Answered step by step

Verified Expert Solution

Question

1 Approved Answer

on excel . Pravjot Singh NorQuest College is considering upgrading all the lighting in CELT to LEDs. The college is supportive of the project but

on excel

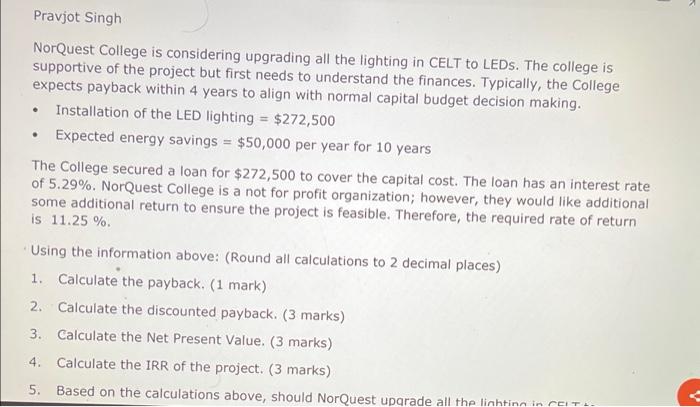

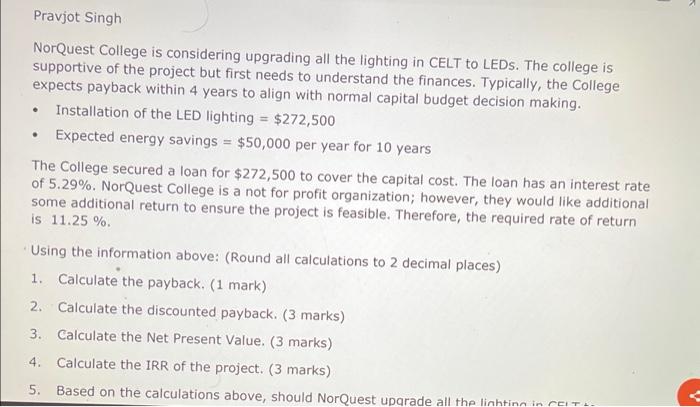

. Pravjot Singh NorQuest College is considering upgrading all the lighting in CELT to LEDs. The college is supportive of the project but first needs to understand the finances. Typically, the College expects payback within 4 years to align with normal capital budget decision making. Installation of the LED lighting = $272,500 Expected energy savings = $50,000 per year for 10 years The College secured a loan for $272,500 to cover the capital cost. The loan has an interest rate of 5.29%. NorQuest College is a not for profit organization; however, they would like additional some additional return to ensure the project is feasible. Therefore, the required rate of return is 11.25 % Using the information above: (Round all calculations to 2 decimal places) 1. Calculate the payback. (1 mark) 2. Calculate the discounted payback. (3 marks) 3. Calculate the Net Present Value. (3 marks) 4. Calculate the IRR of the project. (3 marks) 5. Based on the calculations above, should NorQuest upgrade all the linhting in CCT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started