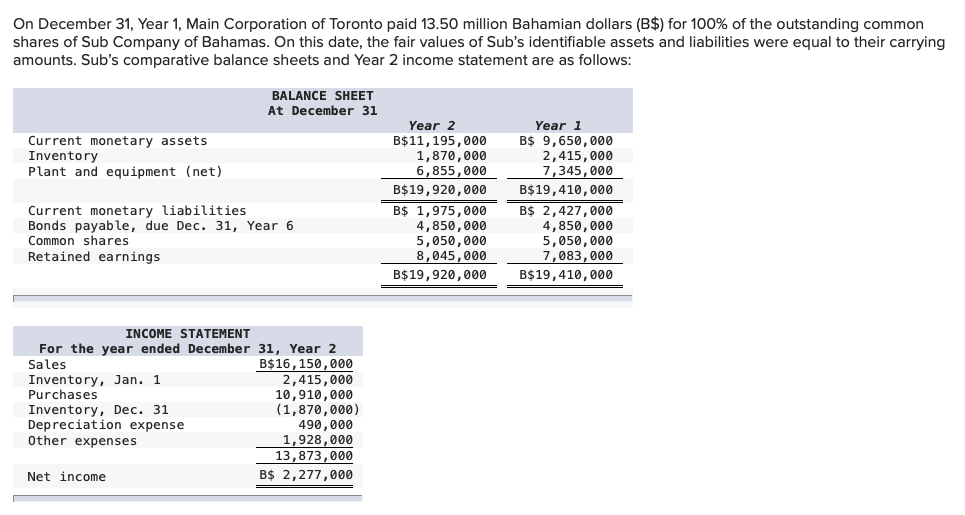

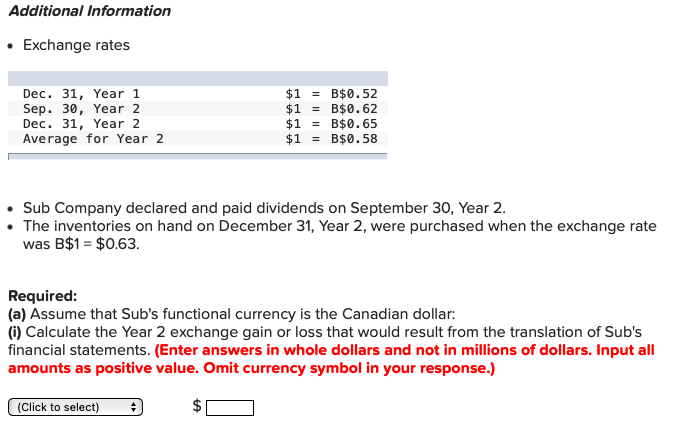

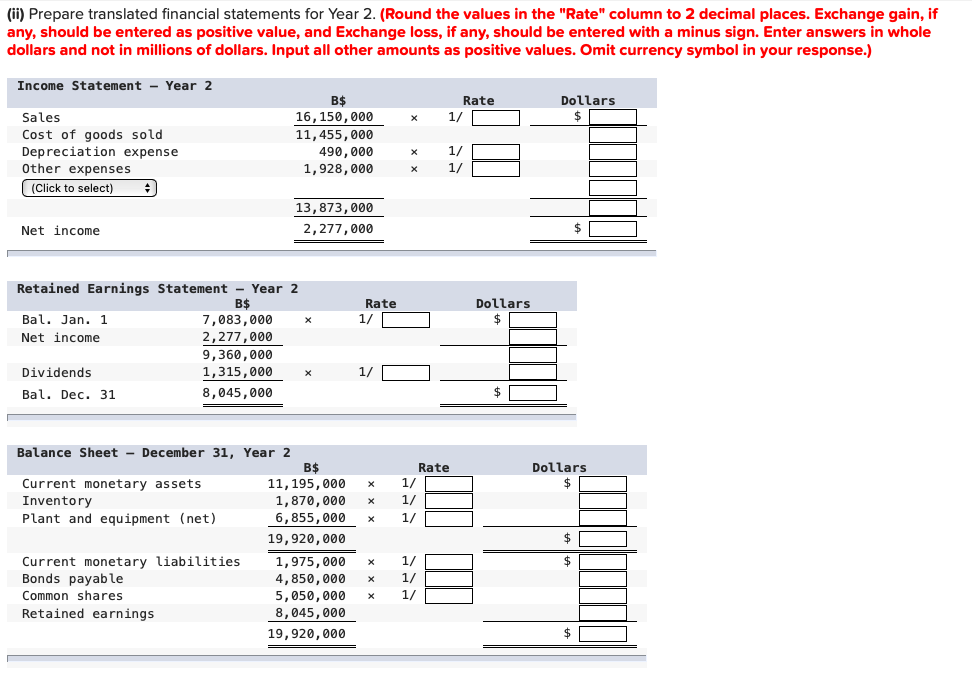

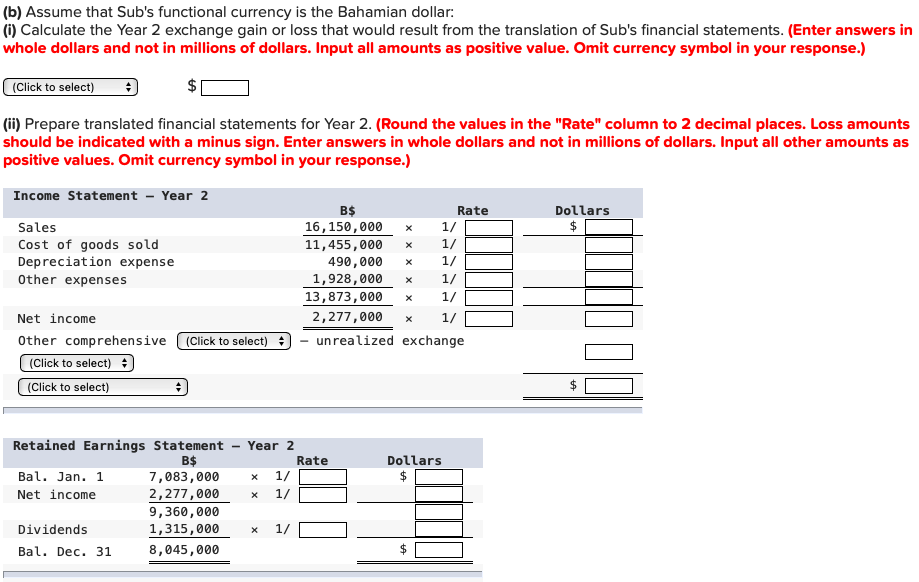

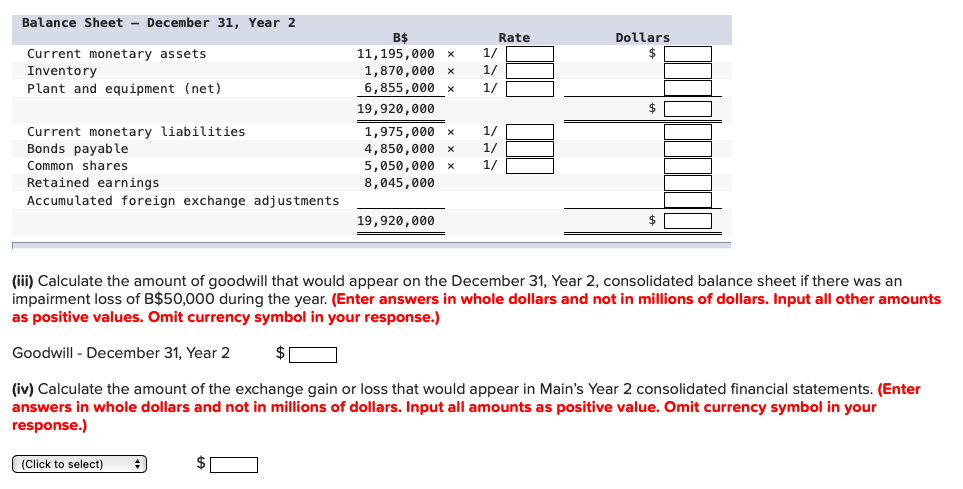

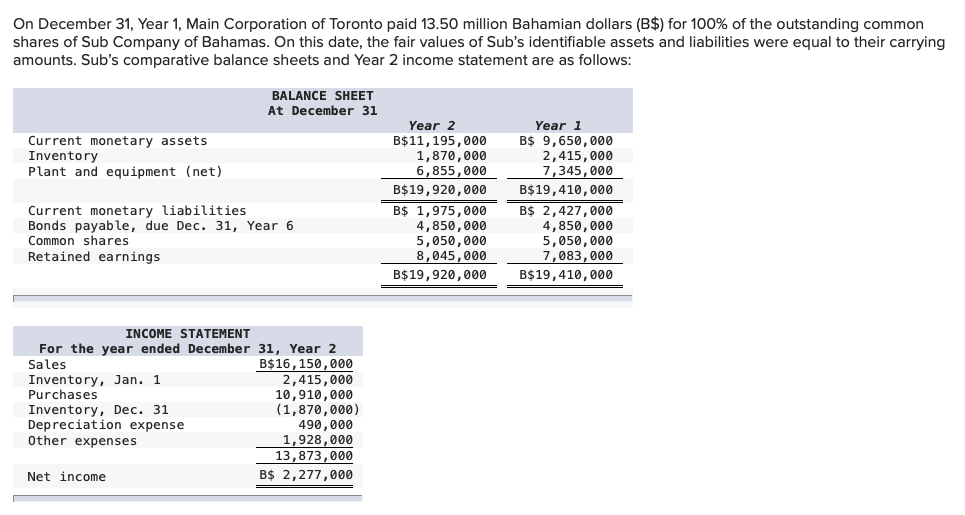

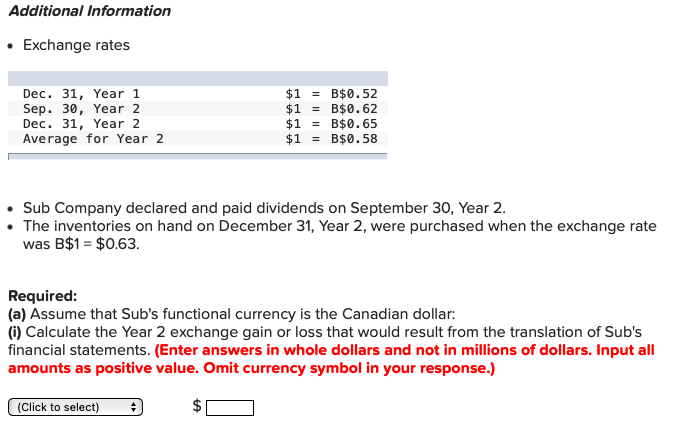

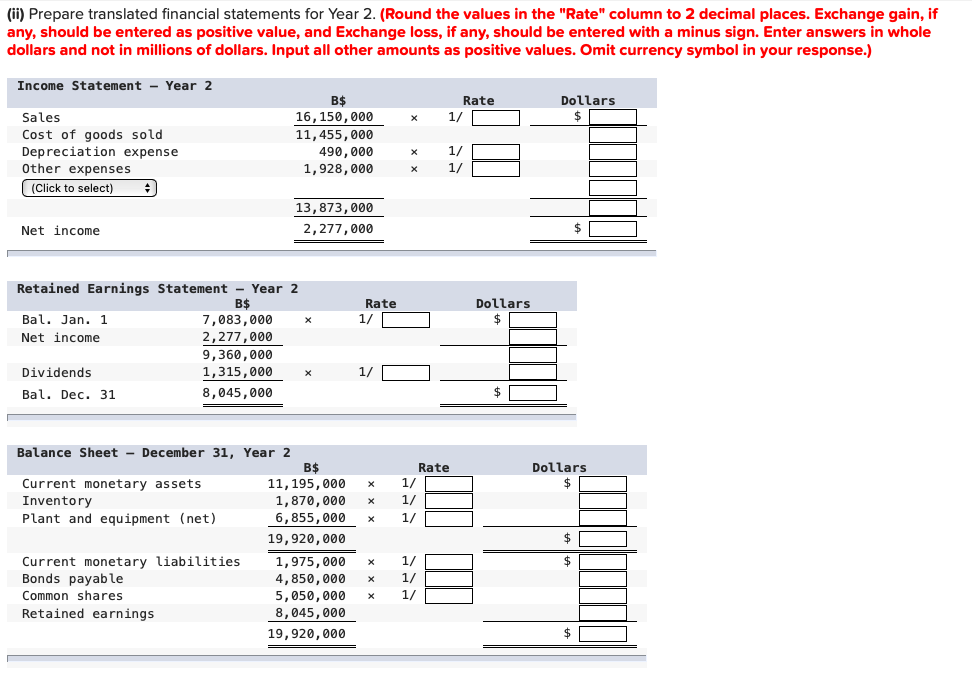

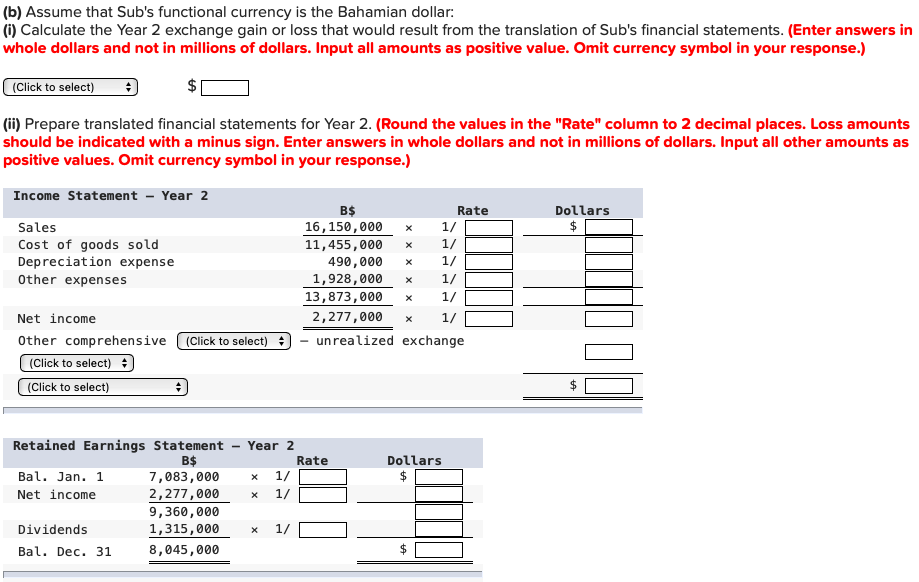

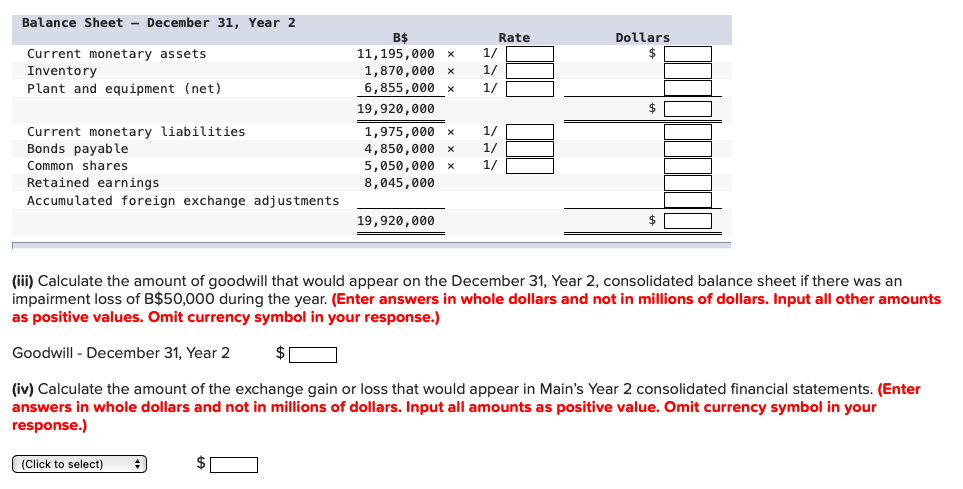

On December 31, Year 1, Main Corporation of Toronto paid 13.50 million Bahamian dollars (B\$) for 100% of the outstanding common shares of Sub Company of Bahamas. On this date, the fair values of Sub's identifiable assets and liabilities were equal to their carrying amounts. Sub's comparative balance sheets and Year 2 income statement are as follows: Additional Information - Exchange rates - Sub Company declared and paid dividends on September 30, Year 2. - The inventories on hand on December 31, Year 2, were purchased when the exchange rate was B$1=$0.63. Required: (a) Assume that Sub's functional currency is the Canadian dollar: (i) Calculate the Year 2 exchange gain or loss that would result from the translation of Sub's financial statements. (Enter answers in whole dollars and not in millions of dollars. Input all amounts as positive value. Omit currency symbol in your response.) $ (ii) Prepare translated financial statements for Year 2. (Round the values in the "Rate" column to 2 decimal places. Exchange gain, if any, should be entered as positive value, and Exchange loss, if any, should be entered with a minus sign. Enter answers in whole dollars and not in millions of dollars. Input all other amounts as positive values. Omit currency symbol in your response.) (b) Assume that Sub's functional currency is the Bahamian dollar: (i) Calculate the Year 2 exchange gain or loss that would result from the translation of Sub's financial statements. (Enter answers in whole dollars and not in millions of dollars. Input all amounts as positive value. Omit currency symbol in your response.) $ (ii) Prepare translated financial statements for Year 2. (Round the values in the "Rate" column to 2 decimal places. Loss amounts should be indicated with a minus sign. Enter answers in whole dollars and not in millions of dollars. Input all other amounts as positive values. Omit currency symbol in your response.) (iii) Calculate the amount of goodwill that would appear on the December 31 , Year 2, consolidated balance sheet if there was an impairment loss of B$50,000 during the year. (Enter answers in whole dollars and not in millions of dollars. Input all other amounts as positive values. Omit currency symbol in your response.) Goodwill - December 31, Year 2 $ (iv) Calculate the amount of the exchange gain or loss that would appear in Main's Year 2 consolidated financial statements. (Enter answers in whole dollars and not in millions of dollars. Input all amounts as positive value. Omit currency symbol in your response.) $ On December 31, Year 1, Main Corporation of Toronto paid 13.50 million Bahamian dollars (B\$) for 100% of the outstanding common shares of Sub Company of Bahamas. On this date, the fair values of Sub's identifiable assets and liabilities were equal to their carrying amounts. Sub's comparative balance sheets and Year 2 income statement are as follows: Additional Information - Exchange rates - Sub Company declared and paid dividends on September 30, Year 2. - The inventories on hand on December 31, Year 2, were purchased when the exchange rate was B$1=$0.63. Required: (a) Assume that Sub's functional currency is the Canadian dollar: (i) Calculate the Year 2 exchange gain or loss that would result from the translation of Sub's financial statements. (Enter answers in whole dollars and not in millions of dollars. Input all amounts as positive value. Omit currency symbol in your response.) $ (ii) Prepare translated financial statements for Year 2. (Round the values in the "Rate" column to 2 decimal places. Exchange gain, if any, should be entered as positive value, and Exchange loss, if any, should be entered with a minus sign. Enter answers in whole dollars and not in millions of dollars. Input all other amounts as positive values. Omit currency symbol in your response.) (b) Assume that Sub's functional currency is the Bahamian dollar: (i) Calculate the Year 2 exchange gain or loss that would result from the translation of Sub's financial statements. (Enter answers in whole dollars and not in millions of dollars. Input all amounts as positive value. Omit currency symbol in your response.) $ (ii) Prepare translated financial statements for Year 2. (Round the values in the "Rate" column to 2 decimal places. Loss amounts should be indicated with a minus sign. Enter answers in whole dollars and not in millions of dollars. Input all other amounts as positive values. Omit currency symbol in your response.) (iii) Calculate the amount of goodwill that would appear on the December 31 , Year 2, consolidated balance sheet if there was an impairment loss of B$50,000 during the year. (Enter answers in whole dollars and not in millions of dollars. Input all other amounts as positive values. Omit currency symbol in your response.) Goodwill - December 31, Year 2 $ (iv) Calculate the amount of the exchange gain or loss that would appear in Main's Year 2 consolidated financial statements. (Enter answers in whole dollars and not in millions of dollars. Input all amounts as positive value. Omit currency symbol in your response.) $