Answered step by step

Verified Expert Solution

Question

1 Approved Answer

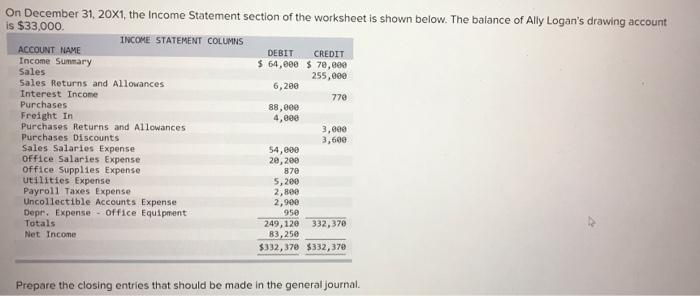

On December 31, 20X1, the Income Statement section of the worksheet is shown below. The balance of Ally Logan's drawing account is $33,000. INCOME

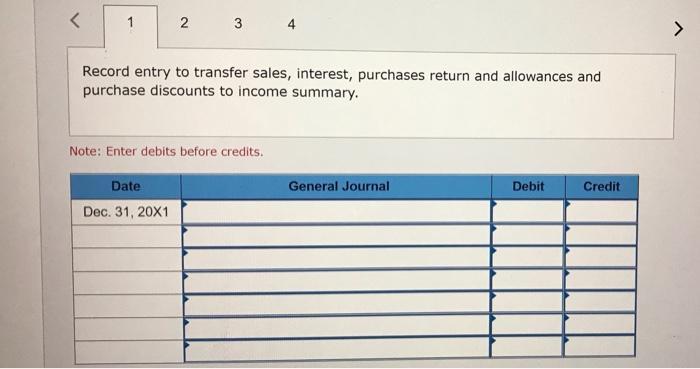

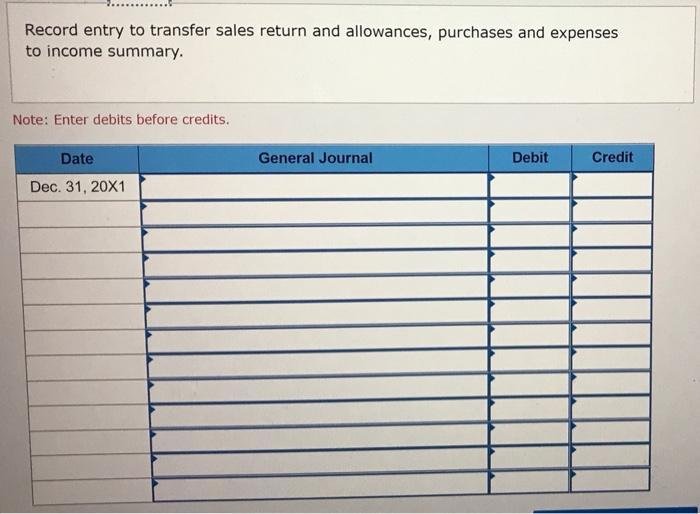

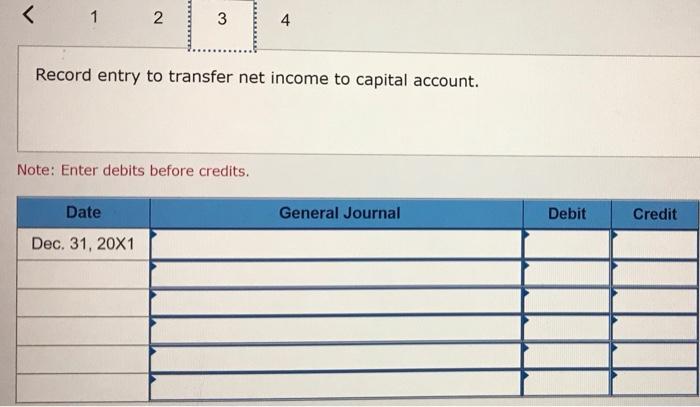

On December 31, 20X1, the Income Statement section of the worksheet is shown below. The balance of Ally Logan's drawing account is $33,000. INCOME STATEMENT COLUMNS ACCOUNT NAME Income Summary Sales Sales Returns and Allowances Interest Income Purchases Freight In Purchases Returns and Allowances. Purchases Discounts Sales Salaries Expense Office Salaries Expense Office Supplies Expense Utilities Expense Payroll Taxes Expense Uncollectible Accounts Expense Depr. Expense Office Equipment Totals Net Income DEBIT $ 64,000 6,200 88,000 4,000 54,000 20,200 870 5,200 2,800 2,900 950 CREDIT $70,000 255,000 770 3,000 3,600 332,370 249,120 83,250 $332,370 $332, 370 Prepare the closing entries that should be made in the general journal. 1 2 3 Record entry to transfer sales, interest, purchases return and allowances and purchase discounts to income summary. Note: Enter debits before credits. Date Dec. 31, 20X1 General Journal Debit Credit Record entry to transfer sales return and allowances, purchases and expenses to income summary. Note: Enter debits before credits. Date Dec. 31, 20X1 General Journal Debit Credit < 1 2 3 Date Dec. 31, 20X1 Record entry to transfer net income to capital account. Note: Enter debits before credits. 4 General Journal Debit Credit 1 2 3 Record entry to transfer drawings to capital account. Note: Enter debits before credits. Date Dec. 31, 20X1 General Journal Debit Credit

Step by Step Solution

★★★★★

3.37 Rating (138 Votes )

There are 3 Steps involved in it

Step: 1

SiNo 1 2 3 4 Date Dec31 20X1 Dec31 20X1 Dec31 20X1 General Journal Sales Inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started