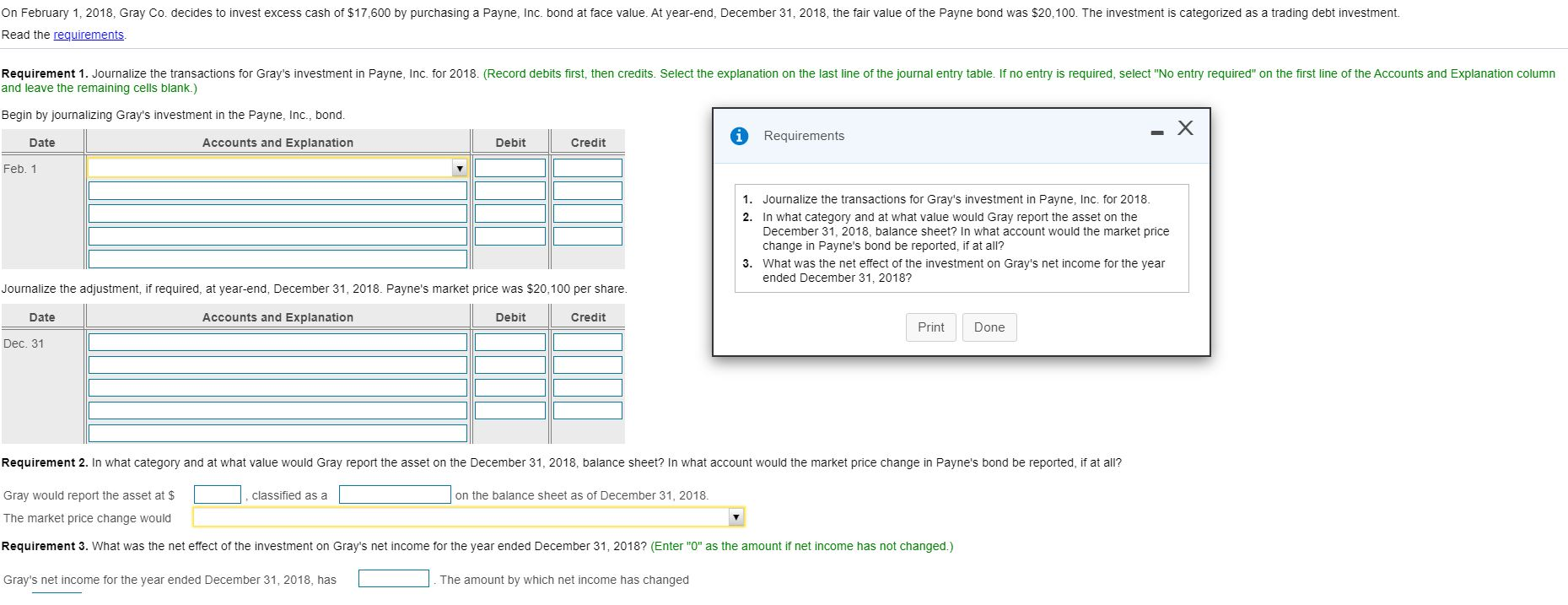

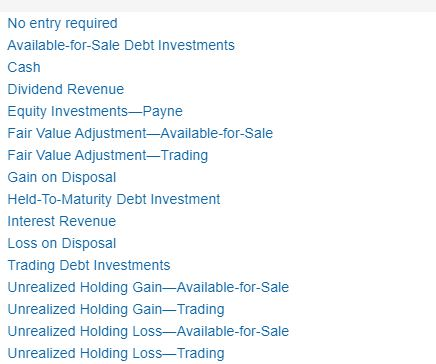

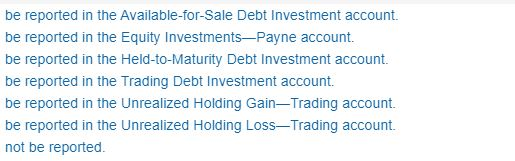

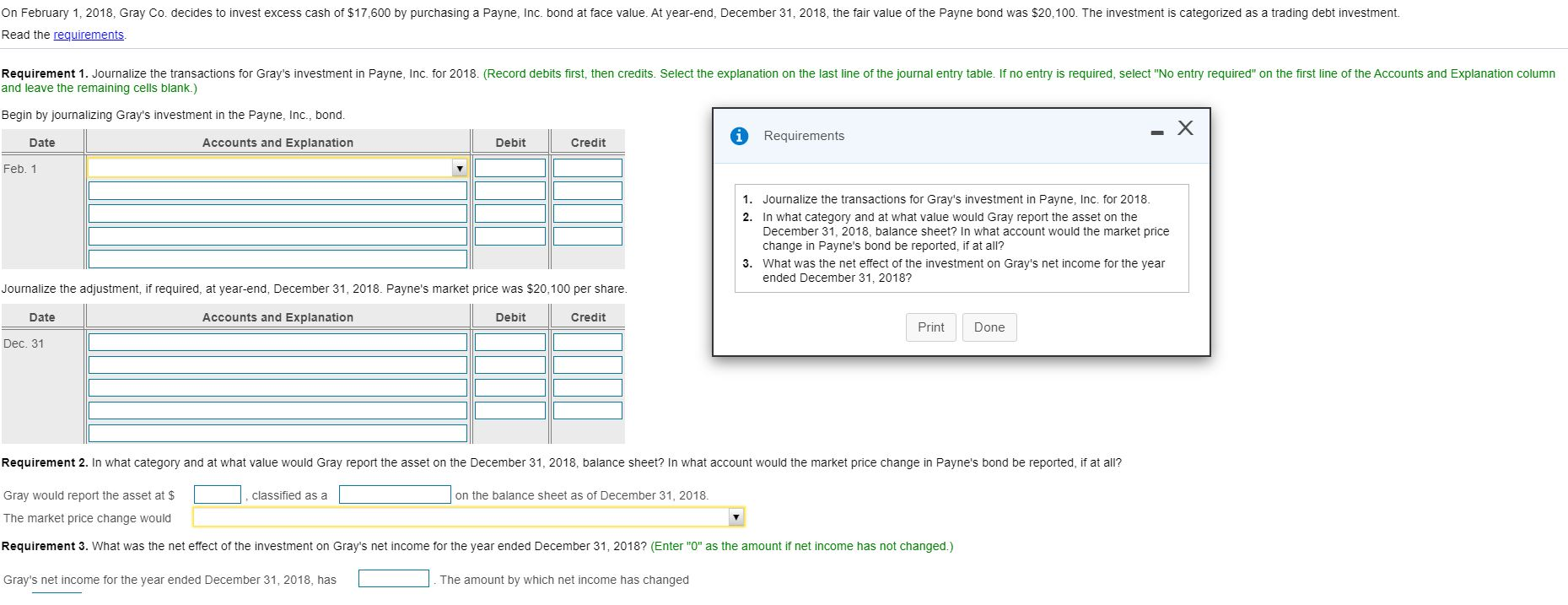

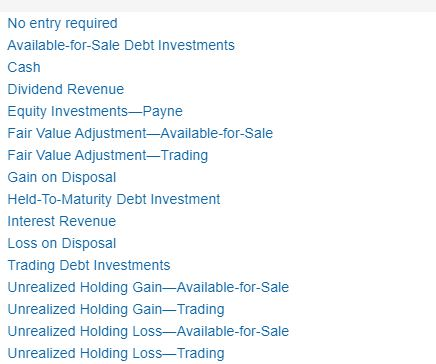

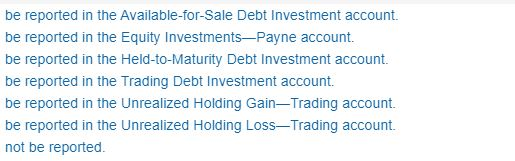

On February 1, 2018, Gray Co. decides to invest excess cash of $17.600 by purchasing a Payne, Inc. bond at face value. At year-end, December 31, 2018, the fair value of the Payne bond was $20,100. The investment is categorized as a trading debt investment. Read the requirements Requirement 1. Journalize the transactions for Gray's investment in Payne, Inc. for 2018. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. If no entry is required, select "No entry required" on the first line of the Accounts and Explanation column and leave the remaining cells blank.) Begin by journalizing Gray's investment in the Payne, Inc., bond. Requirements Date Accounts and Explanation Debit Credit Feb. 1 1. Journalize the transactions for Gray's investment in Payne, Inc. for 2018. 2. In what category and at what value would Gray report the asset on the December 31, 2018, balance sheet? In what account would the market price change in Payne's bond be reported, if at all? 3. What was the net effect of the investment on Gray's net income for the year ended December 31, 2018? Journalize the adjustment, if required, at year-end, December 31, 2018. Payne's market price was $20,100 per share. Date Accounts and Explanation Debit Credit Print Done Dec. 31 Requirement 2. In what category and at what value would Gray report the asset on the December 31, 2018, balance sheet? In what account would the market price change in Payne's bond be reported, if at all? classified as a on the balance sheet as of December 31, 2018. Gray would report the asset at $ The market price change would Requirement 3. What was the net effect of the investment on Gray's net income for the year ended December 31, 2018? (Enter "0" as the amount if net income has not changed.) Gray's net income for the year ended December 31, 2018, has The amount by which net income has changed No entry required Available-for-Sale Debt Investments Cash Dividend Revenue Equity InvestmentsPayne Fair Value Adjustment-Available-for-Sale Fair Value Adjustment-Trading Gain on Disposal Held-To-Maturity Debt Investment Interest Revenue Loss on Disposal Trading Debt Investments Unrealized Holding Gain-Available-for-Sale Unrealized Holding Gain-Trading Unrealized Holding LossAvailable-for-Sale Unrealized Holding Loss-Trading be reported in the Available-for-Sale Debt Investment account. be reported in the Equity InvestmentsPayne account. be reported in the Held-to-Maturity Debt Investment account. be reported in the Trading Debt Investment account. be reported in the Unrealized Holding Gain Trading account. be reported in the Unrealized Holding Loss-Trading account. not be reported