340.81 659,659.19 2 30,000 32,982.96 2,982.96 337,357.85 662,642.15 3 30,000 33,132.11 3,132.11 334,225.75 665,774.25 4 30,000 33,288.71 3,288.71 330,937.03 669,062.97 5 30,000 33,453.15 3,453.15 327,483.89 672,516.11 6 30,000 33,625.81 3,625.81 323,858.08 676,141.92 7 30,000 33,807.10 3,807.10 320,050.98 679,949.02 8 30,000 33,997.45 3,997.45 316,053.53 683,946.47 9 30,000 34,197.32 4,197.32 311,856.21 688,143.79 10 30,000 34,407.19 4,407.19 307,449.02 692,550.98 11 30,000 34,627.55 4,627.55 302,821.47 697,178.53 12 30,000 34,858.93 4,858.93 297,962.55 702,037.45 13 30,000 35,101.87 5,101.87 292,860.67 707,139.33 14 30,000 35,356.97 5,356.97 287,503.71 712,496.29 15 30,000 35,624.81 5,624.81 281,878.89 718,121.11 16 30,000 35,906.06 5,906.06 275,972.84 724,027.16 17 30,000 36,201.36 6,201.36 269,771.48 730,228.52 18 30,000 36,511.43 6,511.43 263,260.05 736,739.95 19 222 30,000 36,837.00 6,837.00 256,423.05 743,576.95 20 30,000 37,178.85 7,178.85 249,244.21 750,755.79 21 30,000 37,537.79 7,537.79 241,706.42 758,293.58

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the price of the bonds Face value of bonds is 1000 per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started