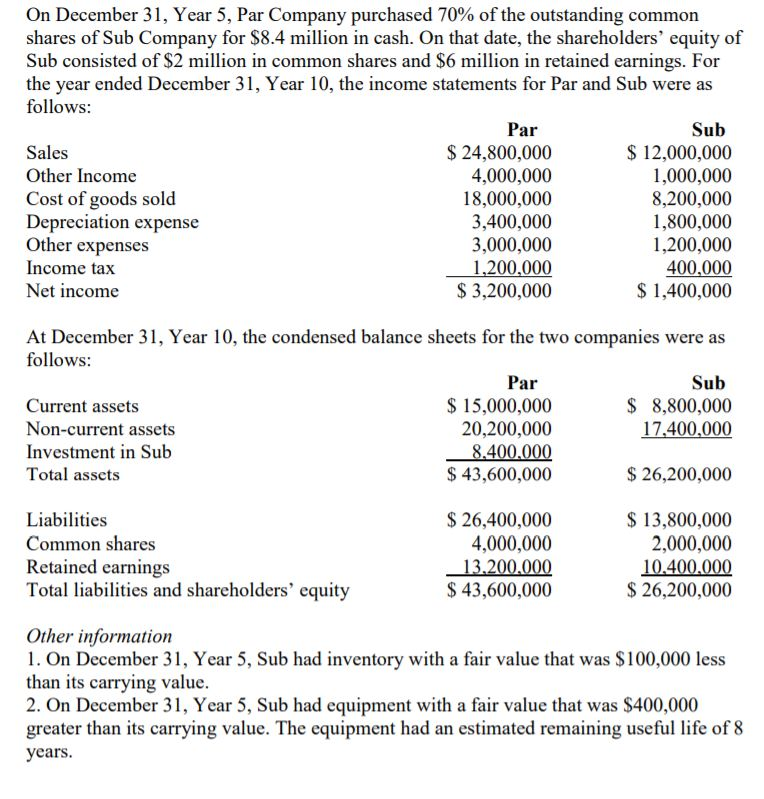

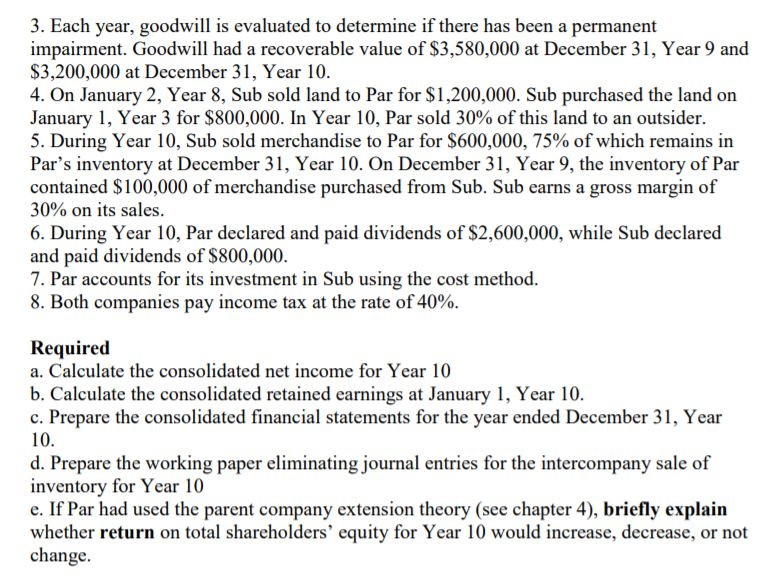

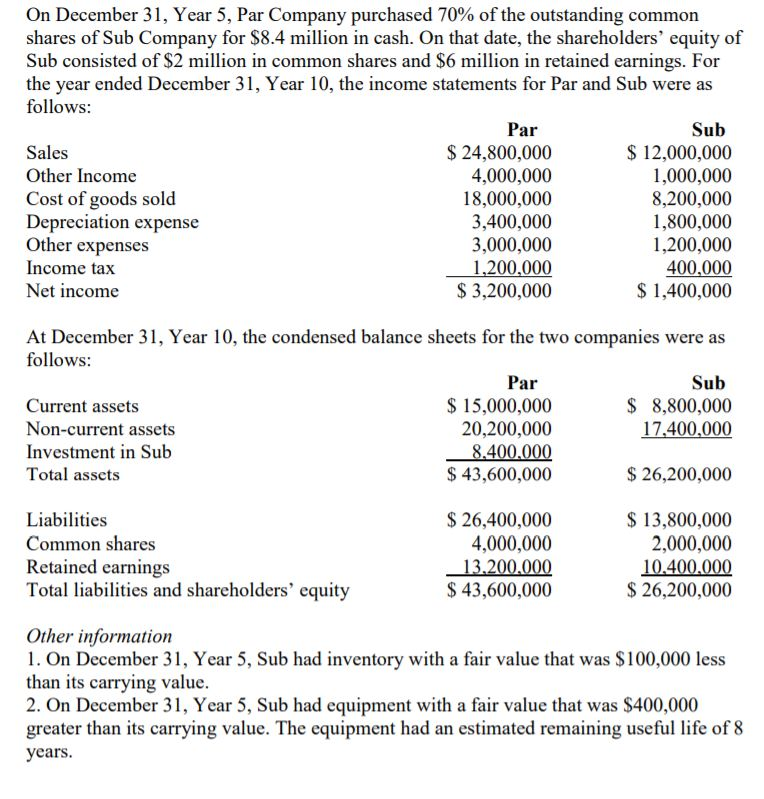

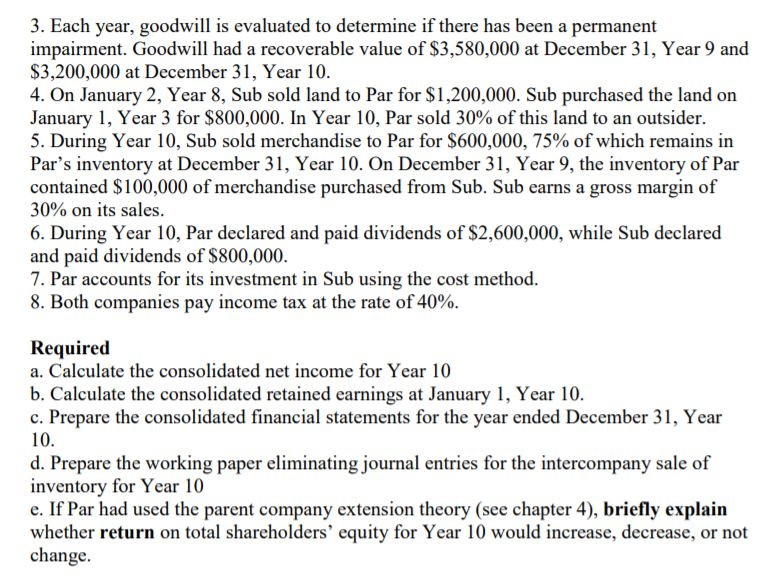

On December 31, Year 5, Par Company purchased 70% of the outstanding common shares of Sub Company for $8.4 million in cash. On that date, the shareholders' equity of Sub consisted of $2 million in common shares and $6 million in retained earnings. For the year ended December 31, Year 10, the income statements for Par and Sub were as follows: Sub S 12,000,000 1,000,000 8,200,000 1,800,000 1,200,000 400,000 $ 1,400,000 Par Sales Other Income Cost of goods sold Depreciation expense Other expenses Income tax Net income $ 24,800,000 4,000,000 18,000,000 3,400,000 3,000,000 ,200,000 $ 3,200,000 At December 31, Year 10, the condensed balance sheets for the two companies were as follows: Par $ 8,800,000 17400,000 $15,000,000 Current assets Non-current assets Investment in Sub Total asscts 20,200,000 $43,600,000 $ 26,400,000 $ 26,200,000 Liabilities Common shares Retained earnings Total liabilities and shareholders' equity S 13,800,000 2,000,000 10400,000 $ 26,200,000 4,000,000 3.20 43,600,000 Other information 1. On December 31, Year 5, Sub had inventory with a fair value that was $100,000 less than its carrying value. 2. On December 31, Year 5, Sub had equipment with a fair value that was $400,000 greater than its carrying value. The equipment had an estimated remaining useful life of 8 years 3. Each year, goodwill is evaluated to determine if there has been a permanent impairment. Goodwill had a recoverable value of S3,580,000 at December 31, Year 9 and S3,200,000 at December 31, Year 10. 4. On January 2, Year 8, Sub sold land to Par for $1,200,000. Sub purchased the land on January 1, Year 3 for $800,000. In Year 10, Par sold 30% of this land to an outsider. 5. During Year 10, Sub sold merchandise to Par for $600,000, 75% of which remains in Par's inventory at December 31, Year 10. On December 31, Year 9, the inventory of Par contained S100,000 of merchandise purchased from Sub. Sub earns a gross margin of 30% on its sales. 6. During Year 10, Par declared and paid dividends of $2,600,000, while Sub declared and paid dividends of $800,000. 7. Par accounts for its investment in Sub using the cost method 8. Both companies pay income tax at the rate of40%. Required a. Calculate the consolidated net income for Year 10 b. Calculate the consolidated retained earnings at January 1, Year 10. c. Prepare the consolidated financial statements for the year ended December 31, Year 10. d. Prepare the working paper eliminating journal entries for the intercompany sale of inventory for Year 10 e. If Par had used the parent company extension theory (see chapter 4), briefly explain whether return on total shareholders' equity for Year 10 would increase, decrease, or not change. On December 31, Year 5, Par Company purchased 70% of the outstanding common shares of Sub Company for $8.4 million in cash. On that date, the shareholders' equity of Sub consisted of $2 million in common shares and $6 million in retained earnings. For the year ended December 31, Year 10, the income statements for Par and Sub were as follows: Sub S 12,000,000 1,000,000 8,200,000 1,800,000 1,200,000 400,000 $ 1,400,000 Par Sales Other Income Cost of goods sold Depreciation expense Other expenses Income tax Net income $ 24,800,000 4,000,000 18,000,000 3,400,000 3,000,000 ,200,000 $ 3,200,000 At December 31, Year 10, the condensed balance sheets for the two companies were as follows: Par $ 8,800,000 17400,000 $15,000,000 Current assets Non-current assets Investment in Sub Total asscts 20,200,000 $43,600,000 $ 26,400,000 $ 26,200,000 Liabilities Common shares Retained earnings Total liabilities and shareholders' equity S 13,800,000 2,000,000 10400,000 $ 26,200,000 4,000,000 3.20 43,600,000 Other information 1. On December 31, Year 5, Sub had inventory with a fair value that was $100,000 less than its carrying value. 2. On December 31, Year 5, Sub had equipment with a fair value that was $400,000 greater than its carrying value. The equipment had an estimated remaining useful life of 8 years 3. Each year, goodwill is evaluated to determine if there has been a permanent impairment. Goodwill had a recoverable value of S3,580,000 at December 31, Year 9 and S3,200,000 at December 31, Year 10. 4. On January 2, Year 8, Sub sold land to Par for $1,200,000. Sub purchased the land on January 1, Year 3 for $800,000. In Year 10, Par sold 30% of this land to an outsider. 5. During Year 10, Sub sold merchandise to Par for $600,000, 75% of which remains in Par's inventory at December 31, Year 10. On December 31, Year 9, the inventory of Par contained S100,000 of merchandise purchased from Sub. Sub earns a gross margin of 30% on its sales. 6. During Year 10, Par declared and paid dividends of $2,600,000, while Sub declared and paid dividends of $800,000. 7. Par accounts for its investment in Sub using the cost method 8. Both companies pay income tax at the rate of40%. Required a. Calculate the consolidated net income for Year 10 b. Calculate the consolidated retained earnings at January 1, Year 10. c. Prepare the consolidated financial statements for the year ended December 31, Year 10. d. Prepare the working paper eliminating journal entries for the intercompany sale of inventory for Year 10 e. If Par had used the parent company extension theory (see chapter 4), briefly explain whether return on total shareholders' equity for Year 10 would increase, decrease, or not change