Question

On December 31, the following data were accumulated for preparing the adjusting entries for Flagship Realty: The supplies account balance on December 31 is $5,450.

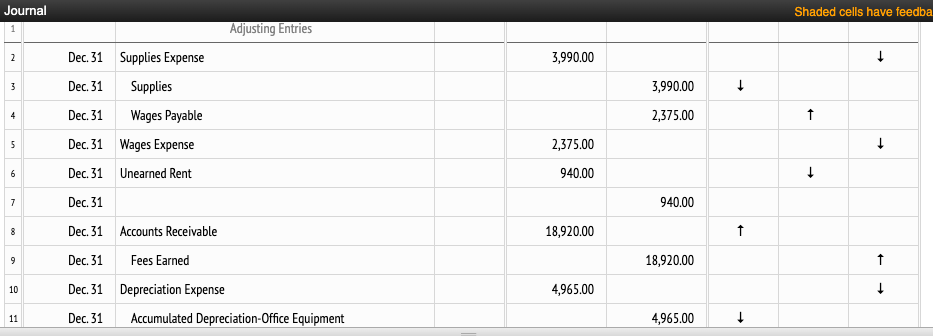

On December 31, the following data were accumulated for preparing the adjusting entries for Flagship Realty: The supplies account balance on December 31 is $5,450. The supplies on hand on December 31 are $1,460. The unearned rent account balance on December 31 is $4,700 representing the receipt of an advance payment on December 1 of five months rent from tenants. Wages accrued but not paid at December 31 are $2,375. Fees earned but unbilled at December 31 are $18,920. Depreciation of office equipment is $4,965.

| Required: | |

| 1. | Journalize the adjusting entries required at December 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. |

| 2. | What is the difference between adjusting entries and correcting entries?

|

CHART OF ACCOUNTSFlagship RealtyGeneral Ledger

| ASSETS | |

| 11 | Cash |

| 12 | Accounts Receivable |

| 13 | Supplies |

| 14 | Prepaid Insurance |

| 15 | Land |

| 16 | Office Equipment |

| 17 | Accumulated Depreciation-Office Equipment |

| LIABILITIES | |

| 21 | Accounts Payable |

| 22 | Unearned Rent |

| 23 | Wages Payable |

| 24 | Taxes Payable |

| EQUITY | |

| 31 | Common Stock |

| 32 | Retained Earnings |

| 33 | Dividends |

| REVENUE | |

| 41 | Fees Earned |

| 42 | Rent Revenue |

| EXPENSES | |

| 51 | Advertising Expense |

| 52 | Insurance Expense |

| 53 | Rent Expense |

| 54 | Wages Expense |

| 55 | Supplies Expense |

| 56 | Utilities Expense |

| 57 | Depreciation Expense |

| 59 | Miscellaneous Expense

|

Need help with Journal

Journal 1 2 3 4 5 6 7 8 9 10 11 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Dec. 31 Supplies Expense Supplies Wages Payable Adjusting Entries Wages Expense Unearned Rent Accounts Receivable Fees Earned Depreciation Expense Accumulated Depreciation-Office Equipment 3,990.00 2,375.00 940.00 18,920.00 4,965.00 3,990.00 2,375.00 940.00 18,920.00 4,965.00 Shaded cells have feedba 2. What is the difference between adjusting entries and correcting entries? Adjusting entries are a planned part of the accounting process, correcting entries are not planned but arise when necessary to correct errors. Correcting entries are a planned part of the accounting process, adjusting entries are not planned but arise when necessary to adjust errors. Both adjusting entries and correcting entries are a planned part of the accounting process. Both adjusting entries and correcting entries are not a planned part of the accounting process. Points: 1/1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started