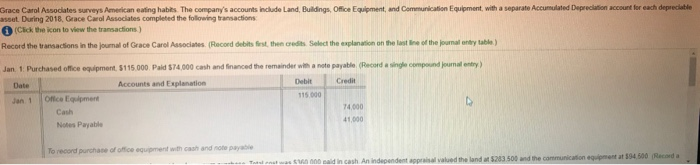

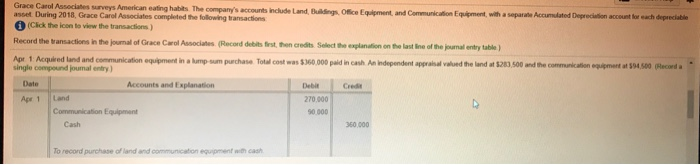

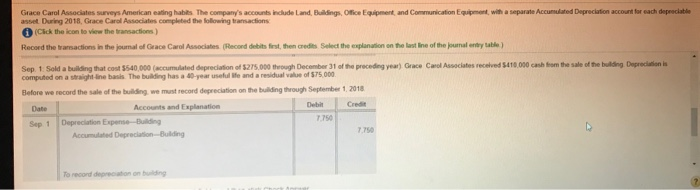

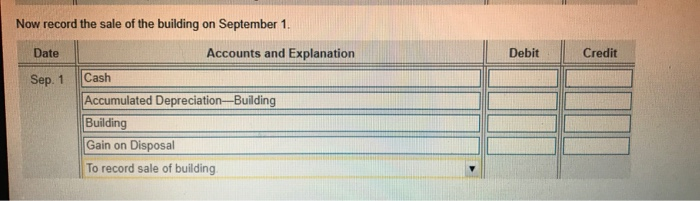

on Equipment with a separate Accu e rdo con for Beace Carol Associates Surveys A c ting habits The company's accounts include and Bings Of E n d Comm During 2018 Grace Carol Associate completed the following transactions Click the icon to view the transactions) Record the transactions in the journal of Grace Care Associates Record debts the cu t the explanation on the last of the b a nya) Jan 1 Purchased office equipment $115 000 Paid $74000 cash and financed the remainder w ante payable Recording compound many Date Accounts and Explanation Debit Credit Jan 1 Of colouent 115 000 Cash Notes Payable cash An d the band 23100 1500 da i ng Office Equipment and Communication Equipment, with a separate Accumulated Depreciation account for each depreciabile Grace Carol Associates surveys American eating habits The company's accounts include Land asset During 2018. Grace Carol Associates completed the following transactions (Click the icon to view the transactions) Record the transactions in the oumal of Grace Cool Associates Record b est the cred Set the explanation on the last one of the table 0 00 din cash independent pas led the land of 20000 and the comm o n ment 94500 Pecord A 1 Acquired land and communication equipment in ampum purchase Total cost w single compound many Accounts and planation C Debit 270.000 000 Land Com To record purchase of land and communication with cash Office Equipment and Communication with a s e conde Depreciation account for each depreciable Grace Carol Associates surveys American eating habis The company's accounts de Land asset. During 2018 Grace Carol Associates completed the wing bansactions Click the icon to the transactions) Record the transactions in the journal of Grace Carol Associates conditions, then cred Select the explanation on the last line of the many table) Sep 1 Sold a building that cou540 000 cc t ed depreciation of $275.000 through December of the preceding year) Grace Carol Associates received 1000 cash on the sale of the building Deprecationis computed on a straight line basis. The building has a 60 years and residuale of 575.000 Before we record the sale of the building we must record depreciation on the building through September 1, 2018 Date Accounts and Explanation Sep 1 Depreciation Expen d ing Accumulated Depreciation bulding Now record the sale of the building on September 1. Date Debit Credit Sep. 1 Accounts and Explanation Cash Accumulated Depreciation-Building Building Gain on Disposal To record sale of building on Equipment with a separate Accu e rdo con for Beace Carol Associates Surveys A c ting habits The company's accounts include and Bings Of E n d Comm During 2018 Grace Carol Associate completed the following transactions Click the icon to view the transactions) Record the transactions in the journal of Grace Care Associates Record debts the cu t the explanation on the last of the b a nya) Jan 1 Purchased office equipment $115 000 Paid $74000 cash and financed the remainder w ante payable Recording compound many Date Accounts and Explanation Debit Credit Jan 1 Of colouent 115 000 Cash Notes Payable cash An d the band 23100 1500 da i ng Office Equipment and Communication Equipment, with a separate Accumulated Depreciation account for each depreciabile Grace Carol Associates surveys American eating habits The company's accounts include Land asset During 2018. Grace Carol Associates completed the following transactions (Click the icon to view the transactions) Record the transactions in the oumal of Grace Cool Associates Record b est the cred Set the explanation on the last one of the table 0 00 din cash independent pas led the land of 20000 and the comm o n ment 94500 Pecord A 1 Acquired land and communication equipment in ampum purchase Total cost w single compound many Accounts and planation C Debit 270.000 000 Land Com To record purchase of land and communication with cash Office Equipment and Communication with a s e conde Depreciation account for each depreciable Grace Carol Associates surveys American eating habis The company's accounts de Land asset. During 2018 Grace Carol Associates completed the wing bansactions Click the icon to the transactions) Record the transactions in the journal of Grace Carol Associates conditions, then cred Select the explanation on the last line of the many table) Sep 1 Sold a building that cou540 000 cc t ed depreciation of $275.000 through December of the preceding year) Grace Carol Associates received 1000 cash on the sale of the building Deprecationis computed on a straight line basis. The building has a 60 years and residuale of 575.000 Before we record the sale of the building we must record depreciation on the building through September 1, 2018 Date Accounts and Explanation Sep 1 Depreciation Expen d ing Accumulated Depreciation bulding Now record the sale of the building on September 1. Date Debit Credit Sep. 1 Accounts and Explanation Cash Accumulated Depreciation-Building Building Gain on Disposal To record sale of building