Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On February 1, 2018, Garden Company invests $19,000 in Iris, Inc. stock. Iris pays Garden a $1,100 dividend on October 1, 2018. Garden sells

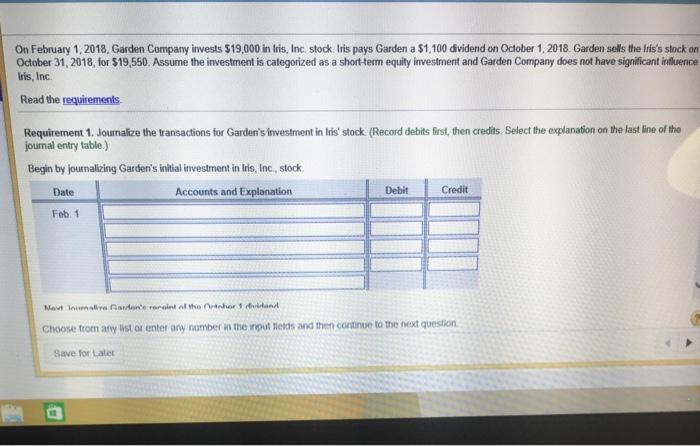

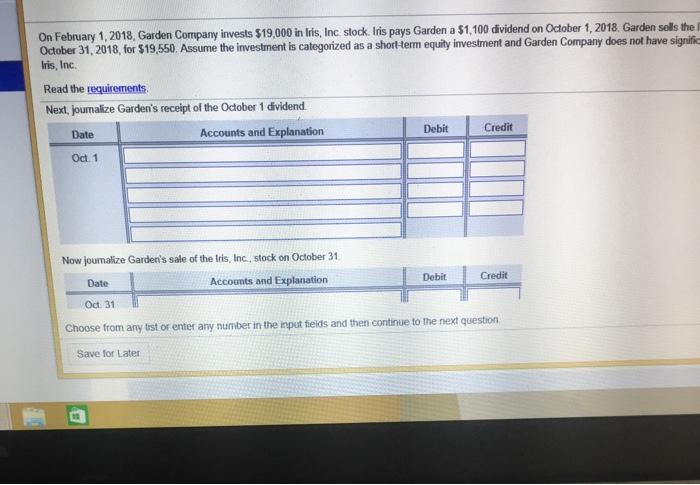

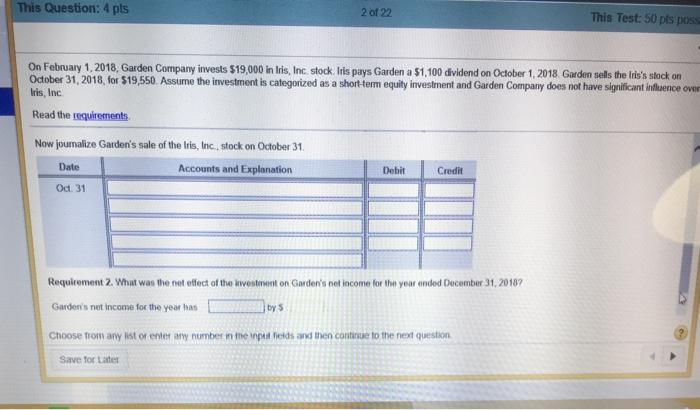

On February 1, 2018, Garden Company invests $19,000 in Iris, Inc. stock. Iris pays Garden a $1,100 dividend on October 1, 2018. Garden sells the Iris's stock on October 31, 2018, for $19,550. Assume the investment is categorized as a short-term equity investment and Garden Company does not have significant influence Iris, Inc. Read the requirements Requirement 1. Journalize the transactions for Garden's investment in Iris' stock (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Begin by journalizing Garden's initial investment in Iris, Inc., stock. Accounts and Explanation Date Feb. 1 Debit B Credit Mavt inimalive Garden'e roroint of the Ortohor 1 duidend Choose from any list or enter any number in the input lelds and then continue to the next question Save for Later On February 1, 2018, Garden Company invests $19,000 in Iris, Inc. stock. Iris pays Garden a $1,100 dividend on October 1, 2018. Garden sells the l October 31, 2018, for $19,550. Assume the investment is categorized as a short-term equity investment and Garden Company does not have signific Iris, Inc. Read the requirements. Next, journalize Garden's receipt of the October 1 dividend Accounts and Explanation Date Oct. 1 Now journalize Garden's sale of the Iris, Inc., stock on October 31. Accounts and Explanation Date Debit Debit Credit Credit Oct 31 Choose from any list or enter any number in the input fields and then continue to the next question Save for Later This Question: 4 pls Now joumalize Garden's sale of the Iris, Inc., stock on October 31. Accounts and Explanation On February 1, 2018, Garden Company invests $19,000 in Iris, Inc. stock. Iris pays Garden a $1,100 dividend on October 1, 2018. Garden sells the Iris's stock on October 31, 2018, for $19,550. Assume the investment is categorized as a short-term equity investment and Garden Company does not have significant influence over Iris, Inc. Read the requirements Date 2 of 22 Oct. 31 Debit Credit Requirement 2. What was the net effect of the investment on Garden's net income for the year ended December 31, 2018? Garden's net income for the year has by S This Test: 50 pls possa Choose from any list or enter any number in the input fields and then continue to the next question Save for Later

Step by Step Solution

★★★★★

3.37 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 2 Naming convention are not available can b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d5de44aeab_174935.pdf

180 KBs PDF File

635d5de44aeab_174935.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started