Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, the Income Summary account of Madison Company has a debit balance of $18,000 after revenue of $20,000 and expenses of $38,000

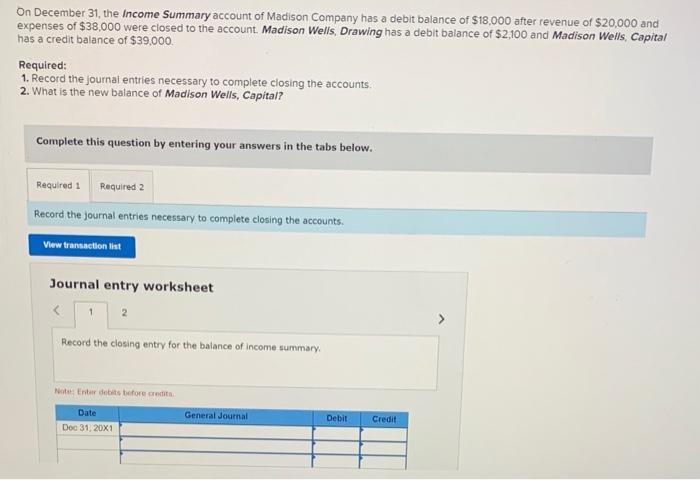

On December 31, the Income Summary account of Madison Company has a debit balance of $18,000 after revenue of $20,000 and expenses of $38,000 were closed to the account. Madison Wells, Drawing has a debit balance of $2,100 and Madison Wells, Capital has a credit balance of $39,000. Required: 1. Record the journal entries necessary to complete closing the accounts. 2. What is the new balance of Madison Wells, Capital? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Record the journal entries necessary to complete closing the accounts. View transaction list Journal entry worksheet < 1 2 Record the closing entry for the balance of income summary. Note: Enter debits before credits. Date Dec 31, 20X1 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required 1 Journal Entries to Complete Closing the Accounts 1 Record the closing entry for the bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started