Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, Colgait Inc. had an installment sale receivable balance of $450,000 recognized on its financial statements, while the amount was not recognized

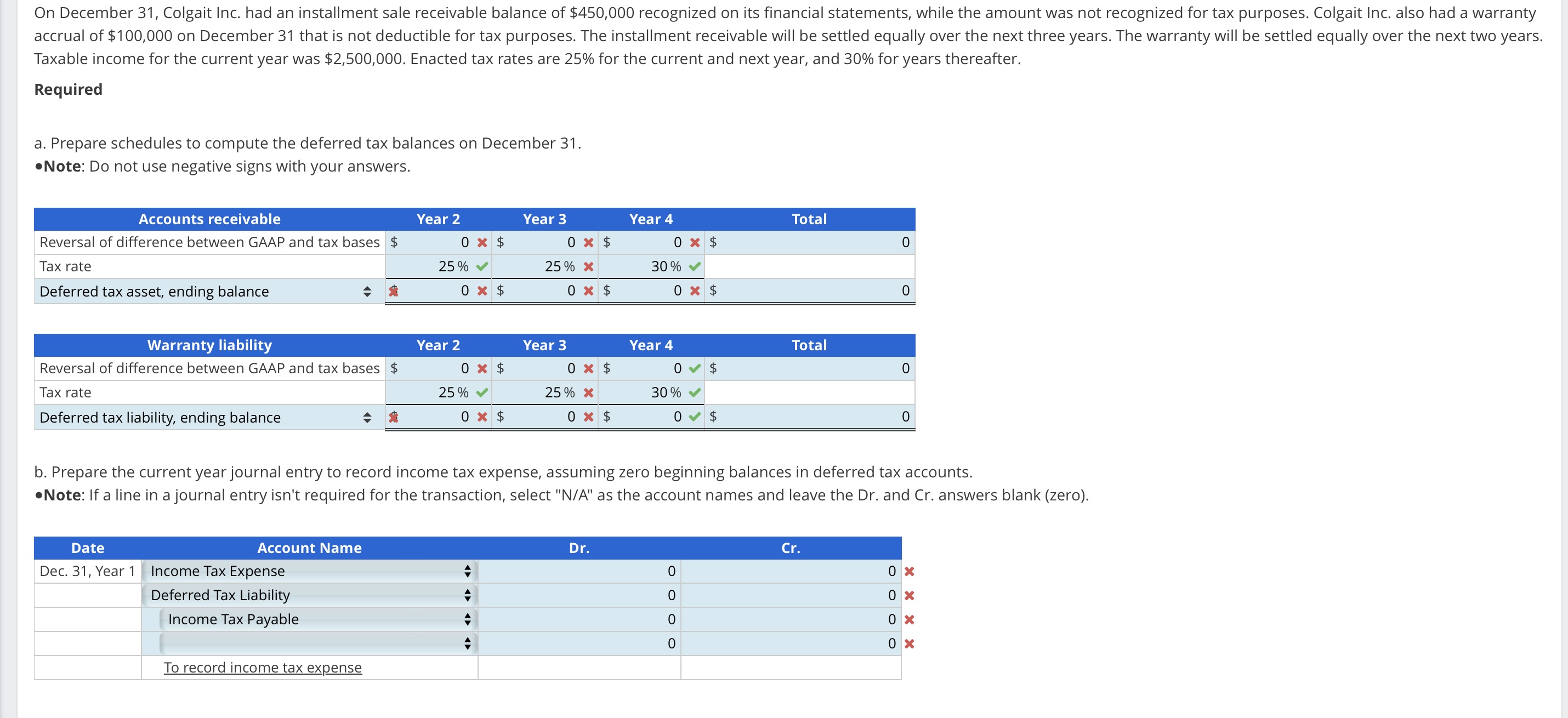

On December 31, Colgait Inc. had an installment sale receivable balance of $450,000 recognized on its financial statements, while the amount was not recognized for tax purposes. Colgait Inc. also had a warranty accrual of $100,000 on December 31 that is not deductible for tax purposes. The installment receivable will be settled equally over the next three years. The warranty will be settled equally over the next two years. Taxable income for the current year was $2,500,000. Enacted tax rates are 25% for the current and next year, and 30% for years thereafter. Required a. Prepare schedules to compute the deferred tax balances on December 31. Note: Do not use negative signs with your answers. Accounts receivable Year 2 Year 3 Year 4 Total Reversal of difference between GAAP and tax bases $ 0 $ Tax rate 25% 0 $ 25% X 0 * $ 30% 0 Deferred tax asset, ending balance 0 $ 0 $ 0 $ 0 Warranty liability Year 2 Year 3 Year 4 Total Reversal of difference between GAAP and tax bases $ Tax rate 0 $ 25% 0 $ 25% X 0 0 Deferred tax liability, ending balance 0 $ 0 $ 30% 0 0 b. Prepare the current year journal entry to record income tax expense, assuming zero beginning balances in deferred tax accounts. Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Dec. 31, Year 1 Income Tax Expense Deferred Tax Liability Income Tax Payable To record income tax expense Dr. Cr. 0 0 0 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Deferred Tax Balances 1 Accounts Receivable Year Reversal of Difference GAAPTax Tax Rate Deferred ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663db48303bfd_963425.pdf

180 KBs PDF File

663db48303bfd_963425.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started