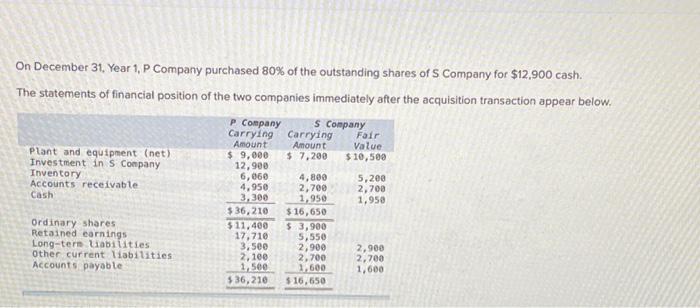

On December 31, Year 1, P Company purchased 80% of the outstanding shares of S Company for $12,900 cash. The statements of financial position

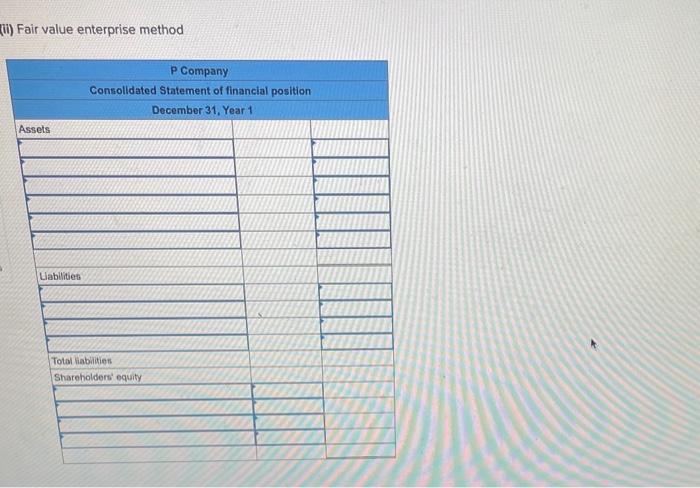

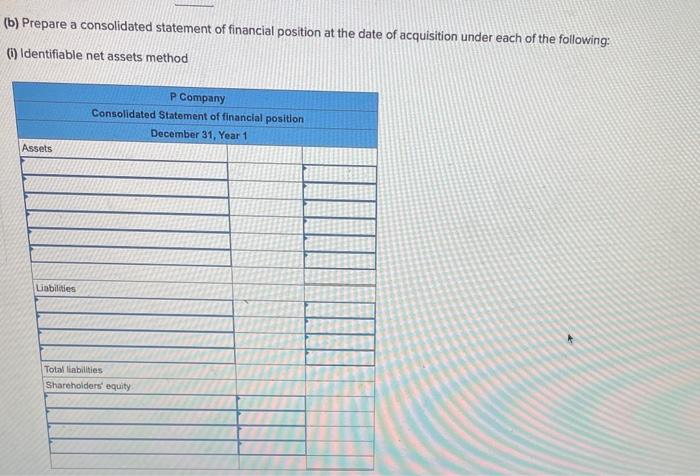

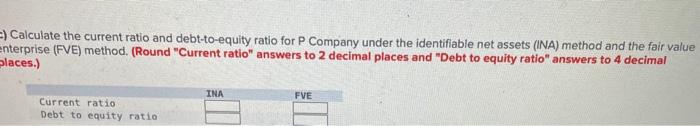

On December 31, Year 1, P Company purchased 80% of the outstanding shares of S Company for $12,900 cash. The statements of financial position of the two companies immediately after the acquisition transaction appear below. Plant and equipment (net) Investment in S Company Inventory Accounts receivable Cash P Company Carrying Amount $ 9,000 S Company Carrying Fair Amount $ 7,200 Value $10,500 12,900 6,060 4,800 5,200 4,950 2,700 2,700 3,300 1,950 1,950 $36,210 $16,650 Ordinary shares $11,400 $ 3,900 Retained earnings 17,710 5,550 Long-term liabilities 3,500 2,900 2,900 Other current liabilities 2,100 2,700 2,700 Accounts payable 1,500 1,600 1,600 $36,210 $16,650 (ii) Fair value enterprise method P Company Consolidated Statement of financial position December 31, Year 1 Assets Liabilities Total liabilities Shareholders' equity (b) Prepare a consolidated statement of financial position at the date of acquisition under each of the following: (i) Identifiable net assets method P Company Consolidated Statement of financial position December 31, Year 1 Assets Liabilities Total liabilities Shareholders' equity. E) Calculate the current ratio and debt-to-equity ratio for P Company under the identifiable net assets (INA) method and the fair value enterprise (FVE) method. (Round "Current ratio" answers to 2 decimal places and "Debt to equity ratio" answers to 4 decimal places.) INA FVE Current ratio Debt to equity ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets work through the requirements step by step b Consolidated Statement of Financial Position i Identifiable Net Assets Method To prepare the consoli... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards